Cost of living in Sydney – single, family & student

This article covers:

- Overview of Cost of living in Sydney

- Do you know?

- A glance at the average cost of living in Sydney

- Average cost of living in Sydney: Single vs Student vs Family

- Cost of living in Sydney as compared to other cities

- Australia Sydney cost of living – Tax scenario in Sydney

- What salary do you need to live in Sydney?

- What should be your monthly budget to live in Sydney?

- Do’s and don’ts to manage the cost of living in Sydney

- Can’t afford Sydney? Here are the top cost-effective Australian cities

- Before you go…

- FAQs

One of the first things that come to our mind when we think of Australia is the Sydney Opera House. With a population of around 5 million, the iconic city of Sydney is the most populous one in Australia.

If you are looking forward to settling in Australia and wondering how much is the cost of living in Sydney, this guide is for you. This blog will walk you through the average cost of living in Sydney along with outlining the best cities to live in Australia for international students and job seekers.

Overview of Cost of living in Sydney

- The cost of living in Sydney for a single person = ~ AUD 4,149 monthly and ~ AUD 49,788 annually.

- Sydney living expenses for a family of 4 = ~ AUD 10,167 monthly and ~ AUD 1,22,004 annually.

- The average cost of living in Sydney for students = ~ AUD 2,000 monthly and ~ AUD 24,000 annually.

Do you know?

- With an impressive score of 96.2 out of 100, Sydney ranks 7th in the QS Best Student Cities 2024. [1]

- Sydney comes at the 4th position in the list of top 20 cities to live in the world. [2]

- As per Numbeo, Sydney has an average monthly salary of AUD 3,764 (after tax), which is higher than all the other cities in Oceania. [3]

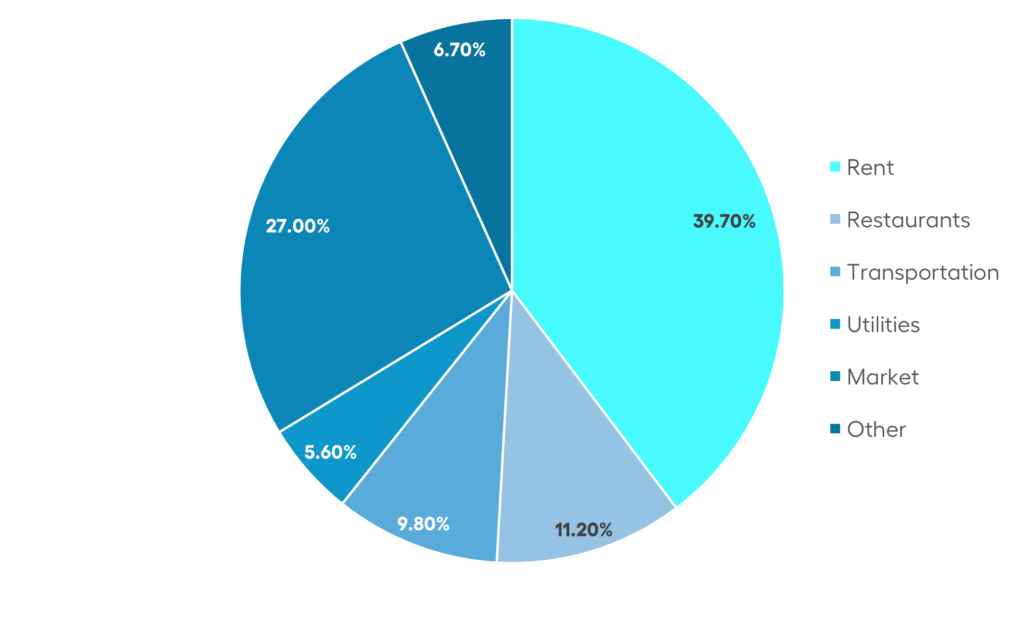

A glance at the average cost of living in Sydney

Source: Numbeo

Average cost of living in Sydney: Single vs Student vs Family

Type of expense | Avg. cost per month for student (AUD) | Avg. cost per month for a single (AUD) | Avg. cost per month for family (AUD) |

Housing & rent | $650 – $1,000 | $1997 | $3759 |

Food | $754 | $863 | $2215 |

Transportation | $160 | $626 | $1626 |

Utility (electricity, water, heating, etc. ) | $190 | $177 | $273 |

Entertainment | $50-$100 | $50-$100 | $300 – $800 |

Source:Livingcost.org

Avg. cost of living for students: Unicred

Also Read: How much does it cost to live in Australia?

An overview of monthly rents in Sydney

Expense Category | Item | Avg. cost per month |

Housing | 1-bedroom apartment (in the city centre) | $2850 |

1-bedroom apartment (outside the city centre) | $1997 | |

3-bedroom apartment (in the city centre) | $6108 | |

3-bedroom apartment (outside the city centre) | $3759 |

Source:Livingcost.org

Cost of living in Sydney as compared to other cities

Type of expense | Sydney | Melbourne | Brisbane | Perth | Adelaide |

Monthly Salary (after taxes) | $5718 | $5615 | $5374 | $5395 | $4248 |

Cost of living (single) | $4149 | $3705 | $3642 | $3578 | $3331 |

Cost of living (family) | $10167 | $8724 | $7676 | $8012 | $7715 |

Rent (single) | $1997 | $1793 | $1847 | $1693 | $1475 |

Rent (family) | $3759 | $2925 | $2538 | $2708 | $2595 |

Food (single) | $863 | $818 | $846 | $862 | $877 |

Food (family) | $2215 | $2096 | $2166 | $2190 | $2208 |

Transport (single) | $626 | $532 | $386 | $380 | $282 |

Transport (family) | $1626 | $1373 | $991 | $985 | $749 |

Overall quality of life | 97 | 97 | 94 | 95 | 91 |

Source: Livingcost.org

Note: The above expenses are average costs in AUD

Australia Sydney cost of living – Tax scenario in Sydney

Tax system in Australia is fairly simple to understand. If you are an Australian resident, for tax purposes, you need to pay taxes according to your applicable tax rates.

To know whether or not you can be called an Australian resident for tax purposes, refer to the ATO website.

Following are the tax rates applicable to different income slabs:

Income levels in Sydney | Tax applicable |

0 – $18,200 | Nil |

$18,201 – $45,000 | 19c for every 1 AUD over 18,200 AUD |

$45,001 – $120,000 | 5,092 AUD + 32.5c for every 1 AUD over 45,000 AUD |

$120,001 – $180,000 | 29,467 AUD + 37c for every 1 AUD over 120,000 AUD |

$180,001 and above | 51,667 AUD + 45c for every 1 AUD over 180,000 AUD |

Source: Australian Taxation Office

Also Read: A comprehensive guide to Australia’s visa options

What salary do you need to live in Sydney?

The average salary in Sydney is AUD 81,000, according to Payscale. But is it enough to support your lifestyle in Sydney?

The cost of living in Australia may vary depending on the location (city or town) you wish to live in. The cost of living in Sydney can be very high as it is one of the most expensive cities to live in Australia.

Typically, a salary ranging between AUD 80,000 to AUD 90,000 is required to live comfortably by covering necessities such as house rent, utilities, transportation, healthcare, food, and leisure activities.

Moreover, those who are living with their families have significantly higher salary requirements than a single-working professional. Simply put, they need to earn above the median income, which is around AUD 90,000 to AUD 100,000 per year.

To live comfortably in Sydney with a family, both partners need to earn to meet their needs and maintain a quality lifestyle.

What should be your monthly budget to live in Sydney?

Category | Student | Single | Family |

Housing/Rent | $800 – $1,500 | $2,000 – $2500 | $4,000 – $4,500 |

Utilities | $50 – $150 | $100 – $200 | $200 – $400 |

Groceries | $150 – $300 | $200 – $400 | $500 – $800 |

Transportation | $50 – $150 | $600 – $800 | $1,800 – $2,000 |

Other (entertainment, shopping, personal care) | $150 -$250 | $200 – $300 | $500 – $800 |

Total##(approximately) | $1,250 – 2,500 | $5,000 – $7,000 | $10,000 – 15,000 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and don’ts to manage the cost of living in Sydney

Do’s

- Rent away from the city: Generally, the rents near the city centre are higher in Sydney. If you want to save on rent, then consider renting an apartment or a house in an area away from the city. You can easily save around AUD 200-300. Moreover, if you are a student, then consider renting a shared apartment.

- Pay bills on time: Late payment penalties can add to your monthly expenses. Hence, always pay your bills on time to avoid unnecessary charges.

- Create a monthly budget: Creating a monthly budget becomes crucial when living overseas. It can help you monitor your finances and avoid unnecessary expenses.

- Utilise money transfer apps: If you want to send money from Australia to India or any other country, then use a reliable fund transfer service like Instarem to avoid hefty exchange rates.

- Review your monthly expenses: Make a habit of reviewing your total expenditure at the end of every week or month. This simple trick can help you identify the necessary and unnecessary expenses, thereby helping you avoid the latter ones.

- Cook your food: Cooking your food is much more affordable than eating out. While it is ok to eat out once in a while, make a habit of cooking for yourself. You can buy cheaper groceries and do meal prep for the entire week to save both time and money.

Dont’s

- Rely on online grocery shopping: No doubt online grocery shopping saves a lot of time and effort. However, it can lead you to buy things you don’t even need. So, consider buying your groceries from a physical grocery store. Further, buy your groceries in bulk instead of buying items every other day.

- Avoid impulsive shopping: If you have a habit of emotional or impulsive shopping, consider fixing it before moving to Sydney. This single habit can make you break the bank.

- Waste leftovers: Throwing away the leftovers can lead to a significant waste of money. So, either find ways to use them or cook them in limited quantities.

- Neglect health insurance: Having health insurance is critical in cities like Sydney, where healthcare costs are soaring. Even a few minutes of a doctor’s visit can cost you hundreds of dollars. So, whether you are a student or a working professional, purchase a suitable health insurance policy. If you live with your family, then consider buying a family floater plan, as it is cheaper than buying an individual policy for each member.

- Ignore savings: Always remember that a penny saved is a penny earned. So, start saving from your first income, regardless of how small or big. This is a very important aspect of living abroad. You can either open a savings account or use traditional ways of saving in cash.

Also Read: An expat’s guide to rent in Australia

Can’t afford Sydney? Here are the top cost-effective Australian cities

Adelaide

Adelaide is the best-kept secret of Australia. From one of the most scenic locations to a relaxed and welcoming atmosphere, there are many reasons to live in this city. According to the Global Liveability Index, Adelaide is the cheapest Australian city to live in.

Surprisingly, the cost of living here is less than Sydney by an unbelievable 33%. However, it is important to note that the employment rate in the city is also less than in the other major cities of Australia.

Average cost of living (without rent): AUD 1381 per month.

Perth

Perth is another great, affordable city, especially for international students. As compared to Sydney, the cost of living here is almost 20% cheaper. Not only that, the city has a strong economy.

It offers a great education system, fair employment opportunities, and a soothing environment to settle in. While it is not as glamorous as Sydney, living in Perth has its perks. It is quiet, has great food and is very close to nature.

Average cost of living (without rent): AUD 1467 per month.

Melbourne

In the Global Liveability Index, Melbourne ranks in the third position, earning a reputation for being one of the most liveable cities in the world. Further, according to the QS Student City Rankings 2024, it has secured the 4th position, which makes it an ideal location for international students.

As compared to Sydney, living in Melbourne is 18% cheaper. From some of the most prestigious universities and a thriving job sector to an incredible atmosphere, it has everything that makes it one of the best alternatives to Sydney.

Average cost of living (without rent): AUD 1589 per month.

Canberra

Canberra may not be as famous as other major cities in Australia, but it is a great alternative to Sydney. Not only does it offer a 12% cheaper cost of living, but it also has one of the strongest economies in Australia.

It offers ample job opportunities in both the public and private sectors, making it an attractive location among foreign job seekers. Besides, it offers many other perks like low traffic congestion, great nightlife, amazing food, top-quality education and social infrastructure.

Average cost of living (without rent): AUD 1411 per month.

Before you go…

Sydney is a dream destination for students and job seekers from all around the world. It offers world-class education, never-ending employment opportunities, higher salaries, and an exceptional quality of life. However, we cannot ignore the fact that the cost of living in Sydney is rising.

Always remember, living in a wonderful country like Australia is highly rewarding but has its own share of challenges. If you need to send money from India to Australia during your overseas journey, join hands with a fund transfer partner like Instarem.

With fair AUD to INR exchange rates and no hidden fees, Instarem helps you send money across the world in a secure, fast**, and affordable# manner.

Moreover, on frequent transactions, you can earn InstaPoints that can be redeemed in future.

Try Instarem for your next transfer. You can download the app or sign up here to send your warm wishes for a happy festive season!

Also Read: Average salary in Australia

FAQs

- Is it expensive to live in Sydney?

Yes. Sydney is among the most expensive cities to live in the world. With higher rents and overall cost of living, it can get difficult for a low-earning individual to live comfortably in the city. However, by taking cost-saving measures and creating a proper budget, you can manage to live comfortably.

- How much money do you need to live in Sydney?

Individuals may need around $85,000 per year to live comfortably in Sydney. While you can live in Sydney with a lower income as well, you need to spend mindfully and compromise on a few things such as entertainment, leisure, etc.

- How much does it cost to live in Sydney for International students?

The average cost of living for students in Sydney ranges between $ 1,985 to $ 2,216 per month. This amount includes rent, food, groceries, transportation, and other miscellaneous expenses.

- Is it cheaper to live in Sydney or Melbourne?

Both Sydney and Melbourne are rated among the most expensive cities to live in Australia. However, Melbourne is slightly cheaper, especially in terms of house rents.

- What is the average room rent in Sydney?

The rents in Sydney are a bit higher as compared to the other Australian cities. Although the average flat rent is $650 per week, it can vary based on the location and amenities it comes with. In the case of a shared apartment, the average room rent is about $490 per week.

- How much is the cost of living in Sydney for a couple?

The cost of living in Sydney for a couple can vary based on their location, amenities, lifestyle, and spending habits. It can range from $10,000 to $15,000 per month. It includes all the necessary expenses like rent, groceries, food, transportation, entertainment, etc.

- What is the cost of living in Sydney for a single person?

The average cost of living for one person in Sydney is approximately $4149, including rent.

- What is the cost of living in Sydney for a family?

The average cost of living for a family of four in Sydney is roughly around $10167, including rent.

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Citations:

Get the app

Get the app