How to open a bank account in Australia for non-residents

This article covers:

- Key Takeaways

- Types of Australian Bank Accounts For Non-Residents

- Bank Requirements For Non-Residents: Items Needed To Open a Bank Account

- A Step-by-Step Guide to Opening a Bank Account in Australia For Non-Residents

- Top 3 Foreigner-Friendly Australian Banks To Choose From

- Commonwealth Bank of Australia

- National Australia Bank (NAB)

- Westpac Banking Corporation

- A Good Starter: Instarem Account For Non-Residents in Australia

- Frequently Asked Questions

Key Takeaways

Eligibility/Bank Requirements

- You must be 14 or older.

- You must present your passport, proof of address, tax information such as Tax Identification Number for the country you are a citizen of, and employer details and salary.

- Holding a valid visa to work or study in Australia (e.g., working holiday visa, student visa).

- In-person visits are required to finalise the application process.

Step-by-Step Instruction for Opening a Bank Account:

- Choose a bank.

- Fill out the online application form.

- Head to your bank branch in Australia to complete the application.

Top 3 Foreigner-Friendly Banks

- Commonwealth Bank of Australia: Allows opening an account online up to 14 days before arrival (no Australian address needed). Offers everyday banking, loans, wealth management and more.

- National Australia Bank: Apply for an account only after arriving in Australia at a branch. Offers NAB Classic Banking Account with no minimum deposits, no overdrawn fees and free ATM withdrawals at over 4,000 ATMs.

- Westpac Banking Corporation: Allows opening an account online. Offers Westpac Choice with debit cards, cashback rewards and card management tools.

Australia is famous for many things: koalas and kangaroos, the Sydney Opera House, Aboriginal art, surfing, you name it. But when you consider opening a foreign bank account for exciting interest rates and special banking services, it’s not the first country you’ll probably think of.

Unlike places like the Cayman Islands or Panama known for offshore banking, or financial centres like Singapore and New York City, Australia doesn’t have that same reputation.

However, it offers a different set of advantages that other countries may have yet to have. Compared to the US, the UK or Canada, opening a bank account in Australia as a non-resident means you get straightforward, online application forms that allow you to set up an account from abroad, several months before you move.

Non-residents can simply choose their preferred bank, find the web portal and start the application process. As long as your financial transactions are legal, you can lawfully open and keep an Australian bank account if you’re not a citizen of the country.

To get you started, we’ll guide you on how to open a bank account in Australia as a foreigner. We’ll also explore additional options, like opening an Instarem account online.

Read on to learn more.

Types of Australian Bank Accounts For Non-Residents

Several bank account options are available across Australian banks. However, there are primarily two account types to explore: transaction accounts and savings accounts. Let’s delve into the details of each category.

Transaction Accounts

A transaction account is an everyday bank account for daily banking needs. You can use it for different purchases like paying bills and groceries, as well as getting your salary paid into this type of account. They also come with a debit card that can be used instead of cash for in-store or online shopping.

With a transaction account, you can set up online banking to easily view your transactions. It also allows you to trigger direct debits so regular payments like mortgage, electricity bill and rent can be automatically paid from your account on time.

To set this up, you’ll just need your account number and a special bank code (BSB) that identifies your bank branch.

Savings Accounts

Unlike a transaction account, the purpose of a savings account is to set aside money for future goals, like a dream vacation or a down payment on a house. This means that they don’t typically come with debit cards to discourage everyday spending.

Think of it as a way to lock away your money but still easily accessible through online transfers from your everyday account. Some banks may limit how often you can withdraw each month to keep you on track.

Moreover, a big advantage of savings accounts in Australia is government protection for your money. Up to $250,000 per account holder is insured under the financial claims scheme (FCS). Meaning, savings accounts are a safer option than some investments like cryptocurrency, which aren’t covered by the FCS scheme.

The downside is savings accounts aren’t always free. Depending on the bank, there might be fees to open an account or keep it running. Another thing to consider is the interest rate. The higher the rate, the more you earn on your savings. These rates can be fixed for a while or change along with what the RBA (Reserve Bank of Australia) does with the cash rate.

Bank Requirements For Non-Residents: Items Needed To Open a Bank Account

One of the greatest things about Australia’s banking system is that it lets you open accounts online before you even arrive. However, due to Know Your Customers (KYC) compliance, you’re required to verify your identity in person at a local branch once you’re in Australia to unlock all the account features.

You need to provide your paperwork and make sure all your information is accurate & up-to-date.

But the most important thing you have to prepare for is the country’s 100-point identification system. They use a point system to verify your identity, whether you’re an Australian citizen or not. This system was created to stop people and businesses from committing fraudulent transactions.

Different documents like passports or bank statements have assigned points. To pass a verification check, your documents need to add up to over 100 points. Remember, they must be valid and unexpired! In some cases, even foreign documents can be used. Let’s take a look at them below

Primary (70 Points)

- Birth certificate

- Birth card issued by NSW Registry of Births

- Citizenship certificate

- Current passport

- An unexpired passport which has not been cancelled and was current within the preceding two years

- Other documents of identity having the same characteristics as a passport including diplomatic documents

Secondary (Photograph and Name): 40 points

- Driver licence issued by an Australian State or territory

- Road and Maritime Services photo card

- Licence or permit issued under a law of the Commonwealth, a State or Territory government

- An identification card issued to a public employee

- An identification card issued by the Commonwealth

- An identification card issued to a student at a tertiary education institution

Secondary (With Name and Address On It): 35 points

- A document held by a cash dealer giving security over your property

- Council rates notice

- Land Titles Office record

- Document from your current employer or previous employer within the last two years

- A mortgage or other instrument of security held by a financial body

Secondary (With Name and Signature/Date of Birth): 25 points

- Marriage certificate (for maiden name only)

- Credit card

- Foreign driver licence

- Medicare card

- EFTPOS card

- Record of primary, secondary or tertiary education institution attended by you within the last 10 years

- Record of professional or trade association of which you are a member

While these are common documents used for verification, it’s always best to confirm the exact requirements with the specific bank you’re interested in. In most cases, you should provide:

- Your passport, driver’s licence or national identity card

- Your visa

- Proof of address

- Tax information such as Tax Identification Number for the country you are a citizen of

- Employer details and salary

- A student ID or a letter of enrollment if you’re on a student visa.

Remember, some banks do not require a residential address in Australia to open a bank account. You can simply provide the general area (suburb and state/territory) where you plan to be. But if you have a residential address you can temporarily use, such as the address of a friend or relative where you’ll be staying, feel free to use it.

It’s also acceptable to use your current address overseas if you haven’t figured out where you’ll be living permanently yet.

A Step-by-Step Guide to Opening a Bank Account in Australia For Non-Residents

While the exact steps to open a bank account in Australia might differ between banks, here’s a general roadmap to guide you through the process:

Step 1: Choose a Bank

When opening a bank account in Australia from overseas, make sure you do some research first. Look for a bank that best suits your needs as a non-resident, which can include factors like:

- Fees: How much does the bank charge to open and maintain an account? Are there monthly fees, and how do they compare to other banks?

- Customer service: Is it easy to get help from the bank? Are there extended hours or 24/7 support available? Can you get assistance in your native language if needed?

- Ease of setup: Can you easily open an account online or at a branch?

- Ease of use: Does the bank offer user-friendly online banking and a mobile app to manage your money on the go?

- International transfers: If you’ll need to send money back home often, how do the bank’s fees and exchange rates for international transfers compare to other banks?

- Safety and security: Does the bank have strong measures to protect your money and personal information?

If you know which bank you prefer, check their application process and the requirements you should submit.

Step 2: Fill Out The Online Application Form

Once you start filling out an online application form, make sure that the name you enter on the form exactly matches your passport. This will help you avoid any issues during ID verification.

The online form will likely ask about your intended Australian visa type. Keep in mind that you won’t need official visa approval yet; they just want to confirm you’re relocating and not just visiting.

Most importantly, you must provide your estimated arrival date. Don’t worry about your plans changing—simply email the bank and update them. They understand travel arrangements can be flexible.

The online form itself should only take about five minutes to complete, as long as you have all your information ready. Once you’re done, you’ll get either a confirmation page or a message from the bank.

If it redirects you to a confirmation page, it might include a few extra steps and a downloadable PDF letter you’ll need to bring to the bank later. Don’t forget to save the file and your new account details.

However, if you get a message instead, the bank needs to further review your application before confirming. Don’t worry, this is normal.

Step 3: Head To Your Bank Branch

If your online application has been approved, head to your bank branch in Australia to verify your documents and complete the application.

Top 3 Foreigner-Friendly Australian Banks To Choose From

Finding the right Australian bank as a foreigner can feel overwhelming, especially when you know nothing about the country. Each bank offers various advantages and services, so which one is best for you?

Luckily, we’ve picked the best foreigner-friendly Australian banks you can choose from. By considering the factors we’ll explore next, you can confidently compare different banks and find the perfect financial partner to facilitate your journey in Australia.

Here’s a quick summary of the best Australian banks for foreigners, along with steps on how to open an account from overseas with each of these banks:

Commonwealth Bank of Australia | National Australia Bank | Westpac Banking Corporation | |

Eligibility |

|

|

|

Required documents |

|

|

|

Minimum deposit | Depends on the type of bank account | No minimum monthly deposits | Up to AU$2,000 to waive account-keeping fee |

Card availability | Debit card and credit card | Debit card and credit card | Debit card and credit card |

Commonwealth Bank of Australia

Also referred to as CommBank, the Commonwealth Bank of Australia is one of the Big 4 banks in Australia. It offers a variety of financial products and services, from everyday banking to loan-term planning. This includes credit cards, loans, wealth management, investment and insurance, to name a few.

One of their most popular accounts is the Everyday Account Smart Access. It comes with a physical and digital Debit Mastercard, zero monthly account fee if you meet certain conditions and cashback rewards.

You also get access to digital banking tools like Spend Tracker and Bill Sense to manage your future bills.

But what makes CommBank a foreigner-friendly bank is how they support non-residents in moving to Australia. You can open a bank account up to 14 days before you arrive, and you don’t even need an Australian address to get started. However, to fully activate your account and use it for deposits and transactions, you’ll need to verify your ID at a CommBank branch in Australia within 20 days of opening the account.

How To Open a CommBank Account

- Head to CommBank’s official website and complete the application form. Make sure that you have your passport ready, know the city you’ll be staying in Australia and your visa details.

- When you’re in Australia, visit a branch to get your debit Mastercard. Bring your original passport and tax ID (TIN) for any country you pay taxes in. Verify your ID within 20 days to avoid account closure. You can visit any CommBank branch to verify.

- Keep in mind that you won’t be able to deposit funds or transact on your account until you complete this step.

- Once the identification check is done, download the CommBank app or log in to NetBank to access your account. You can also withdraw cash from CommBank ATMs without your card using Cardless Cash.

National Australia Bank (NAB)

Ranked the world’s 21st-largest bank in 2019, the National Australia Bank (NAB) operates in Australia, New Zealand and Asian countries. As of writing, the bank currently serves more than 8.5 million customers in Australia and overseas.

NAB has a special bank account tailored for foreigners and expatriates in Australia, known as the NAB Classic Banking Account. It has no minimum monthly deposits, no overdrawn fees and no ATM withdrawal fees at over 4,000 ATMs across Australia.

You can also access NAB Online Banking through either the NAB Internet portal or the NAB mobile app, which works both on Android and iOS devices.

However, please note that there has been a change in the process. You can no longer apply for an account before arriving in Australia. Instead, you’ll need to visit an NAB branch after your arrival to set up your account.

The good news is that you can have a smooth transition by reading about NAB’s banking features and accounts before you land.

How To Open an NAB Account

- Check your eligibility. View the Document Checklist For Individual Customers to prepare for your application.

- Visit a branch to finalise your application. Once you’re in Australia, head to a nearby NAB branch with your completed application and required documents. A NAB representative will guide you through the final steps and get your account set up.

Westpac Banking Corporation

Westpac Banking Corporation is considered the oldest bank in Australia with over 14 million customers, originally founded in 1817. They offer various financial services like savings accounts, business banking, asset management and personal loans.

For everyday banking, their popular Westpac Choice account comes with a secure debit card and helpful features to effectively manage monthly budgets. You can earn cashback rewards, robust security features and a Cards Hub to manage all your cards in one place.

One of the reasons why Westpac is a great Australian bank for foreigners is because of its customer support. The bank has personnel that understand Korean, Vietnamese, Mandarin and Greek, along with multilingual ATMs.

How To Open a Westpac Account

- Visit Westpac’s official website and click ‘Apply Now’. You will be directed to a secure application form where you need to complete all the sections.

- Once you complete everything, hit ‘Submit’ and the sales team will process your request.

- Get your temporary account. The bank will initially set up your account for deposits only.

- Verify and unlock full features. You’ll receive a paper application by mail. To unlock full access, sign it and bring it to a Westpac branch along with your ID.

A Good Starter: Instarem Account For Non-Residents in Australia

Even though some Australian banks let you start an account before moving, you can’t use it until you visit a branch in person with documents. This might be inconvenient if you need to handle Australian dollars before your trip or if you’d prefer an account for non-residents.

It’s not as difficult as opening a bank account in the US as a non-resident, but flying to Australia can be expensive and time-consuming. That’s why you have to carefully consider your needs before applying—is a trip to Australia really necessary for your banking purposes?

Thankfully, Instarem provides a favourable starting point for non-residents in Australia. We can be your ideal first step for managing your finances as you settle into a new country.

- Fast and Easy Setup: Ditch the paperwork and lengthy application processes. Instarem lets you open an account online within minutes, often ideal for urgent financial needs.

- Accessibility for Non-Residents: No minimum income or employment proof is required, making it accessible for newcomers settling in or short-term residents.

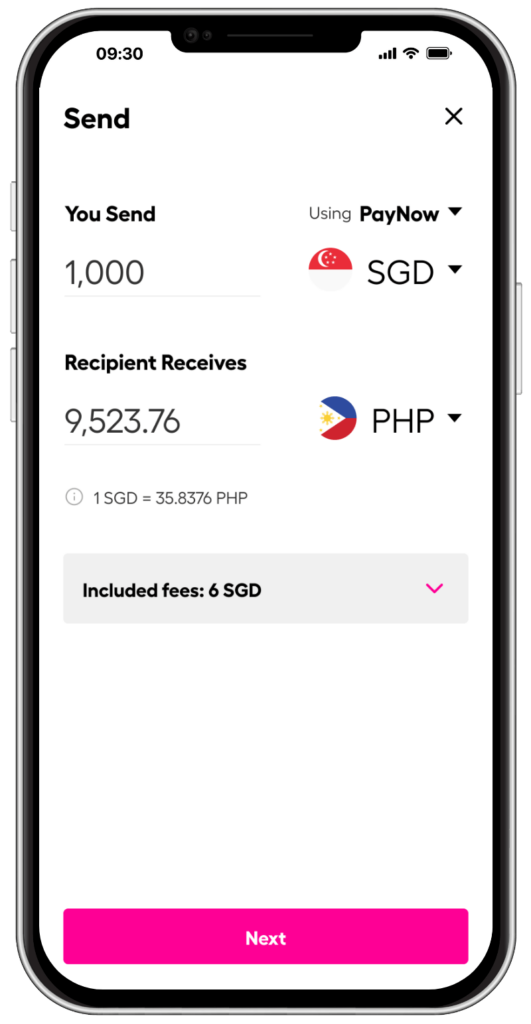

- International Money Transfer: Send and receive money internationally with competitive rates and transparent fees.

- Mobile-First Convenience: Manage your account on the go with our user-friendly app, eliminating the need for frequent physical branch visits.

- InstaPoints: Earn with each transfer and use them to save up on future payments.

Keep in mind that Instarem is meant to complement your bank account, not replace it. For example, once the account application process is done, you might need to move your funds to your Australian bank account. Skip the banks and use Instarem instead.

*rates are for display purposes only.

If you decide on this digital route and explore what Instarem has to offer non-Australian citizens, we’re ready to assist you every step of the way. Download the app or sign up today!

Frequently Asked Questions

Can I open a bank account in Australia as a non-resident?

Yes, many Australian banks allow non-residents to open accounts, especially if you’re on a visa to work or study in Australia.

Can I apply from overseas?

Yes, in most cases you can initiate the application online or by phone before you arrive in Australia. However, you’ll likely need to visit a branch in person to finalise the process once you’re in the country.

What if I don’t have proof of address in Australia yet?

Some banks may accept an overseas address, while others may require proof of an Australian address. Check with the bank you’re interested in for their specific requirements.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products.

Get the app

Get the app