This article covers:

InstaReM – Helping Financial Enterprises Send, Spend and Receive

Over the past few years, InstaReM has been on a journey which has seen the transformation from a consumer remittance business to a global payments platform and network, which can offer a fast and scalable solution for banks and enterprises.

We streamline the process of sending and settling overseas payments, powered by our market-leading innovations in transparency, security, and cost-efficiency. We make it easy for banks and financial enterprises to send, spend and receive.

A Few Busy Months

The last few months at InstaReM have seen announcements about our new card-issuing platform and our upcoming application for a digital banking licence in Singapore. Also, we’ve completed our US$ 41 million Series C funding and brought a reputed client on board in the form of KBank. Let’s dive into the details.

A New Platform Is On The Cards

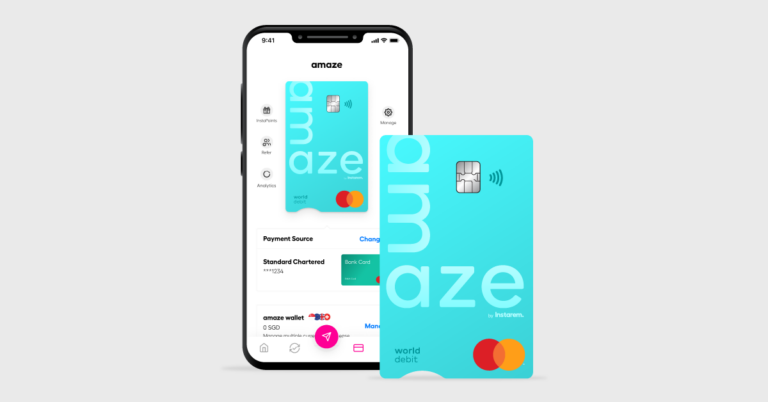

Just last month, InstaReM announced the launch of an API-based digital platform which will let start-ups, Fintechs and enterprises bring their own branded cards to market.

This platform will offer next-generation digital payments and cards as a B2B solution and will operate alongside the Visa Fintech Fast-Track Program. We announced that we’d joined the program back in February.

With the card-issuing platform, InstaReM’s Fintech partners and enterprise customers will be able to take advantage of InstaReM’s global digital ecosystem for payments and remittance, without the need to obtain multiple local licences to be able to issue payment cards to their employees and vendors.

This is the latest innovation as part of InstaReM’s mission to democratise payments globally, helping businesses move money globally more conveniently.

Read more on this here.

Our Latest Funding Round Comes To An End

We recently announced the close of our US$ 41 million Series C funding round. With this latest investment, InstaReM’s total secured funds have risen to US$ 59.5 million, putting us in the top ten most-funded Fintech companies in Southeast Asia.

This round of funding was led by Singapore’s Vertex Growth Fund (their first investment in Southeast Asia) and supported by Atinum Investment, a leading venture capital investor from South Korea.

James Lee, the Managing Director of Vertex Growth Fund, was impressed by “the sheer determination of [our] founders, backed by a solid team of professionals that work round-the-clock to provide a great product and experience to their consumer and enterprise customers”. While Aram Shin, Vice President and Head of Southeast Asia for Atinum Investment, said that he “recognised the dedication the founders had towards maximising value for their clients through tailored products and customer service”.

This news has been reported extensively in the press; we’ve picked out finextra.com for further reading.

InstaReM To Apply For A Digital Banking Licence

The Monetary Authority of Singapore has announced that it will grant up to two digital full-bank licences and as many as three digital wholesale bank licences. InstaReM has announced that it will apply for a digital banking licence in Singapore.

InstaReM’s CEO, Prajit Nanu, says that as we already provide “services similar to transaction banking in a bank… this would be a natural extension for us”.

KBank On Board

We were delighted to welcome as a client, Thailand’s leading banking group, Kasikornbank (KBank).

We’ll be powering cross-border payments for the clients of KBank, a partnership that further cements InstaReM’s position as a leading provider for cross-border transactions. And it’s good news for KBank clients, who will enjoy faster payments and certainty when it comes to payout amounts and delivery times.

Meet Our Team

Following a few busy months, InstaReM will be in London for the Sibos 2019 event. Meet the team at stand 23 in the Discover Zone, where you will be able to get a demo, learn about our strengths in emerging markets and speak to us about how we can help your financial institution.

Get the app

Get the app