Can foreigners buy property in Singapore? A complete guide

This article covers:

- Key Takeaways

- Who is Considered a Foreigner in Singapore’s Property Market?

- Types of Properties Foreigners Can Purchase

- Eligibility Criteria for Foreigners

- Stamp Duties and Taxes

- Owner-Occupied Residential Properties

- Non-Owner-Occupied Residential Properties

- Financing Options for Foreign Buyers

- How To Buy a Property in Singapore as a Foreigner

- Final Thoughts

- Making a large overseas transfer for a big milestone, a move abroad, or a new goal?

- FAQs

Key Takeaways

- Foreigners Can Buy Property in Singapore but Restrictions Apply

Foreigners can purchase private condominiums and apartments freely but need approval from the Singapore Land Authority (SLA) to buy landed properties. Public housing (HDB flats) is generally off-limits to non-residents.

- Significant Taxes Apply to Foreign Buyers

In addition to the standard Buyer’s Stamp Duty (BSD), foreigners must pay an Additional Buyer’s Stamp Duty (ABSD) of 60% on property purchases, making ownership significantly more expensive compared to Singaporeans and Permanent Residents.

- Financing and Legal Approval Are Key Considerations

Foreign buyers face lower loan-to-value (LTV) limits when financing a property and may require approval from authorities for certain types of real estate. Engaging an experienced property agent and legal professional is recommended to navigate the process smoothly.

Singapore had humble beginnings—a small trading port with a small Malay fishing village. Who would’ve thought that it would turn into a global financial hub? With sleek skyscrapers, lush greenery and a rock-solid economy, Singapore is now one of the most desirable places to live and invest.

But here’s the million-dollar question: can foreigners buy property in Singapore? This is the short answer: yes, but with some restrictions. The country has clear laws about what foreigners can and can’t own, mainly to ensure housing remains accessible to locals.

This guide will explain the types of properties non-residents can purchase, the key rules to follow, the application process and more. Read on!

Who is Considered a Foreigner in Singapore’s Property Market?

In Singapore, property ownership is regulated under the Residential Property Act (RPA) to ensure that residential land remains primarily in the hands of Singaporeans. Under this act, a foreigner is defined as anyone who is not:

- A Singapore Citizen

- A Singapore Company, Limited Liability Partnership (LLP) or Society with significant local ownership

This means that Permanent Residents (PRs) and non-residents fall under the ‘foreigner’ category for certain property restrictions, though PRs have some advantages over non-residents.

Types of Properties Foreigners Can Purchase

Singapore’s property market has strict regulations on foreign ownership, particularly for public and landed housing. While foreigners can freely buy private condominiums and apartments, restrictions apply to landed properties and HDB flats.

Below is a breakdown of the types of properties foreigners can and cannot purchase.

Property Type | Singapore PRs | Non-Singapore PRs | Notes |

Private condominiums and apartments | Allowed | Allowed | No restrictions and no prior approval are required. |

Strata-Landed Houses | Allowed | Allowed | Must be part of a government-approved condominium project. |

Landed Properties | Restricted (requires SLA approval) | Restricted (requires SLA approval) | Both need Singapore Land Authority (SLA) approval, but PRs have a higher approval chance. |

Landed Properties in Sentosa Cove | Allowed (with SLA approval) | Allowed (with SLA approval) | Sentosa Cove is an exception where both groups can buy, subject to approval. |

HDB Flats (Public Housing) | Allowed (Resale Only) | Not Allowed | Non-PR foreigners cannot buy HDB flats. PRs, however, can purchase resale HDB flats. |

Executive Condominiums (ECs) | Allowed (Resale after 5-year MOP) | Allowed only after 10-year MOP | Non-PR foreigners can only buy ECs after the 10-year Minimum Occupation Period (MOP) when fully privatised. PRs can buy resale ECs after 5 years. |

Eligibility Criteria for Foreigners

Keep in mind that Singapore has strict regulations on foreign property ownership. Here’s what you need to know:

HDB Flats

Unfortunately, foreigners cannot buy government-subsidised HDB (Housing and Development Board) flats. These are reserved for Singapore Citizens (SCs) and Permanent Residents (PRs).

While PRs can purchase resale HDB flats, they must meet certain criteria. This includes:

- Minimum PR Status Duration: PRs are generally required to hold Permanent Resident status for at least three years before they can purchase a resale HDB flat. This waiting period reflects a level of commitment to Singapore.

- Citizenship: If a PR is purchasing with another PR, at least one of them must have permanent residency for three years. Two newly granted PRs cannot buy a resale HDB flat together.

- Family Nucleus Requirement: PRs can only buy a resale HDB flat under the Public Scheme (with a spouse, children or parents who are PRs or Singapore Citizens) or the Fiancé/Fiancée Scheme. Single PRs are not eligible.

- No Private Property Ownership: PRs must sell off any private property they own (in Singapore or overseas) at least 30 months before applying for a resale HDB flat.

- Ethnic Integration & SPR Quota: The purchase must comply with the Ethnic Integration Policy (EIP) and Singapore Permanent Resident (SPR) Quota, which regulate the proportion of PR households in an HDB block or neighbourhood.

First-time home-buying families with one Singapore Citizen and one or more Permanent Residents (PRs) will face an S$10,000 price premium on their flat purchase. However, this additional cost can be offset by applying for the Citizen Top-Up Grant once the PR becomes a Singapore Citizen or when the couple has a child who is a Singapore Citizen.

Private Condominiums & Apartments

Singapore Permanent Residents (SPRs) and foreigners can buy private condominiums in Singapore. This also includes strata landed houses within approved condominium developments, and leasehold interests in landed residential properties for terms of up to seven years (including renewals).

These purchases do not require prior approval from the Singapore Land Authority (SLA).

Landed Properties

Due to the scarcity of land, foreigners need approval from the Singapore Land Authority (SLA) to buy landed property in Singapore. This applies to the following types of landed residential properties:

- Vacant residential land

- Terrace houses

- Semi-detached houses

- Bungalows

- Townhouses or cluster houses

- Shophouses for mixed or residential use

Buyers must apply to the Land Dealings Approval Unit (LDAU). LDAU approval determines your eligibility as a foreigner or SPR to own land and/or landed property in Singapore. Applications are submitted online, and the process usually takes about a month.

The SLA assesses each LDAU application individually. Key factors they consider include:

- Having PR status for at least five years.

- Make significant economic contributions to Singapore evaluated through factors like taxable employment income.

Approved applicants must also adhere to these conditions:

- The property must be used solely as a dwelling for the owner and their family, not for rental or other purposes.

- The property cannot be sold within five years of legal completion of the purchase, or if under construction, five years from the Temporary Occupation Permit or Certificate of Statutory Completion date (whichever comes first).

- The property cannot be subdivided without approval.

Stamp Duties and Taxes

When purchasing property in Singapore, buyers must be aware of the stamp duties and taxes that apply to the transaction. These taxes regulate the property market and ensure fair ownership distribution.

Below are the key stamp duties every buyer needs to understand, including the Buyer’s Stamp Duty (BSD) and Additional Buyer’s Stamp Duty (ABSD) for foreigners and PRs, along with recent changes that may affect your purchase.

Buyer’s Stamp Duty (BSD)

All property purchases in Singapore, including HDB flats, condos, and landed homes, are subject to Buyer’s Stamp Duty (BSD), regardless of citizenship.

The BSD is calculated based on the higher of two figures:

- The property’s purchase price (as documented in the sales agreement) or

- Its market value (as determined by an official valuation).

The BSD rate follows a progressive structure, increasing as the property’s value or price goes up.The specific rates are shown in the table below.

The purchase price or market value of the property | BSD rates for residential properties | BSD rates for residential properties |

First $180,000 | 1% | 1% |

Next $180,000 | 2% | 2% |

Next $640,000 | 3% | 3% |

Next $500,000 | 4% | 4% |

Next $1,500,000 | 5% | 5% |

Remaining amount | 6% |

Additional Buyer’s Stamp Duty (ABSD)

In addition to the Buyer’s Stamp Duty, foreigners and PRs are subject to Additional Buyer’s Stamp Duty (ABSD) on their property purchases. Implemented in December 2011, the ABSD is a cooling measure designed to curb property speculation.

ABSD is charged on top of BSD and is calculated based on the higher of the property’s purchase price or market value. While foreigners, PRs and Singapore citizens are all subject to ABSD, the rates vary for each group.

The rates are as follows:

Buyer’s profile | ABSD rates on or after 27 Apr 2023 |

Singapore Citizens (SC) buying their first residential property | N/A |

SCs buying a second residential property | 20% |

SC buying third and subsequent residential property | 30% |

PRs buying their first residential property | 5% |

PRs buying a second residential property | 30% |

PRs buying a third and subsequent residential property | 35% |

Foreigners buying a residential property | 60% |

However, ABSD does not apply to US nationals or nationals and permanent residents of Switzerland, Liechtenstein, Norway and Iceland. Full remission conditions can be found here.

Property Tax

Property tax is mandatory for all property owners in Singapore. It is a recurring tax imposed on property owners, whether the property is used for personal use, rental income, or investment purposes. The tax amount is based on the property’s Annual Value (AV) and is calculated using progressive tax rates.

The property tax payable depends on:

- Annual Value (AV) – This is the estimated yearly rental income the property could generate, based on market conditions. The Inland Revenue Authority of Singapore (IRAS) determines this value.

- Tax Rates – Different tax rates apply to owner-occupied and non-owner-occupied properties, with non-owner-occupied properties facing higher tax rates.

Owner-Occupied Residential Properties

If you live in the property you own, you enjoy lower tax rates, which range from 0% to 32%, depending on the AV of your home.

Annual Value | Tax Rate | Property Tax Payable |

First $12,000 Next $28,000 | 0% 4% | $0 $1,120 |

First $40,000 Next $10,000 | – 6% | $1,120 $600 |

First $50,000 Next $25,000 | – 10% | $1,720 $2,500 |

First $75,000 Next $10,000 | – 14% | $4,220 $1,400 |

First $85,000 Next $15,000 | – 20% | $5,620 $3,000 |

First $100,000 Next $40,000 | – 26% | $8,620 $10,400 |

First $140,000 Above $140,000 | – 32% | $19,020 |

Non-Owner-Occupied Residential Properties

If you rent out your property, higher tax rates apply, ranging from 12% to 36%.

Annual Value | Tax Rate | Property Tax Payable |

First 30,000 Next $15,000 | 12% 20% | $3,600 $3,000 |

First $45,000 Next $15,000 | – 28% | $6,600 $4,200 |

First $60,000 Above $60,000 | – 36% | $10,800 |

Financing Options for Foreign Buyers

Now that you are familiar with the taxes associated with property purchases in Singapore, it’s important to also consider the financing options available, especially for foreign buyers.

Take a closer look at them below:

Loan-to-Value (LTV) Ratios and Financing Limits

In Singapore, the Loan-to-Value (LTV) ratio determines the maximum amount you can secure based on your property’s value.

Foreign buyers generally have a lower LTV ratio compared to Singapore citizens and permanent residents.

If you have no existing mortgage loan, you can borrow up to 75% of the property’s purchase price. However, if you already have one outstanding loan, it can reduce your borrowing limit to 45%. For those with two or more existing loans, the maximum loan amount is capped at 35%.

Mortgage Options Available to Non-Residents

To get a mortgage in Singapore as a foreigner, here are the steps you should follow:

- Step 1: Find a mortgage banker and submit the necessary documents to secure an In-Principle Approval (IPA). This is a formal confirmation of the maximum loan amount a bank is willing to offer. You can apply for multiple IPAs at this stage.

- Step 2: After signing the Sale & Purchase (S&P) Agreement, hire a conveyancing lawyer and provide the required documents. The lawyer will coordinate with the bank, the CPF Board and the seller’s bank to facilitate the transaction.

- Step 3: Once the transaction is completed, the bank will begin deducting loan repayments from your local bank account according to the agreed schedule.

You are also required to submit the following documents to help banks determine your maximum loan amount:

- A government-issued ID

- Three most recent computerised payslips or bank statements (for self-employed applicants)

- Two most recent annual income tax assessments

- Latest CPF statement showing account balance and contributions (if applicable)

- Passport or Identity Card (for Permanent Residents)

If you have already secured a property for purchase, additional documents will be needed:

- Signed Option to Purchase (OTP) or Sale & Purchase (S&P) Agreement

- Official valuation report

- HDB confirmation page (printed from the HDB online portal, if applicable)

Some banks that offer home loans to foreigners include OCBC Bank, UOB, Maybank, Citibank and HSBC Bank, to name a few.

How To Buy a Property in Singapore as a Foreigner

If you are a foreign buyer, here are the steps you should know when buying a property in Singapore:

Step 1: Secure Financing and Loan Pre-Approval

Make sure that you assess your budget and secure financing. Check your Loan-to-Value (LTV) ratio.

Before making an offer on a property, apply for an In-Principle Approval (IPA) from banks to understand how much financing you qualify for. At this stage, ensure you have sufficient funds for BSD, ABSD, legal fees and other costs.

Step 2: Hire a Licensed Real Estate Agent

Next, you should engage a licensed real estate agent experienced in handling foreign buyer transactions. Your agent will help you shortlist suitable properties based on your preferences and budget.

Step 3: Make an Offer and Secure The Option to Purchase (OTP)

Once you find a property you wish to purchase, negotiations with the seller take place. When both parties agree on a price, you will pay a 1% option fee to obtain the Option to Purchase (OTP), which grants you exclusive rights to buy the property within a specified period, typically 14 days.

Step 4: Pay the Option Exercise Fee and Sign the Sale & Purchase Agreement (S&P)

To proceed with the purchase, pay another 4% to 9% of the property price (depending on agreement terms) to exercise the OTP.

Then, sign the Sale & Purchase (S&P) Agreement and submit it to a conveyancing lawyer.

Step 5: Pay Stamp Duties

Pay the Buyer’s Stamp Duty and Additional Buyer’s Stamp Duty within 14 days of signing the agreement.

Step 6: Legal Conveyancing and Completion

Once the legal processes are completed, the transaction moves to the final stage. Your lawyer will conduct legal checks, process payments and liaise with the seller’s legal representatives. The final balance payment is made, and ownership of the property is officially transferred to you.

Step 7: Collect the Keys and Register Ownership

Upon completion, you will receive the keys to your new property. If the property is newly built, you may receive a Temporary Occupation Permit (TOP) or a Certificate of Statutory Completion (CSC), depending on its status. At this point, you can proceed with any necessary renovations or move-in preparations.

Final Thoughts

There’s no doubt that living in Singapore is a dream for many. The country offers world-class infrastructure, excellent healthcare, political stability, a safe living environment, and the whole nine yards. It attracts expatriates, investors, and entrepreneurs from around the world, all eager to experience the high quality of life it offers.

However, purchasing property in Singapore as a foreigner is not a walk in the park. It comes with its own set of challenges, including regulatory approvals, financing limits, and additional taxes such as BSD and ABSD.

Having the financial means to purchase property is only part of the equation; eligibility is just as crucial.

While these barriers may seem scary, owning property in Singapore is not out of reach. You just have to stay informed, prepare financially and work with experienced professionals such as property agents, lawyers and more.

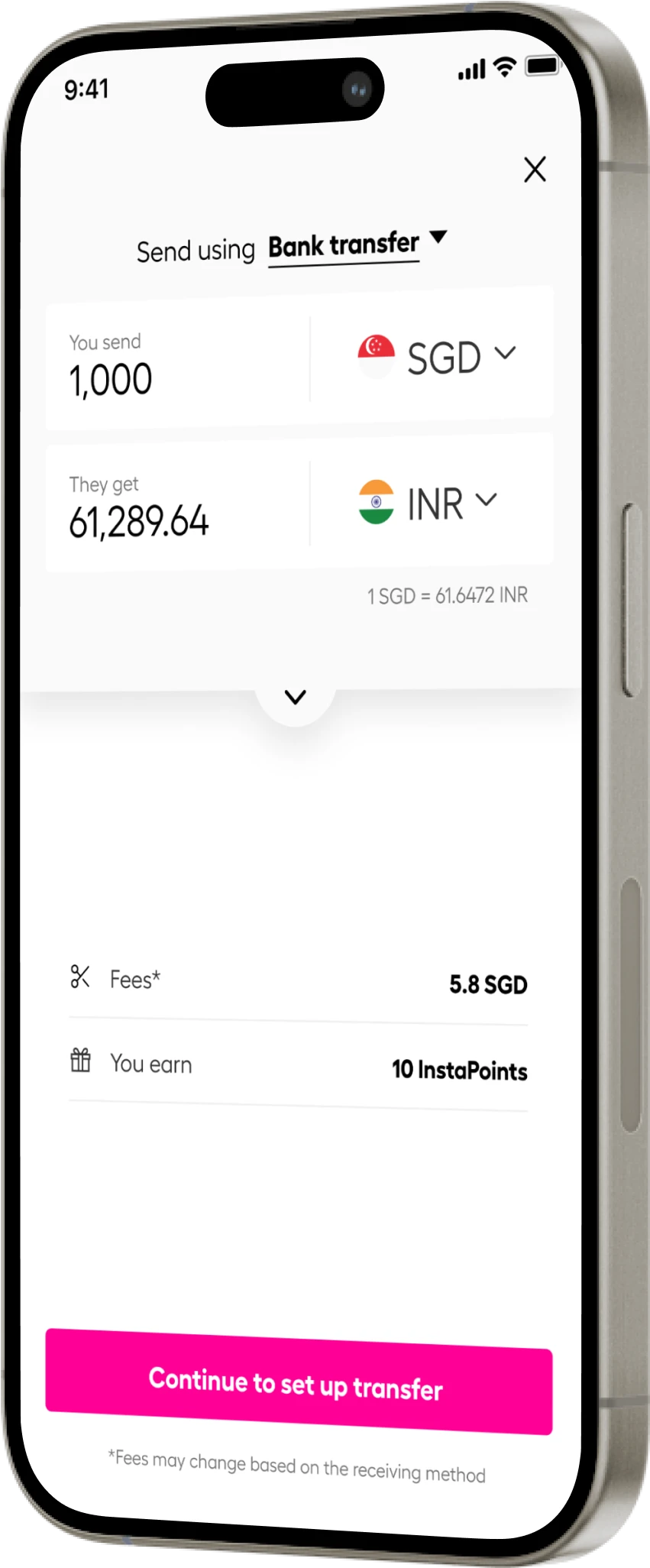

And when it comes to managing your funds for such an investment, Instarem can make international money transfers easier and more cost-effective.

*rates are for illustration purposes only.

- Get Everything in One App: Fast, simple, and affordable. Send money with low fees, great rates, full transparency, and easy tracking.

- International Payments: Easily send and receive real estate payments with low fees and great rates, ensuring a smooth investment experience.

- No Hidden Fees: There are no setup or subscription fees, nor are there any hidden charges to surprise you.

Grow your real estate investment with Instarem. Download the app or sign up now and manage your property finances more easily—no matter where you are.

Making a large overseas transfer for a big milestone, a move abroad, or a new goal?

We’re here to help with more than just great rates.

Enjoy transparent pricing—no hidden fees, no sneaky markups. Just unbeatable rates, low fees, and dedicated support to ensure your transfer is seamless and stress-free.

Sending large amounts has never been easier. Join us today and keep more of your money where it belongs—in your pocket.

FAQs

Can you buy property in Singapore if you are not a citizen?

Yes, foreigners can buy property in Singapore, but with a limitation. Foreigners can purchase condominiums or apartments in private developments, but they cannot purchase landed property unless they have special approval from the government.

Additionally, they are subject to the Additional Buyer’s Stamp Duty (ABSD), a tax that is imposed on foreign buyers to cool the property market.

Can I buy HDB with a foreigner?

No, foreigners cannot buy HDB flats in Singapore unless they meet specific conditions. HDB flats are typically available to Singaporean citizens and Permanent PRs.

If you are a foreigner married to a Singaporean or PR, you may be eligible to purchase a resale HDB flat, but there are restrictions on the type of flats you can buy, such as only resale flats, and you must meet eligibility criteria such as age and family nucleus requirements.

What is the tax rate for foreigners buying property in Singapore?

Foreigners are subject to the Buyer’s Stamp Duty (BSD) and the Additional Buyer’s Stamp Duty (ABSD). The BSD is charged at a rate of 1% for the first S$180,000 of the property’s purchase price, 2% for the next S$180,000, and 3% for the remaining amount.

On top of this, foreigners must pay an ABSD of 60% on the purchase price or market value, whichever is higher.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app