Busting 5 Common Myths About Online Remittances

This article covers:

Online money transfer is a fairly new concept and is often met with skepticism by a large section of people. The lack of familiarity with this new-age mode of money transfer and speculations about the industry pave the way for a lot of misconceptions about online remittances. While being cautious about online transactions is a sign of good judgement, one must be able to filter out the facts from the myths. In this blog, we have tried to bust some common myths surrounding the remittance industry.

Myth #1: Bank Transfers Are Cheaper Than Online Remittance Services

One of biggest misconceptions surrounding the remittance industry is that money transfers via banks are cheaper. Years of dependency on banks for all our financial needs, including money transfers, has created an illusion that bank transfers are the cheapest. The reality, however, is far from it. According to a World Bank report on Remittance Prices Worldwide, the global average transaction costs stood at 7.09% at the fourth quarter of 2017. The report stated that banks are the most expensive type of service provider, with an average transaction cost of 10.44%. Money transfer operators (MTOs) were a close second with an average transaction cost of 8.23%. This is mostly due to the fact that most banks offer only wire transfer services, which tend to be very expensive and are better suited for business transactions than for small-scale remittances.

When you transfer money via banks, you are not the only one who bears the brunt of FX spreads and hidden charges; it’s also your recipient who can end up receiving a significantly lesser amount of money than he was supposed to. What makes it worse is that neither party is made aware of these exorbitant charges beforehand. The sender and the recipient find out about the deductions only after the transaction has been processed.

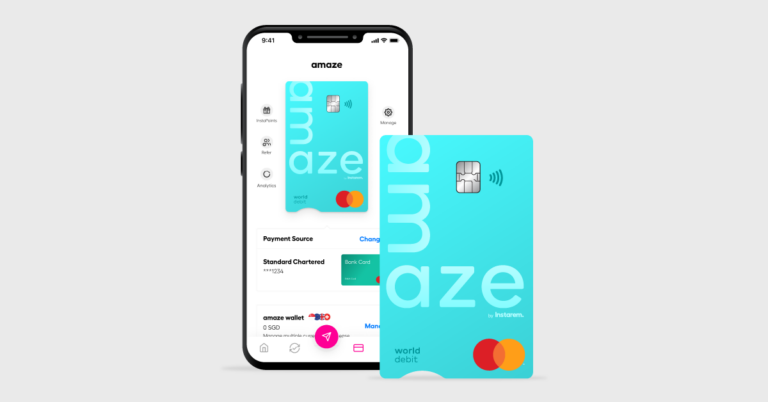

Online remittance providers such as InstaReM are striving to plug the gap by bringing in transparency about costs, giving transparent mid-market FX rates straight from the provider, and charging a nominal fee, all of which is displayed upfront for the user.

Myth #2: Remittances Are Time-Consuming

Thanks to banks, the popular belief is that international money transfers take a very long time (sometimes weeks) to get processed. The reason: complicated, interdependent internal procedures, resulting in slower service. Besides, one should not forget that international payments are not a bank’s core area of operation. Banks also manage internal bank transfers, foreign bank transfers, mortgages, personal loans, business loans, student loans, deposits, offshore accounts, etc.

That’s where service providers like InstaReM come to your rescue. InstaReM typically takes one or two business days to transfer your money abroad. However, there are certain factors that may affect the timeline of the payments. Besides, the banking systems and holidays in both the sending and receiving countries also impact the transfer time. The good thing about InstaReM is that unlike banks, it keeps you posted about where your money is. InstaReM keeps its clients updated via email at each stage of the transfer. Users can also track their transfers on our website and app on the go.

Myth #3: Online Remittance Is Too Risky As Compared To Banks

One of the primary reasons why a large section of the population shies away from online money transfers is the idea that bank transactions are better protected. The reality, however, is that online service providers have a robust risk management system in place to safeguard your funds against money laundering or terrorism financing.

Digital payments companies report to a number of regulatory bodies globally and have preventive measures designed to safeguard your profile against unauthorised access, fraud and money laundering. Just like banks, remittance companies also undergo regular audits and are supervised by regulatory bodies at the state, federal and international levels.

Myth #4: Remittance Is A Man’s Thing

When it comes to overseas money transfers, the general perception is that it’s the men who move out of their home country to support their families. Jesus Cervantes of CEMLA writes, “it is commonly though that remittance flows (…) stem from a migratory process where men leave their country to seek better employment and income opportunities, and then send remittances to their wives and children back home.”

A lot of studies have also shown that, in countries around the world, recipients of remittances are mostly women. For example, in Guatemala, 63% of primary remittance recipients are women. In Colombia, 70% of remittance recipients are women. A study of BANORTE transfers to Mexico found that women receive 72% of all remittances to that country.

While women do tend to be remittance recipients in most cases, they are not limited to this role only. In fact, women account for nearly half of all international migrants, and many women send money back home to support their families. A recent study by Dialogue found that women were responsible for much of the increase in remittances to Latin America and the Caribbean in the post-recession period. The report also stated that male migrants sent remittances of almost the same amount and frequency between 2009 and 2014, while female migrants sent more money, more frequently.

Myth #5: Signing Up With An Online Provider Is Complicated & Time-Consuming

If you thought it’s easier to walk into a bank and transfer money than signing up with an online remittance provider, here’s a reality check. Filling out pages and pages of forms and attaching hard copies of all your address and identity proofs to it is neither simple nor does it save you time. Whereas an online remittance company offers an easy sign-up process. All you need to do is go to the sign-up page of your preferred money transfer company and fill in some basic personal information and upload a few documents for verification. Once your account is approved, you can just add your recipient details and start sending money. Yes, it’s that simple!

Now that we have busted these myths about online remittances, it’s time to discover a faster and cheaper way to transfer funds. How about InstaReM?

Get the app

Get the app