A comprehensive guide to CIMB business accounts

This article covers:

Key Takeaways

Multiple CIMB Business Account Options

CIMB Biz Account, Thailand

CIMB BusinessGo, Singapore

Business Current Account, Malaysia

Benefits for Businesses of All Sizes

Convenient online account management

Free or discounted chequebooks

Free monthly e-statements for clear record-keeping

Competitive interest rates on account balances (depending on the account and country)

Complimentary accident insurance for employees (Thailand)

Zero-fee account management options

Fast and secure transaction processing

Instarem As a Business Banking Alternative

International Business Payments

Enhanced cash flow management with card funding

QuickBooks integration for seamless bookkeeping

User-friendly online platform

No hidden charges & fast transactions

Founded in 1974 in Malaysia, the CIMB (Commerce International Merchant Bankers Berhad) group is considered one of the top banks in ASEAN. They operate in Indonesia, the Philippines, the United Kingdom, Cambodia, Singapore, Vietnam, Greater China, Malaysia, Myanmar and Thailand.

With over 25 million customers, they offer everyone regular and Islamic banking services. This includes personal loans, savings accounts with higher interest rates and more. Their 24-hour self-service banking facilities are also open 24/7, allowing you to make transactions any time of the day.

But what makes CIMB stand out is its comprehensive suite of features to help businesses of all sizes manage their finances effectively. With features like convenient online account management, cheque options and complimentary monthly statements, the CIMB Business Account can help you streamline your business’s financial records and tax information.

Read on to learn more about their application process, eligibility criteria and requirements!

Getting Started: Opening a CIMB Business Account

One of the biggest reasons businesses open a business account is to separate personal and business finances, making it easier to track income and expenses. Luckily, CIMB offers a variety of business account options to fit your specific needs.

Discover the right CIMB business account for you! We’ll dive into the details of their account options across different countries and guide you through the application process.

CIMB Thailand: CIMB Biz Account

Take charge of your business payments

In CIMB Thailand, the bank offers a business account solution, the CIMB Biz Account. This account combines the ease of online transactions with competitive interest rates to help you save and grow your business.

Features and Benefits

Here’s what you can get with a CIMB Biz Account:

Step-up Interest Rates: Enjoy the advantage of step-up interest rates that can increase up to 0.40%. This means the more your business deposits grow, the higher your interest earnings become.

See the table below for deposit amounts and corresponding interest rates.

Deposit Amount | Interest Rate (p.a.) |

Tier 1: Less than THB 200,000 (1) | 0.00% |

Tier 2: From THB 200,000 to less than THB 10,000,000 (2) | 0.25% |

Tier 3: From THB 10,000,000 to less than THB 500,000,000 (3) | 0.40% |

Tier 4: THB 500,000,000 and above (4) | 0.25% |

Average interest rate | (1) = 0.00% (2) = 0% – 0.24% (3) = 0.24% – 0.40% (4) = 0% – 0.40% |

Note: CIMB may occasionally update the terms, conditions and interest rates for this account. Keep yourself informed through their website and account statements.

- Free Cheque Book – Buy 1 Get 1 Free: With a complimentary chequebook, the CIMB Biz Account lets you simplify payment processes. You can even take advantage of their special offer—buy one chequebook and get another one free. That way, you get double the number of cheques to manage your business payments without any additional cost.

- Cheque Collection Across Thailand: Deposit cheques from different zones across the country for free. You can deposit cheques drawn from any bank in Thailand at any CIMB THAI branch, regardless of the issuing bank’s location.

You don’t have to be concerned about zone restrictions, a common feature in some cheque collection systems.

- No Annual Fees: There are no annual maintenance charges associated with the CIMB Biz Account. This can be a significant cost saving for businesses compared to accounts with annual fees.

- Free Account Statements: CIMB Biz Account provides complimentary monthly statements that detail all your account activity. This allows you to easily track your income, expenses and overall financial health.

- Free Accident Insurance (up to THB 30,000): CIMB Biz Account offers complimentary accident insurance coverage for your employees. It can potentially reduce your business’s financial burden in case of unforeseen accidents.

How To Apply For a CIMB Biz Account

To apply for a CIMB Biz Account, here’s a step-by-step guide you should follow:

- Determine eligibility. Eligible applicants include individual business operators, juristic persons resident in Thailand, non-profit organisations, government agencies, state-owned enterprises, independent entities and other specified juristic persons as per the bank’s criteria.

- Gather the required documents. You have to present a government-issued business operator identification document, such as your commercial registration or certificate of value-added tax (VAT) registration.

- Visit a CIMB Thai branch. Locate your nearest CIMB THAI branch. You can find branch locations and contact information on their website.

- Speak to a bank representative. Inform the bank staff of your interest in opening a CIMB Biz Account. Make sure you provide the required documents for verification.

- Complete the application form. A bank representative will assist you in completing the application form. Ensure all information provided is accurate and up-to-date.

- Discuss account details: If you have preferences regarding your initial deposit or chequebook quantity, this is the time to discuss them with the representative.

- Wait for account approval: Once your application and documents are verified, the bank will process your application.

For the most up-to-date information and any potential changes, it’s recommended to visit a CIMB THAI branch or contact their customer service directly.

CIMB Singapore: CIMB BusinessGo

The CIMB BusinessGo is a current account for businesses registered in Singapore. It offers a combination of interest-bearing features and convenient transaction options to help you manage your business finances effectively.

Features & Benefits

Here’s what you can get with a CIMB BusinessGo Account:

Competitive Interest Rates: Earn a base interest rate of up to 2.00% p.a. on your business funds. Your idle funds can grow passively over time, generating additional income for your business.

See the table below for balance tiers and corresponding interest rates.

Balance Tiers | Base Interest |

Account Balance of S$30,000.00 and below | 0% |

Account Balance of S$30,000.01 – S$1,000,000.00 | 0.80% |

Account Balance of S$1,000,00.01 – S$2,000,000.00 | 2.00% |

Account Balance of S$2,000,000.01 and above | 0.28% |

- Free FAST transfers: Transfer funds instantly to any participating bank in Singapore without any fees. You can also enjoy zero transaction fees when you issue your employees’ salaries through BizChannel. This can lead to significant cost savings for your business, especially if you have a large number of employees.

- Zero Maintenance Fees: CIMB BusinessGo offers a zero-fee account management structure. You have no recurring costs associated with simply maintaining your business account. This is ideal for new startups with limited budgets or low monthly account balances.

- Free E-Alerts: Receive real-time notifications about your account activity for better financial management. Get notified about your deposits, withdrawals and transfers.

- Cheque Books: Get your first chequebook for free. However, you have to pay a fee for any chequebooks you order after the first one.

- Virtual Accounts: With a CIMB BusinessGo account, you can assign VAs to payers or payees. This helps you easily track who sent or received money.

How To Apply For a CIMB BusinessGo Account

To apply for a CIMB BusinessGo account, here’s a step-by-step guide you should follow:

- Prepare the necessary paperwork. Depending on the type of business entity you have, the required documents may vary. Here’s how the required documents differ based on your business type:

- Private Limited/Public Company:

- Certified true copies of Memorandum and Articles of Association or Constitution.

- NRIC/Passport copy and specimen signatures of all directors, authorised signatories, controlling persons (if applicable), ultimate beneficial owners and approving persons.

- Image holding NRIC for all individuals listed above.

- Partnership:

- A certified true copy of the Partnership Agreement.

- NRIC/Passport copy and specimen signatures of all authorised signatories, partners (for partnership entities) and approving persons.

- Image holding NRIC for all individuals listed above.

- For Sole Proprietorship:

- NRIC/Passport copy and specimen signatures of all authorised signatories, owners for sole proprietor and approving persons.

- Image holding NRIC for all individuals listed above.

- Private Limited/Public Company:

- Complete the application form. To begin your application, fill out the online application form accurately and completely. This may take up to 15 minutes.

- Prepare for the verification process and account approval. The bank will verify the authenticity of the documents provided and may contact you for any additional information if required.

- Wait for your account to open. Upon successful verification, your account will be opened and you will be notified accordingly. Make sure that you maintain a monthly average balance of S$30,000 to avoid incurring a fee of S$88 per month.

CIMB Malaysia: Business Current Account

CIMB Malaysia offers a Business Current Account designed to meet the needs of businesses of all sizes. This account provides features and functionalities to help you manage your business’s day-to-day banking activities.

Features & Benefits

Here’s what you can get with a Business Current Account:

- Effortless Online Banking: You can access BizChannel@CIMB for remote account management. This allows for convenient account inquiries, transactions, fund transfers and bill payments.

- Same-Day Account Activation: Upon completing your application at a CIMB branch, you can receive your account number on the same day. No more delays and allows for quicker access to manage your business finances.

- Free Monthly E-Statements: Access detailed electronic statements every month, providing a clear record of all account activity. Ideal for easier transaction reconciliation and accurate record-keeping.

How To Apply For a Business Current Account

To apply for a Business Current Account, here’s a step-by-step guide you should follow:

Sole Proprietorship, Partnership, or Limited Liability Partnership

- Visit a CIMB Branch. Locate a CIMB Malaysia branch near you and proceed there with your supporting documents.

- Meet with a representative. A customer service officer will assist you with opening the account and handle any questions you may have.

Other Entity Business Types

- Download the application form. Fill out the Business Account Application Form with all required information.

- Email the application. Send the completed application form to [email protected].

- Schedule a branch visit. A CIMB representative will contact you to schedule an appointment to visit a branch for document verification.

- Ensure you have a minimum initial deposit amount ready. The minimum initial deposit for most business types is RM3,000. Meanwhile, clubs, associations or societies require a minimum initial deposit of RM1,000.

Remember to keep a copy of your application and submitted documents for your records. Also, bring the original documents for verification during your branch visit (if applicable through the second application process).

Who Can Benefit from a CIMB Business Account?

When you’re a business owner, settling for your personal bank account to manage your business finances seems like the better option. When you consider opening a CIMB business bank account, you’re likely going to spend time filling out forms, paying fees and preparing required paperwork.

And while it may involve some initial paperwork and fees, a CIMB business account can streamline finances and keep everything organised. Think of it as an investment: the time spent setting up the account can free you up later to focus on revenue-generating activities and strategic growth for your business.

It can especially benefit the following account holders:

- Startups and New Businesses: This account is a good fit for new ventures that require a user-friendly platform for everyday banking tasks like online transactions, bill payments and managing initial expenses.

CIMB may also offer additional services to support your company’s growth. For instance, CIMB Thailand provides cash management services and Corporate Super Savings to help you manage your business payments.

- Established Businesses: If you’re managing a company with a high volume of transactions, you can benefit from CIMB’s convenience of online banking and clear record-keeping features like monthly e-statements.

- Businesses Seeking Shariah-compliant Banking: CIMB offers the BusinessGo-i account as an alternative for businesses adhering to Islamic financial principles.

But before you start an application for a CIMB Business Account, make sure that you consider your specific needs. This includes transaction volume, minimum balance requirements and business structure, among many others.

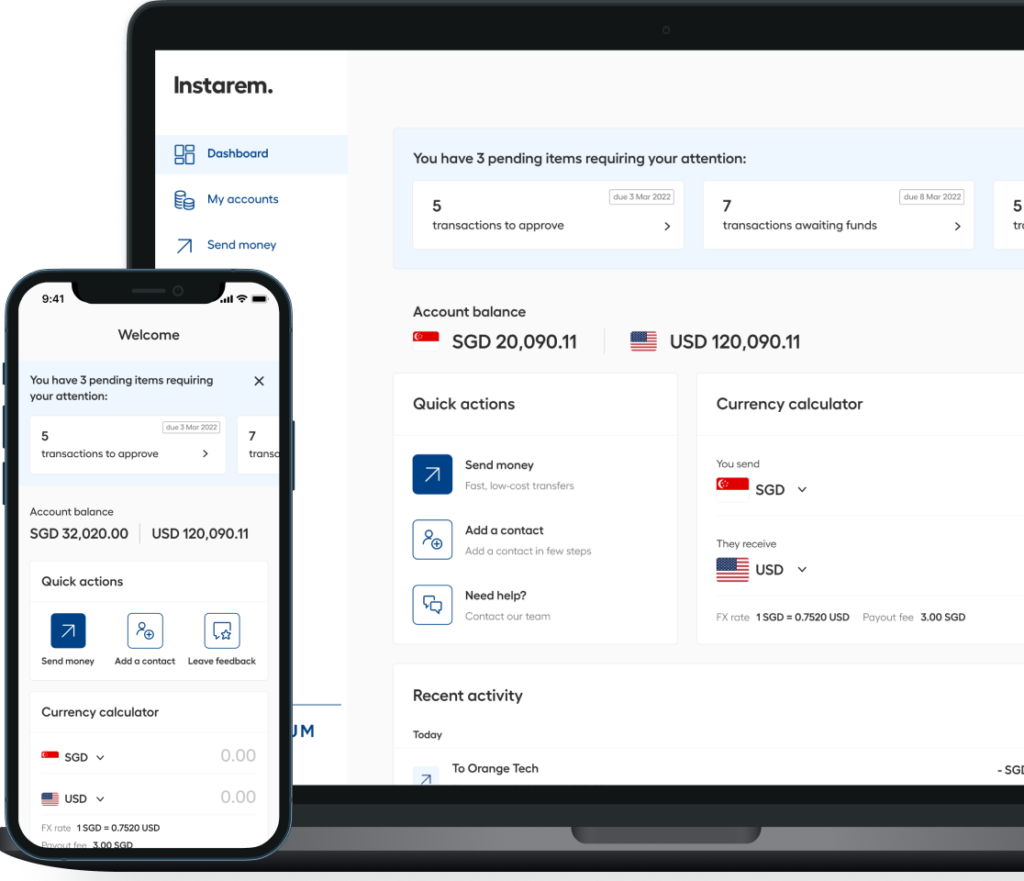

Instarem: Expanding Your Business Banking Options Alongside CIMB

While CIMB offers a comprehensive business banking solution, expanding your options to ensure you find the best fit for your company is beneficial. For businesses with frequent international transactions, Instarem might be worth exploring. Here’s a quick glimpse into what Instarem offers:

- International Business Payments: Send and receive payments to your overseas partners and employees in over 160 countries, all at competitive exchange rates and low fees. You can also transfer funds securely and efficiently between your different business locations.

- Tailored For Businesses: Instarem provides business accounts with features like salary payments, dedicated customer support and QuickBooks integration for seamless bookkeeping. You can import transactions directly into your accounting system, saving time and minimising errors during data entry.

- Enhanced Cash Flow Management with Card Funding: Instarem empowers you to leverage the convenience of credit cards for payments. Fund local and overseas suppliers and clients directly through their platform using your Visa or Mastercard.

- Fast Transactions: Up to 12X faster than banks. Most business transactions are completed within the same day.

- Online Platform: Similar to CIMB, Instarem offers a user-friendly online platform for managing finances and international transactions.

- No Hidden Fees: There are no setup or subscription fees, nor are there any hidden charges to surprise you.

Just like any financial institution, opening an Instarem business account will require you to comply with regulations. You’ll need a valid email address and an active phone number.

They’ll ask for some basic information about your company during the application process. This might include your business registration number and details about your directors and shareholders. It’s a standard procedure called ‘Know Your Customer’ (KYC), and it helps keep everyone safe.

The good news is, you don’t need to visit a branch to open an Instarem business account. Everything can be done online.

Grow your business with Instarem. Sign up now and manage your business finances easier—no matter where you are.

FAQs

How can a foreigner open a CIMB business account?

Unfortunately, there is no available information on requirements for foreigners opening a CIMB business account. CIMB likely offers business accounts only to companies registered in the country where the specific CIMB branch is located.

For details on eligibility and the application process, we recommend contacting CIMB directly.

Can I use CIMB internationally?

Yes, CIMB offers some international banking services, but it depends on your location and account type. You can access your account and perform various banking transactions internationally through CIMB’s online banking platform or mobile app.

Can an Indian open a bank account in Malaysia?

There are no restrictions based on nationality for opening a bank account in Malaysia. An Indian citizen can open a bank account in Malaysia, but they will need to meet the bank’s specific requirements for eligibility, which may include documents like a valid passport, proof of residence in Malaysia and more.