How to open a US bank account as a non-resident: A friendly guide

This article covers:

Opening a US bank account as a non-resident might seem like a Herculean task at first glance. But worry not! We’re here to untangle the process, turning it into a smooth and manageable journey. Whether you’re an international student, expatriate, or a globe-trotting investor, this guide is your trustworthy buddy, ready to help you navigate the banking waters of the United States.

Taking the leap to open a US bank account is a substantial financial step. From managing day-to-day expenses to handling cross-border transactions, a US bank account is a non-resident’s loyal financial companion. So, let’s kickstart this journey together, ensuring that each step you take is steady and well-informed.

Understanding the need for a US bank account

First off, why should you consider opening a US bank account? Well, having a US-based account is like having a financial home base when you’re dealing with US dollars. Especially for international students, expatriates, and business enthusiasts, a US bank account is not just an option—it’s a necessity.

Imagine managing your tuition fees, daily expenses, or business transactions without the hassle of currency conversion or international transaction fees—sounds relieving, right? Furthermore, it bolsters your financial credibility, making things like renting an apartment or setting up a phone line less complicated.

Types of US bank accounts for non-residents

Now, diving into the types of bank accounts, there’s no one-size-fits-all. Depending on your needs, you might lean towards a checking, savings, or business account.

Checking accounts: The everyday wallet

Checking accounts are your go-to for daily transactions. They’re like a financial Swiss Army knife—versatile and essential for managing regular expenses. Here’s why a checking account could be a favourable option:

- Accessibility: With a checking account, your money is always within easy reach. It offers various methods of access, such as debit cards, checks, and online banking, ensuring you can make purchases or pay bills with ease.

- No or Low Minimum Balance: Most checking accounts are quite forgiving when it comes to maintaining a minimum balance, allowing you flexibility in managing your funds.

- Monthly Fees: While checking accounts are convenient, they might come with monthly maintenance fees. However, these fees can often be waived through direct deposits or maintaining a certain balance.

Savings accounts: Your money’s cozy home

Savings accounts are where your funds take a snug nap, growing gradually through interest. It acts as a money sanctuary, promoting saving habits by keeping funds slightly out of immediate reach. Here’s what makes savings accounts stand out:

- Interest Earnings: Unlike checking accounts, savings accounts enable your money to grow over time, rewarding you with interest on your balance.

- Withdrawal Limits: To maintain the sanctity of saving, these accounts usually limit the number of withdrawals you can make, encouraging the accumulation of funds.

- Emergency Fund: Savings accounts are excellent vessels to build an emergency fund, safeguarding you against unexpected financial hiccups.

Business accounts: The entrepreneur’s ally

Business accounts are your financial allies in navigating the world of commerce and entrepreneurship. They are specialized accounts that cater to the nuanced needs of business operations. Let’s unpack the benefits:

- Professionalism: Having a dedicated business account enhances professionalism. It simplifies transactions by separating personal and business finances, creating a clear financial demarcation.

- Enhanced Features: Business accounts often come with tailored features such as higher transaction limits, business credit cards, and merchant services to accommodate business needs.

- Expense Tracking: With a business account, monitoring business expenses and revenues becomes a streamlined process, facilitating easier accounting and tax filing.

To sum it up, selecting the right type of account is instrumental in aligning with your financial goals and operational needs as a non-resident. By understanding the distinctive features and benefits of each account type, you can make an informed decision that resonates with your objectives and lifestyle.

Documentation and eligibility

Entering the realm of paperwork, let’s demystify the documents and eligibility criteria. Typically, banks would ask for identification documents such as a passport. Proof of address and some personal details to get a vivid picture of your financial demeanour might also be required. Navigating through these prerequisites might seem like a bureaucratic maze, but with the right guidance and preparation, it can be a straightforward process

Identification: Proving you’re you

Foremost, banks need assurance regarding your identity. A valid passport is universally accepted and is a cornerstone document that you must present. Some banks might also request an additional form of identification, such as a driver’s license or a national ID, to bolster the verification process.

Address verification: Anchoring your presence

Banks will want to establish a connection between you and a physical location. Proof of address, such as utility bills or a rental agreement that showcases your name and address, helps in establishing this link. It’s crucial to ensure that the documents are current to maintain their validity in the eyes of the bank.

Social security number (SSN) or individual taxpayer identification number (ITIN): Navigating the labyrinth

The SSN might appear as a colossal barrier, but fear not! While it’s true that having an SSN simplifies the process, its absence doesn’t spell doom. Banks, understanding the constraints of non-residents, offer alternative routes.

- Utilising an ITIN: An ITIN acts as a substitute for the SSN. It’s a tax-processing number issued by the IRS, facilitating those who are ineligible for an SSN to open a bank account.

- Exploring Flexibilities: Some banks might show flexibility by allowing the opening of an account with the promise of providing an SSN or ITIN within a specific period post-account opening.

Additional documentation: Painting a fuller picture

Banks might seek to gather hues of your financial personality and reliability. This could involve providing information regarding your employment, income, or even references. Having this information readily available could expedite the process and smooth out potential wrinkles.

The hurdles: Anticipating and overcoming

Awareness of potential hurdles is half the battle. Knowing that the absence of an SSN is manageable, and understanding the alternatives and flexibilities offered by banks, can imbue you with confidence as you navigate the process.

In essence, being prepared, well-documented, and knowledgeable about the requirements and potential roadblocks primes you for a successful endeavour in opening a US bank account as a non-resident. So, arm yourself with the necessary documents and information, and step forward with clarity and assurance.

Choosing the right bank

Choosing where to open your account is a crucial decision, almost akin to choosing a trustworthy friend. It’s not just about entrusting them with your money; it’s also about ensuring that they provide services that align with your needs and expectations. Various factors come into play in making this selection, each weighing its level of importance in the decision-making process.

Reputation matters

Begin with a bank’s reputation. A well-regarded bank doesn’t just offer financial security; it also tends to have a broader range of services and better customer support. Look for customer reviews and ratings to get a sense of their service quality and reliability.

Location convenience

The convenience of branch locations is another pivotal factor. Proximity to physical branches can be essential, especially if you prefer in-person consultations or need to perform frequent transactions. Consider the bank’s network – whether they have branches or ATMs close to your home, workplace, or places you regularly visit.

Online and mobile banking

In today’s digital age, online banking services have become a necessity. Assess the clarity and usability of a bank’s online platforms, including its website and mobile app. These platforms should offer a seamless experience, enabling you to manage your accounts, make transfers, pay bills, and access customer support with ease and security.

Customer service

Lastly, consider the quality of customer service. A bank that values its customers will offer responsive and helpful customer service, ensuring that your queries and issues are addressed promptly and satisfactorily. Look for banks that offer multiple channels of communication such as phone, email, and live chat, and consider the availability and responsiveness of their customer support team.

Remember, choosing the right bank is about finding a balance between these various factors, prioritising what matters most to you in managing your financial affairs seamlessly and securely. Consider your banking needs, do your research, and choose a banking partner that aligns with your requirements and preferences.

This approach will pave the way for a fruitful banking experience, tailored to support your financial journey in the United States as a non-resident.

Step-by-step account opening process

Embarking on the journey of opening a U.S. bank account might seem like climbing a mountain, but fear not! With a well-prepared backpack of documents and a bit of guidance, you’ll find yourself at the summit in no time. Here’s a step-by-step guide to walk you through the trails and turns of this process, ensuring you know what to expect at each stage.

Step 1: Choose your account type

Before you step into a bank or visit its website, clear in your mind the type of account you wish to open—be it a checking, savings, or business account. Each account serves unique purposes, and your choice should align with your financial needs and goals.

Step 2: Prepare your documents

Gear up by gathering all necessary documents. Generally, you’d need identification documents such as a valid passport and proof of address. Ensure all documents are up-to-date and have clear, legible information.

Step 3: Visit the bank or its website

Either stroll into a physical branch, or if you prefer the comfort of your space, visit the bank’s official website. Banks offer both online and in-person options for account opening, keeping in mind the convenience of the customers.

Step 4: Complete the application

Guided by bank representatives or clear online instructions, proceed to complete the application forms. Ensure that you fill out all information accurately to avoid any future complications.

Step 5: Overcoming language and terminology barriers

Don’t hesitate to seek assistance if you find banking terms or languages to be complex mazes. Banks usually offer customer support, simplifying jargon, and clarifying doubts, making the process smoother and more comprehensible.

Step 6: Verification process

After you’ve submitted your application, the bank will embark on a journey to verify your documents and information. Patience is your friend here, as this process may take a bit of time.

Step 7: Account approval and setup

Once your application clears the forest of verification, you’ll receive approval, and voilà, your account is set up! You can now start managing your funds, making deposits, and embarking on other banking adventures.

Navigating through the process with this roadmap will hopefully make the journey less daunting and more efficient. Remember, the bank is there to guide and assist you, ensuring that your pathway to opening an account is as smooth as a scenic trail.

The integral role of Instarem in streamlining cross-border transactions

Having a reliable partner for international transactions is golden. Instarem enters the stage here, offering a hassle-free, cost-effective way to manage your international money transfer.

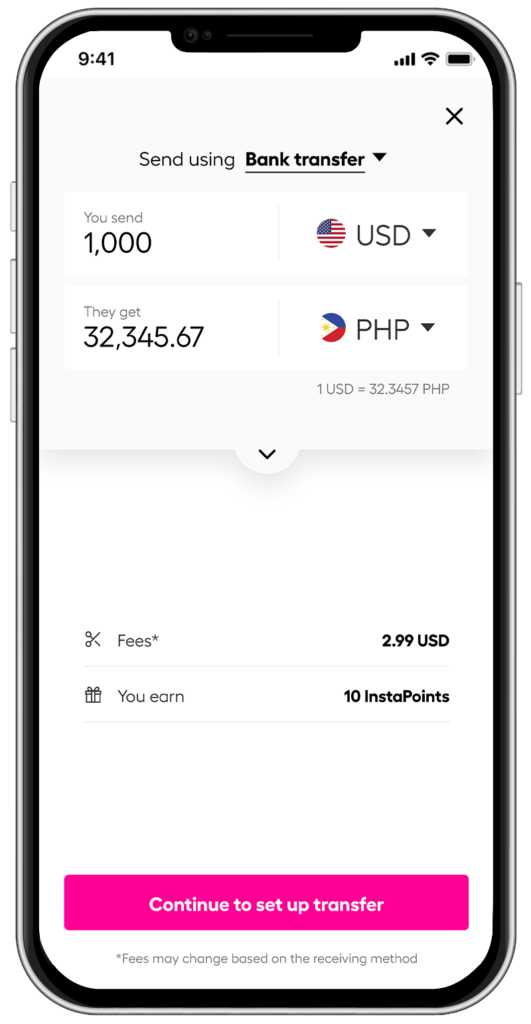

*rates are for display purposes only.

With a user-friendly interface and transparent fee structures, Instarem ensures that your international transactions are smooth and affordable.

Download the app or sign up here.

Wrapping It up: The final takeaway

So, we’ve navigated through the twists and turns of setting up a US bank account as a non-resident, and here we are, at the end of our journey. It’s like we’ve been on a financial road trip, and securing a US bank account is that awesome diner we discovered – it just makes the whole trip worthwhile.

Having a US bank account is not just another checkbox ticked off your list; it’s your ticket to a universe of financial possibilities. It’s like having a superpower where managing funds, making transactions, and dealing with US businesses become a walk in the park.

And let’s not forget our co-pilot on this journey, Instarem. It’s like the ultimate road trip buddy that makes sure our cross-border money moves are smooth, affordable, and hassle-free.

In a nutshell, getting that US bank account teamed up with Instarem, is like gearing up with the best travel gear. It makes sure you’re all set to explore the world of global finances, cruising through transactions with ease and confidence.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.