10 Practical Financial Ideas To Help You Become A Successful Digital Nomad

This article covers:

Consider these questions:

- Are you a freelancer working on temporary online projects in a foreign country?

- Do you travel from country to country, doing temporary work to satiate your wanderlust?

- Is your Internet-enabled laptop your main tool for earning money?

You may not have heard the term digital nomad, but if you answered ‘Yes’ to any of the above questions, you already are one. According to some estimates, the number of freelance workers is on the rise globally, but more so in developed countries like the USA and the UK. A number of factors are responsible for this growing trend, but one of the most important factors is the pervasiveness of the Internet.

In fact, the ubiquity of the Internet offers a range of work opportunities, which allows digital nomads to earn from almost anywhere. Thus, you can be a digital nomad and live a borderless life as long as you have a reliable Internet connection, a sense of adventure and a love for travelling.

In this article, we attempt to explain who a digital nomad is and provide practical advice to help you on your journey to becoming a successful digital nomad.

Reality Check – Is A Digital Nomad Lifestyle Suitable For You?

The lifestyle of a digital nomad may appeal to you in a vaguely romantic or utopian sense. Or you may be considering it because you are genuinely unhappy with your life or job. The freedom to travel, explore, set your own schedules, be your own boss, discover exotic destinations – all of these are good reasons to recommend the lifestyle of a digital nomad.

But if you are considering adopting a nomadic lifestyle yourself, remember that you will be giving up your current job and be turning your entire life upside down in order to live and work in another location. Make sure you do this with both eyes open and both feet firmly on the ground. Before you make any major decisions, first do a comprehensive 360-degree analysis of your past history, present lifestyle and future objectives. Steer clear of impulsiveness and do your homework!

Ask yourself these questions and answer them honestly:

- What are my financial and personal goals in life?

- What are my qualifications? What skills do I have to earn money and support myself financially as a digital nomad? What kind of jobs can I do?

- What kind of jobs are available in the countries I plan to travel to? What kind of technology (especially Internet connectivity if your work will be computer-related) is available in these countries? Is the technology reliable? Expensive?

- What are my income requirements? How much do I need to earn per day/week/month to live a comfortable nomadic life?

- What is my risk appetite? How long can I survive without a regular income? Do I have enough to keep me going for a few months?

- How should I schedule my work commitments with my travel plans? Remember that even freelancers are not exempted from deadlines!

The above questions are applicable to anyone considering the life of a digital nomad. However, it is usually easier to live a nomadic life (along with its associated instability) if you are single and without major familial responsibilities. However, if you have a partner/spouse and/or children, the decision to become a digital nomad is not so cut-and-dried. In such a case, you will also have to analyse your family situation by asking yourself some more tough questions:

- Will my family live the nomadic life with me?

- Will my partner work?

- If no, how will I support the family on my single income?

- If yes, what kind of work will he/she do? What skills does he/she have? What jobs are available to match his/her skills?

- How will I manage my children’s schooling, especially if we are constantly moving from one country to another?

You must also consider your country of origin before you decide to pack it all in and become a digital nomad. If you hold a passport from a developed country like the USA, the UK, Canada or Australia, you may find it easier to move from country to country because these citizens are usually granted tourist/work/working holiday visas without much hassle. Also, digital nomads from these countries tend to find jobs more easily almost everywhere, especially if English is their first language.

The Bottomline

Before adopting the digital nomad lifestyle:

- Ask yourself the hard questions about your current lifestyle and future aspirations

- Consider your family situation

- Consider your passport/visa situation

Going To Be A Digital Nomad? Read This Financial Checklist First!

Being a digital nomad can give you the freedom to live and work from wherever you want. However, the life of a digital nomad can be unstable at best and financially disastrous at worst. Also, achieving such a lifestyle is rarely a matter of luck or providence. It often requires a dose of reality, a heap of planning (rational, not emotional!) and a mountain of common sense.

At the same time, it is important to realise that even the most meticulous planner in the world is not immune to future disasters. However, for the most part, careful planning and rational analysis prior to embarking on this adventure will dramatically increase your chances of being a successful digital nomad. The key is to take calculated risks, not foolhardy ones.

Once you have done your reality check and decided that the lifestyle of a digital nomad is indeed for you, review the to-do list below. This checklist will help you manage your finances effectively so you can better understand what actions you need to take before you embark on your new adventure:

#1: Clear Your Debts

A lifestyle change is stressful enough without the added worry of pending debts. Before you leave, get rid of your debts (student loans, mortgages, etc.) or at least minimise them as much as possible.

#2: Calculate Your Nest Egg

If you have been working and saving for a few years, you probably have a nice nest egg built up by now. You might have to use up some of these savings to pay off your debts. Even so, the nest egg might keep you going until you find your financial sea legs in your new life. Make sure you have enough to cover critical expenses like food and accommodation for at least 3-6 months.

#3: Make A Budget & Stick To It

In addition to #1 & #2 above, you should draw up a budget that includes an estimate of weekly and monthly expenses. Budget necessary expenses like food and accommodation but keep some money aside for emergencies as well (such as sudden hospitalisations). Making a budget is only half the battle. Keeping track of your expenses and comparing it to your estimates is equally important.

#4: Keep Track Of Your Money

Your new lifestyle is likely to be extremely chaotic (at least at the beginning) and your finances even more so. Therefore, it’s very important to track your expenses and income and use this information in conjunction with your budget to stay financially healthy as a digital nomad.

#5: Find A Location-Independent Job Before You Travel

Although it is possible to find a job after you arrive at a new location, it’s definitely not easy. The pressure of managing multiple activities such as travelling/arranging accommodation/looking for a job and money worries will take the joy out of your new life. So, while you are still living at home with the security of a regular income, start looking for potential opportunities that are ideally location-independent and ongoing. Update your resume, make new contacts, look for potential clients and finalise a few jobs or projects that you can start after you land in your new place.

#6: Buy Travel Insurance

In many situations, travel insurance can be a life-saver. Buy a policy that is valid for the entire duration of your trip and that covers emergencies such as loss of passport, illness, accidents, etc. Read the fine print to understand the rules and exceptions. And make sure that the insurance covers the country you are travelling to.

#7: Figure Out Your Tax Situation

Check the tax rules in your home country and the country you are travelling to, to understand your tax liability in each. Depending on where you’re from and where you’re going, you may have to pay tax in either or both countries. Find out before you leave! Expatriates can be a good source of useful information in such matters.

#8: Arrange Credit/Debit Cards That Don’t Cost The Earth In Transaction Fees

Many cards impose hefty international fees for purchases and ATM withdrawals. Shop around for a card that allows you to withdraw your cash and make international transactions without a heavy impact on your wallet.

#9: Get An International Bank Account

Many regular banks require their customers to be resident of a particular country. Plus accessing your money from abroad can involve withdrawal fees, transaction fees and currency exchange fees – all of which can quickly add up. Shop around for international banks that offer online banking services for digital nomads in your home country and the adopted country. A few regular banks also offer good international options with inexpensive credit/debit cards that are widely accepted around the world. Do your research!

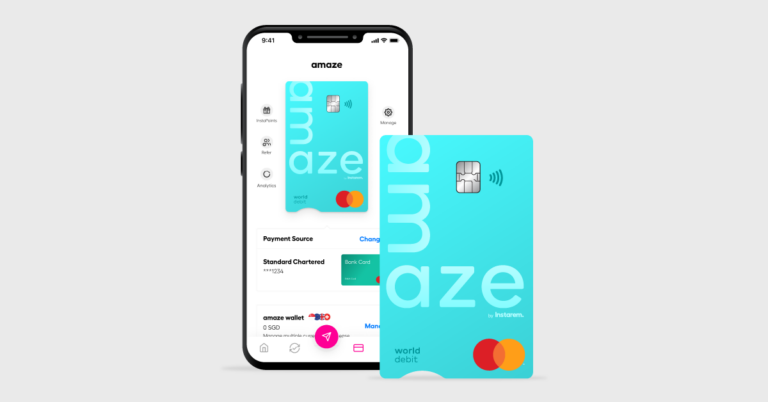

#10: Use A Specialised Money Transfer Service Like InstaReM

Fast and reliable, InstaReM is cheaper than most banks – an ideal solution for digital nomads. Through InstaReM’s remittance service, you can access your money at a good rate across currencies and countries in Asia, Europe, North America and Oceania. InstaReM ensures that your new lifestyle is free of money worries, no matter where you’re!

With InstaReM, you get:

- Zero-Margin FX Rates: mid-market rates sourced directly from Reuters with absolutely no margins added

- Nominal Transaction Fee & No Hidden Charges: Save more on your overseas money transactions and get an accurate break-up of your transaction. With InstaReM, what you see is what you get – no nasty surprises.

- Best Transfer Amount: With zero margins, you are guaranteed the best transfer amount possible.

- Easy Sign Up, Straightforward Transfers: The service is extremely easy to use. All you have to do is sign up, verify your account, upload the relevant documents and start transacting!

- Quick & Hassle-Free: Your transfer will be completed in 1-2 business days so you have quick access to your money, even while travelling.

In Conclusion

The life of a digital nomad can be wonderful, exciting and incredibly liberating. But it can also be unpredictable, unstable and downright disastrous. Not everyone is cut out to be a digital nomad, but if the lifestyle does appeal to you, do everything you can to learn more about it and about yourself. With careful planning and intelligent decision-making, you can be both happy and successful as a digital nomad.

Get the app

Get the app