Top 10 cheapest currencies in the world in 2024

This article covers:

Many people living in developing economies encounter situations where they would receive lesser United States Dollars (USD) in exchange for their home currency. For example, if one exchanges 500 INR in India, they may get only around USD 6 in return. This is when their home currency (INR) is “weaker” than the other country’s local currency (USD).

However, consider a situation wherein an exchange of 500 INR, one can get around 2,50,000 IRR worth of local currency in Iran. This is when the home currency is “stronger” than the other country’s currency.

In the above example, the terms “stronger” and “weaker” are used to compare INR’s relative to USD and IRR.

A currency is stronger when it can buy more foreign money. That doesn’t mean everyone in that country is doing better. When a currency gets weaker, it can buy less foreign money, but that doesn’t mean everyone in the country is doing worse.

Many people may consider having a stronger currency favourable since this makes imported goods cheaper, and residents of a stronger currency can take vacations overseas easily. However, that may not always be the case. When a country’s currency is weaker, more people would want to buy the goods manufactured/produced in their home country, thereby increasing the demand, creating jobs, and accelerating growth.

Various factors affect the currency to make it strong or weak. Additionally, some countries may even choose to devalue their currency.

In the article below, we shall look at some of the least valued or cheapest currencies in the world, the significant factors that affect their exchange rate, and why finding the best exchange rate is vital while making an international money transfer.

Weakest Currencies in the Word

Foreign exchange trading always happens in pairs where one currency is bought against the other. The first currency or the one to the left in the pair is the base currency, and the other is the quote currency. Hence, the currency depreciation would show how many more units of quote currency are needed to buy base currency than previously.

The table below lists the most struggling currencies and shows the weakest global currency rankings.

Currency | Currency Code | 1 USD Value | 1 INR Value |

Iranian Rial | IRR | 42265.00 | 509.86 |

Vietnamese Dong | VND | 24099.50 | 290.68 |

Lao/Laotian Kip | LAK | 19813.85 | 239.00 |

Sierra Leonean Leone | SLL | 19750.00 | 238.24 |

Indonesian Rupiah | IDR | 15357.65 | 185.27 |

Uzbekistani Som | UZS | 12150.04 | 146.57 |

Guinean Franc | GNF | 8575.34 | 103.45 |

Paraguayan Guarani | PYG | 7255.21 | 87.52 |

Ugandan Shilling | USH | 3716.51 | 44.83 |

Iraqi Dinar | IQD | 1308.17 | 15.78 |

*Currency rates as of 12 Sept 2023, 8:58 am UTC

1. Iranian Rial (IRR)

Iran, an oil-exporting country and an influential member of OPEC, is also a significant player in global finance and trade due to its nuclear program. The Iranian Rial (IRR) is the country’s official currency, introduced in 1798 but named Toman. 1 USD is worth 42265 IRR, making it the lowest currency in the world.

Symbol | – |

ISO 4217 Code | IRR |

Central Bank | Central Bank of the Islamic Republic of Iran |

Denominations | Bills: 100, 200, 500, 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000 rials Coins: 50, 250, 100, 500, 1,000, 2,000, 5,000 rials |

Currencies Pegged to IRR | None |

IRR is Pegged to | None |

2. Vietnamese Dong (VND)

Vietnamese Dong (VND), the official currency of Vietnam, is considered one of the cheapest currencies in the world. The dong replaced the hao in 1978. The dong was subdivided into hao, but since hao is no longer a legal tender, the dong is no longer divided into smaller units. With 1 USD worth 24099.50 VND, the currency forms a part of countries with the lowest currency values.

Symbol | ₫ |

ISO 4217 Code | VND |

Central Bank | State Bank of Vietnam |

Denominations | Bills: 100, 200, 500, 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000, 200,000, 500,000 Coins: 200, 500, 1,000, 2,000, 5,000₫ |

Currencies Pegged to VND | None |

VND is Pegged to | None |

3. Lao/Laotian Kip (LAK)

Lao Kip (LAK) is the currency of Laos after it replaced the Indochinese piaster at par in 1945. The country achieved freedom from France in 1952; since then, the kip has become its official currency. The country suffers from high inflation; thus, coins and smaller bills are no longer used. The kip is among the least valuable currencies, as 1 USD can be worth 19813.85 LAK.

Symbol | ₭, ₭N |

ISO 4217 Code | LAK |

Central Bank | Bank of the Lao P.D.R. |

Denominations | Bills: 1, 5, 10, 20, 50, 100, 500, 1,000, 2,000, 5,000, 10,000, 20,000, 50,000, 100,000 kip Coins: 10, 20, 50 att |

Currencies Pegged to LAK | None |

LAK is Pegged to | None |

4. Sierra Leonean Leone (SLL)

The Sierra Leonean Leone (SLL) is the official currency of a Western African nation, Sierra Leone. It is considered among the weakest currencies due to slow economic growth, civil war impact, and poor governance. The country is mainly dependent on diamond and other mineral mining.

Symbol | Le |

ISO 4217 Code | SLL |

Central Bank | Bank of Sierra Leone |

Denominations | Bills: 1,000, 2,000, 5,000, 10,000 leones Coins: 10, 50, 100, 500 leones |

Currencies Pegged to SLL | None |

SLL is Pegged to | None |

5. Indonesian Rupiah (IDR)

Next on our list of weakest currencies in the world is the Indonesian Rupiah (IDR). The currency began circulating in the country in 1946, along with other currencies. However, with the independence from the Dutch in 1950, the Indonesian Rupiah became the sole official currency. The country faced high inflation at various stages, leading to economic challenges and currency devaluation.

Symbol | Rp |

ISO 4217 Code | IDR |

Central Bank | Bank Indonesia |

Denominations | Bills: Rp 1,000, Rp 2,000, Rp 5,000, Rp 10,000, Rp 20,000, Rp 50,000, Rp 100,000 Coins: Rp 50, Rp 100, Rp 200, Rp 500, Rp 1000s |

Currencies Pegged to IDR | None |

IDR is Pegged to | None |

6. Uzbekistani Som (UZS)

The Uzbekistani Som (UZS) is the official currency of Uzbekistan and is included among the weakest currencies. The UZS replaced the Uzbekistani ruble at par on 15 Nov 1993. At that time, 25 Som was equal to 1 USD; however, due to inflation, the currency was devalued in 1994 at 1 new Som = 1,000 old Som.

Symbol | Som |

ISO 4217 Code | UZS |

Central Bank | Central Bank of the Republic of Uzbekistan |

Denominations | Bills: 1, 3, 5, 10, 25, 50, 100, 200, 500, 1,000 som Coins: 1, 5, 10, 25, 50, 100 som |

Currencies Pegged to UZS | None |

UZS is Pegged to | None |

7. Guinean Franc (GNF)

Guinea Franc (GNF) is the official currency of the Republic of Guinea and was earlier known as French Guinea. The country attained independence from France in 1958, and until then, the common area currency, the CFA franc, was in circulation. Guinea is rich in gold, diamonds, and high-grade iron ore reserves. However, the country’s economy was stalled due to political instability.

Symbol | FG, Fr, GFr |

ISO 4217 Code | GNF |

Central Bank | Central Bank of the Republic of Guinea |

Denominations | Bills: 25, 50, 100, 500, ,1000, 5,000, 10,000 francs Coins: 1, 5, 10, 25, 50 francs |

Currencies Pegged to GNF | None |

GNF is Pegged to | None |

8. Paraguayan Guarani (PYG)

The official currency of the Republic of Paraguay, Paraguayan Guarani (PYG), is one of the lowest-value currencies in the world. The Government decided to replace the peso with PYG as legal tender in 1943 at the rate of one guarani for every 100 pesos. The value of PYG continued to erode over time.

Symbol | ₲ |

ISO 4217 Code | PYG |

Central Bank | Banco Central del Paraguay |

Denominations | Bills: 1,000, 2,000, 5,000, 10,000, 20,000, 50,000 & 100,000 guaranies Coins: 50, 100, 500, 1,000 guaraníes |

Currencies Pegged to PYG | None |

PYG is Pegged to | None |

9. Ugandan Shilling (USH)

The national currency of Uganda, the Ugandan Shilling (USH), replaced the East African Shilling at par in 1966. This free-floating currency was again revalued in 1987 for the new Ugandan Shilling at the rate of 100:1. It is one of the lowest currencies in the world, making 1 USD equal to 3716.51 USH.

Symbol | USh |

ISO 4217 Code | USH |

Central Bank | Bank of Uganda |

Denominations | Bills: 1,000, 2,000, 5,000, 10,000, 20,000, 50,000 shillings Coins: 10, 50, 100, 200, 500 shillings |

Currencies Pegged to USH | None |

USH is Pegged to | None |

10. Iraqi Dinar (IQD)

The last of our top 10 cheapest currencies in the world list is the national currency of Iraq, the Iraqi Dinar (IQD). The currency is valued at 1308.17 IQR in exchange for each USD. The new dinar was released on 15 Oct 2003 with better security features and protection against counterfeiting.

Symbol | – |

ISO 4217 Code | IQD |

Central Bank | Central Bank of Iraq |

Denominations | Bills: 50, 100, 250, 500, 1,000, 5,000, 10,000, 25,000 dinar Coins: 25, 50, 100 dinar |

Currencies Pegged to USH | None |

USH is Pegged to | None |

Factors Affecting the Exchange Rates of Weakest Currencies

Simply put, trading one currency for another is called foreign exchange or Forex. For example, if the INR trades at 82.91 to one USD, the foreign exchange rate for USD for INR is 82.91. This exchange rate keeps moving or is constantly fluctuating due to several factors.

Keeping track of exchange rate fluctuations in weak currency markets and understanding the factors that affect these changes is essential for a country to trade with its counterparts. Similarly, it helps individuals know how much money they can get in exchange for a currency. It must be noted that the currency crisis in developing nations or any other country occurs at a macroeconomic level, affecting global currency exchange rates.

- Inflation: If a country has consistently low inflation rates, the currency value typically rises or is stable. This is because the currency’s purchasing power increases compared to other countries. Similarly, consistently high inflation rates will lead to currency depreciation due to low purchasing power and increased prices of goods and services.

- Interest rates: Higher interest rates offer higher rates to lenders, attracting foreign capital to earn higher returns. However, if these rates stay high, a country may see a steady rise in inflation due to the high cost of borrowing. Thus, inflation, interest rates, and currency rates are interlinked.

- Public or Government debt: Countries often borrow to finance their economic growth. However, if the country’s debt overtakes its economic growth, it may lead to high inflation. Governments may sometimes print additional money to finance debt, resulting in inflation and currency depreciation.

- Political instability: A politically stable country with less risk of turmoil attracts foreign investments, and an increase in foreign investments strengthens a currency. On the contrary, politically unstable countries will affect local economic drivers and financial policies and, in turn, make foreign investors shy away, thereby leading to currency depreciation.

- Balance of trade: Balance of trade refers to the difference between the country’s imports and exports. A country with a negative trade balance would have higher imports than exports, thus devaluing its currency.

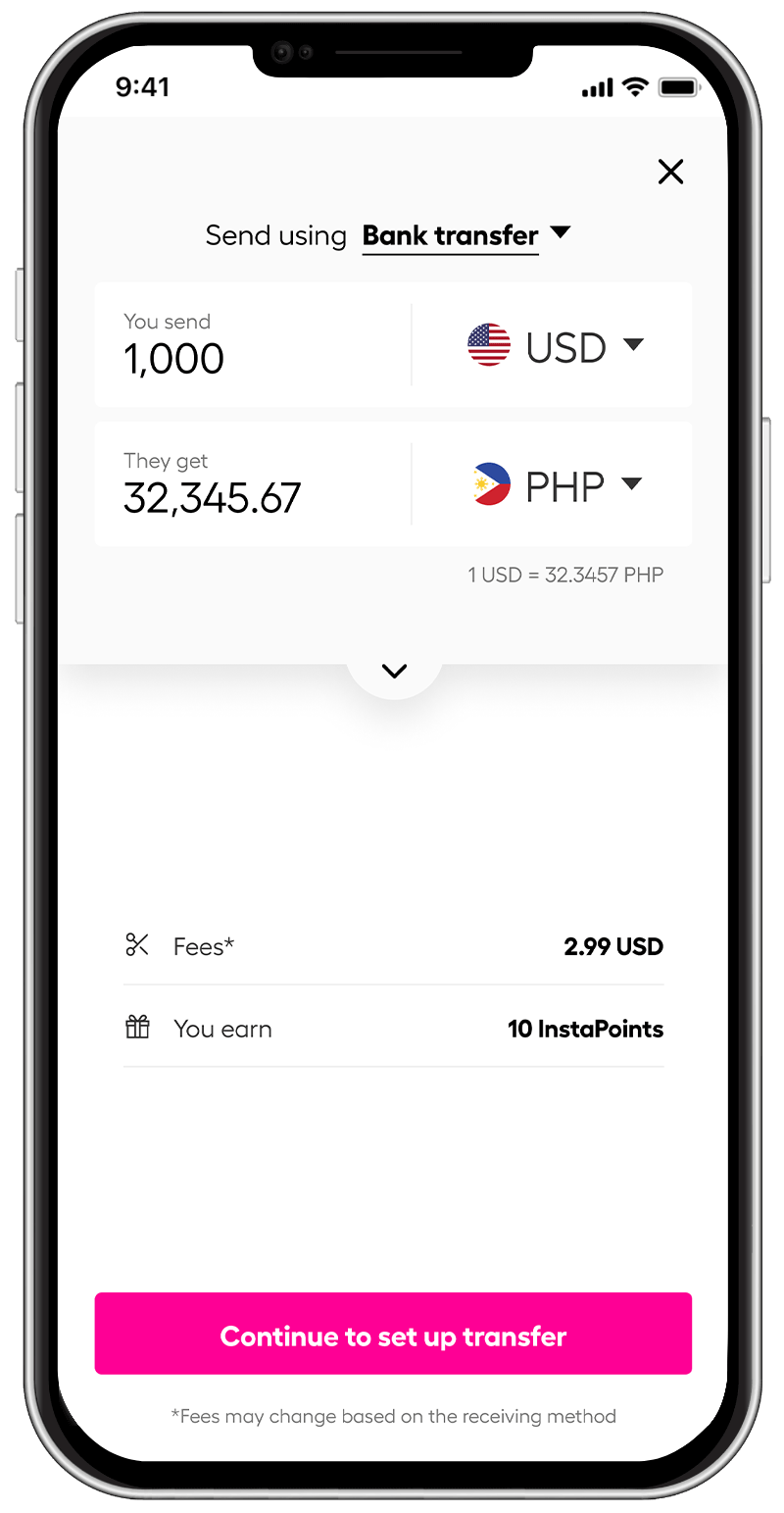

Find the Best Exchange Rates with Instarem

Regardless of your reason for buying or transferring foreign currency, finding, comparing, and negotiating the rates is essential. Thus, knowing foreign exchange rates before making a transfer is crucial. A good exchange rate can reduce the cost considerably, especially if you transfer large amounts.

- You can compare currency exchange rates offered by different providers to find the best rates.

- Then, look for the one that offers the best rates with the lowest fees.

- Exchange rates fluctuate constantly. Hence, it is crucial to choose the time to transfer funds.

- Ease in money transfer also plays an important role.

Instead of doing the above hassle, you can simply use a specialist provider like Instarem for international money transfer services. We offer a great exchange rate with no hidden charges. You can find the cost upfront so that you know how much you are paying and how much the recipient will receive.

*rates are for display purposes only.

Also, to know the current exchange rate for two given currencies and the conversion value at any time, you can use Instarem’s currency converter.

Further, Instarem offers the simplicity of the user experience for people. For example, people who want to send payment to an Indian or receive payment from overseas.

Instarem simplifies cross-border payments with affordable# costs and quick* processes to over 60+ countries. Try Instarem for your next transfer.

Download the app or sign up here.

Frequently Asked Question

Which is the highest currency in the world?

Kuwaiti Dinar (KWD) is the world’s highest or strongest currency. 1 Kuwaiti Dinar equals 3.2401 USD (as of 12 Sept 2023, 1:20 pm UTC).

What causes the value of a currency to go down?

As discussed earlier, currency depreciation may occur due to the high inflation rate, too high or too low-interest rates, high government debt, political instability, negative balance of trade, etc.

What happens if the currency keeps falling?

Struggling currencies may lead to higher inflation. Further, economic challenges and currency devaluation may increase the cost of imported commodities, leading to higher prices for consumers and reducing their purchasing power and living standards.

Who decides the value of a currency?

Market forces like demand and supply determine the currency’s value. Additionally, inflation, growth, interest rates, and balance of trade also decide the value of a currency. If a currency is pegged to another currency, then the currency to which it is pegged also influences its value.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

* Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

#When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Get the app

Get the app