Best business accounts in Australia for international money transfer

This article covers:

With so many banks and remittance services offering a variety of business accounts for international money transfers, it’s not easy finding the right one for your business. Owning a business is as tough as it gets, and then comes to the key decisions like choosing a business bank account or other means to manage your international money transfer.

We will guide you through the fees, features and benefits that you should be looking for when choosing a business account to handle your international transactions.

Why do you need a business bank account?

A business bank account, when compared against personal bank accounts, provides expanded service offerings, such as multi-user access, added flexibility and security for overseas payments and fund transfers, batch payments, automation payrolls, and more. A business bank account is crucial to managing and scaling your business.

Here’s how you can evaluate which business bank account is suitable to handle your business’s overseas money transactions

Business accounts play an undeniable role in every business and are available in several different types. Therefore, it is important to carefully choose one that is best suited for your business, keeping in mind factors like banking fees, user access, and other features.

Here are some of the most important factors you must consider:

Security and compliance

Sending money overseas often comes with one big worry: whether the transactions are secure. When choosing the right remittance provider, check if they take all the necessary precautions to transfer your money securely and if they comply with the highest possible security standards such as mandating a KYC process.

Fees

Business checking accounts around the world may come with a variety of fees to charge their clients for the services they provide, as well as maintaining their clients’ accounts.

Here are some of the fees to look out for:

- Subscription fees

- Processing fees

- Transaction fees

- Cheque issuance and clearing fees

- Overdraft fees

- Excess fees

The fees mentioned above and their rates differ from one bank to another. Thus, it’s crucial to take into account what those fees mean in terms of access to your money, and which bank’s services you should employ.

Minimum deposit and balance

Before opening a business bank account, it’s best to keep in mind the minimum deposit and balance that a user is required to put in to maintain your account at any time. Some banks require a higher deposit and balance, while others require them lower.

User access

Business account users are often concerned with the access and convenience for managing their expenses. Thus, they typically go for business accounts with multi-user access, such as providing full access to authorised users and individual business debit cards.

Limits on transfers and currency conversion fees

Two other things that are on the must-check list when comparing business bank accounts are the limitation on transfers, as well as their currency conversion fees. As a business, you’re expected to make frequent deposits, withdrawals, and bill payments or transfers from one bank account to the other. Thus, finding a business bank account that allows a larger transaction limit with a reasonable currency conversion rate will be the most ideal.

Extra features

Other than the usual banking features, some businesses require their business account to have extra features and added benefits, such as budgeting tools, payroll automation, expenditure tracking and analytics, and more, to better manage their business.

Customer support

Having extra help at hand is always better than facing the problems and doubts alone when it comes to dealing with transactions. Thus, ensuring the institutions and banking service providers have good customer service to help maintain your business account and solve banking errors would be of great convenience.

Comparing best business accounts for international money transfer in Australia*

*Information below is correct as at 1 Feb 2022 , below is general information only We don’t consider your personal objectives, financial situation or needs and we aren’t recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

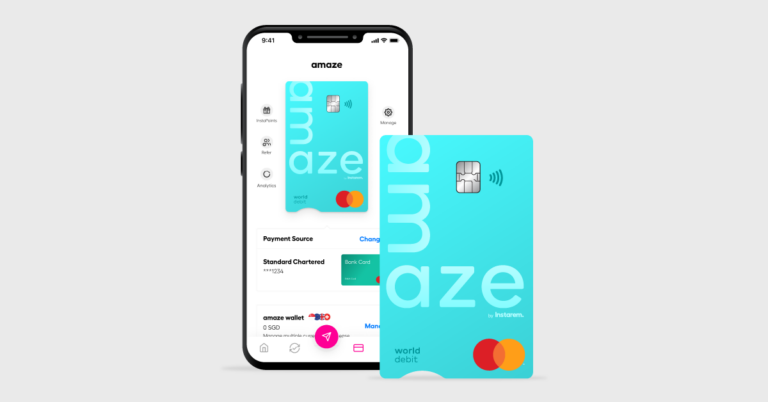

Better choice: Instarem for business

Instarem is most known for its convenience in sending and receiving money, as well as transferring funds at national and international levels. This money remittance platform also helps increase operational efficiency for businesses that constantly send overseas transactions for international payments, such as staff salaries, rent, business suppliers, contractors, and more.

With a global reach of more than 60 countries, Instarem uses a cost-efficient approach, such as having multi-currency wallets which offer great exchange rates with no hidden charges. Not just that, but Instarem also comes with extra features that improve the quality of their services, such as the ability to manage global accounts using one dashboard, custom reports generator, and digital invoicing and tracking.

All in all, Instarem has made cooperative payments easier and smarter where you can pay and send money over to your subsidiaries, vendors, suppliers, and even freelancers with lower fees and competitive exchange rates.

Check them out and see how they can make your transactions easier!

*Information below is correct as at 1 Feb 2022 , below is general information only We don’t consider your personal objectives, financial situation or needs and we aren’t recommending any specific product to you. You should make your own decision after reading the PDS or offer documentation, or seeking independent advice.

**Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.