Top digital money remittance services in United States

This article covers:

Finding the best money transfer services in the US can be challenging, especially when transfer fees and charges to various worldwide destinations aren’t obvious. Don’t worry, we’ve done the hard work for you and shared what we believe to be the top companies below, from your local bank to the money transfer specialists, together with a quick overview and their advantages and disadvantages.

While consumers can choose from several banks and fintech companies to complete a wire transfer, they should take these considerations into account:

- Exchange rates

Foreign exchange rate, or FX rate, is the value of a country’s currency in comparison to another country. Generally banks and online remittance service providers will add a markup on top of the foreign exchange rate. The exchange rate differs greatly and you might be able to save on your exchange rate by doing your own research.

- Fees

“Why do I have to pay a fee to transfer money?!” Well, if you don’t already know, companies and banks such as Paypal and Western Union are going to charge you a small amount of fees when you’re transferring money outside of the US.

- Limits on amounts

Limits on the transferred amount may be a deal-breaker to some. So depending on the total amount of money you want to send out of the US, you might want to pay attention to the bank or company’s transaction limit. Most companies and banks are likely to have a minimum and maximum amount of transaction limits per transaction or per cumulative amount over a set period of time due to various international banking regulations.

- Processing time

Isn’t every transaction going to be an instant transfer? Well, the answer is yes and no. Most of the time, international fund transfer would take up to several days or more depending on the countries you’re sending the money to and the company or bank that you use. There are, of course, several other options for you to transfer the money out instantly, but just know that it’s going to come with a fee.

- Money destinations

Certain companies or banks will require you and the recipients to have an account with them to use their transfer services. Companies such as Western Union allow their recipients to have pickup options at certain physical locations. So, do your research and determine which options are most convenient for you!

- Countries

In some countries, remittance sent from the US might not be an option. Hence, it’s essential for you to make sure that the bank or company provides money remittance services to the receiver’s country!

Ways to send money overseas from the US

Now, we’re sure you must be thinking that you’ve already grasped the idea of things to look out for when it comes to remittance services, but as mentioned, this is just the surface of the money remittance services.

So, what are the ways for you to send money overseas from the US? Well, there are three primary ways:

- Specialized remittance service platform – If you’re looking to transfer money with lower fees and exchange rates, then the money remittance service platform is definitely for you.

- Cash transfer service – Worry that your recipients might not have a bank or service account? Fret not! Just use cash transfer services so that your recipients can pick up cash directly.

- Banks – If you’re the skeptical type who’s worried about almost everything, then using a bank with a SWIFT network will probably calm you down. As long as you’re providing the correct recipient details, established banks are relatively safe to use. However, note that banks are relatively more expensive on the transfer fees and have marked up exchange rates.

Top remittance services for sending money overseas from the US

Among all the money remittance services available for sending money overseas from the US, Instarem, Wise, XE, MoneyGram, Western Union, Xoom, Paysend, WorldRemit, and Bank of America are at the top of the pile for consideration.

But with so many options, which remittance service should you employ? Don’t worry. To make things easier for you, we’ve already sorted them out according to the fees, exchange rates, transfer speed, transfer amount, supported currencies pair, payment options, and receiving options, as shown below.

*data as extracted from the named platform providers public website correct as at 1 Dec 2021)

What should you watch out for?

If you don’t already know, even if the companies or banks are legitimate businesses, they come with hidden fees, unfavourable rates, and taxes and regulations. Make sure to be on the lookout for these ‘fees,’ or you’ll be paying more than what you’re supposed to be paying.

And of course, we’re sure you’ll come across some money remittance services with extremely low fees and with a good currency exchange rate that’s too good to be true. So, be aware! These online money remittance services you found on Google might just be another form of online scam trying to steal your money!

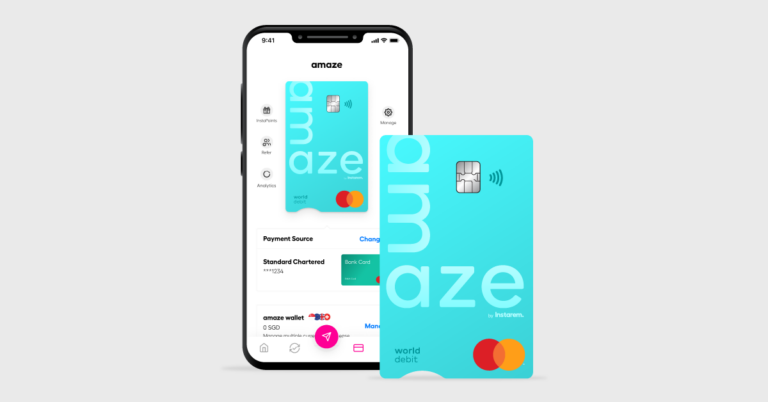

Better choice: Instarem

Sending money overseas shouldn’t cost a fortune. Compare money transfer services for the strongest rates, lowest fees, and flexible delivery. Here’s why Instarem is an option worth looking into:

Save on transfer fees with Instarem – Why pay more to transfer money? With Instarem, you don’t have to worry about the transfer fees as there will be no transaction charges for most countries and amounts you’re sending!

Consistent rates on all transfers – Most money remittance services offer a low exchange rate, but that’s only on the first transfer. With Instarem, you’ll be able to enjoy a consistent rate when you’re sending money overseas!

Transparent – No hidden charges or service fees. Instarem values transparency most so that you wouldn’t be paying more while receiving less.

Trust – Instarem is regulated by 9 financial regulators across the globe, so you can be sure they do everything by the book.

Simple and easy to use – Once you’ve set up an account with Instarem, you’ll be good to go.

See how Instarem works and find out for yourself.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app