Cost of living in the UK – single, family & student

This article covers:

- Quick Overview

- Do you know?

- A glance at the average cost of living in the UK

- Average cost of living in the UK: Single vs student vs family

- The average cost of living in the UK citywise

- Tax scenario

- What salary do you need to live in the UK?

- What should be your monthly budget for living in the UK?

- Do’s and don’ts

- Top UK cities for students and job seekers

- Before you go…

- FAQs

The monthly cost of living in the UK, including rent, is £1,732 for a single person, £1,943 for a student, and £4,102 for a family of four. Also, check out the city-wise costs and the budget needed to live in the UK.

The United Kingdom is renowned for its prestigious educational institutions and dynamic economy, offering promising career opportunities alongside state-of-the-art facilities. Relocating to this vibrant nation naturally comes with its set of financial challenges. If you are plagued with questions like,’ How can I plan my budget to live in the UK?’ you are in luck.

This guide provides detailed insights into the UK’s cost of living index, helping you understand the UK’s standard of living and plan your finances accordingly.

Quick Overview

- The cost of living in the UK for a single person = £1732 per month with rent and £645 without rent.

- The average cost of living in the UK for a student = £1,943 per month with rent and £743 without rent.

- The cost of living in the UK for a family of four = £4102 per month with rent and £2226 without rent.

Do you know?

- The CO2 emissions in the UK were only 4.6% of metric tons per capita, which is relatively low compared to other developed nations. This indicates the country’s efforts towards sustainability and improvement of the quality of life of its residents. [1]

- The UK inflation rate on annual consumer prices was 6.7% in 2023, a 1.1% drop from 2022. [2]

- In 2023, only 4.1% of the total labour force was unemployed in the United Kingdom.[3]

- According to the World Happiness Report 2024, the United Kingdom ranks 20th globally. [4]

A glance at the average cost of living in the UK

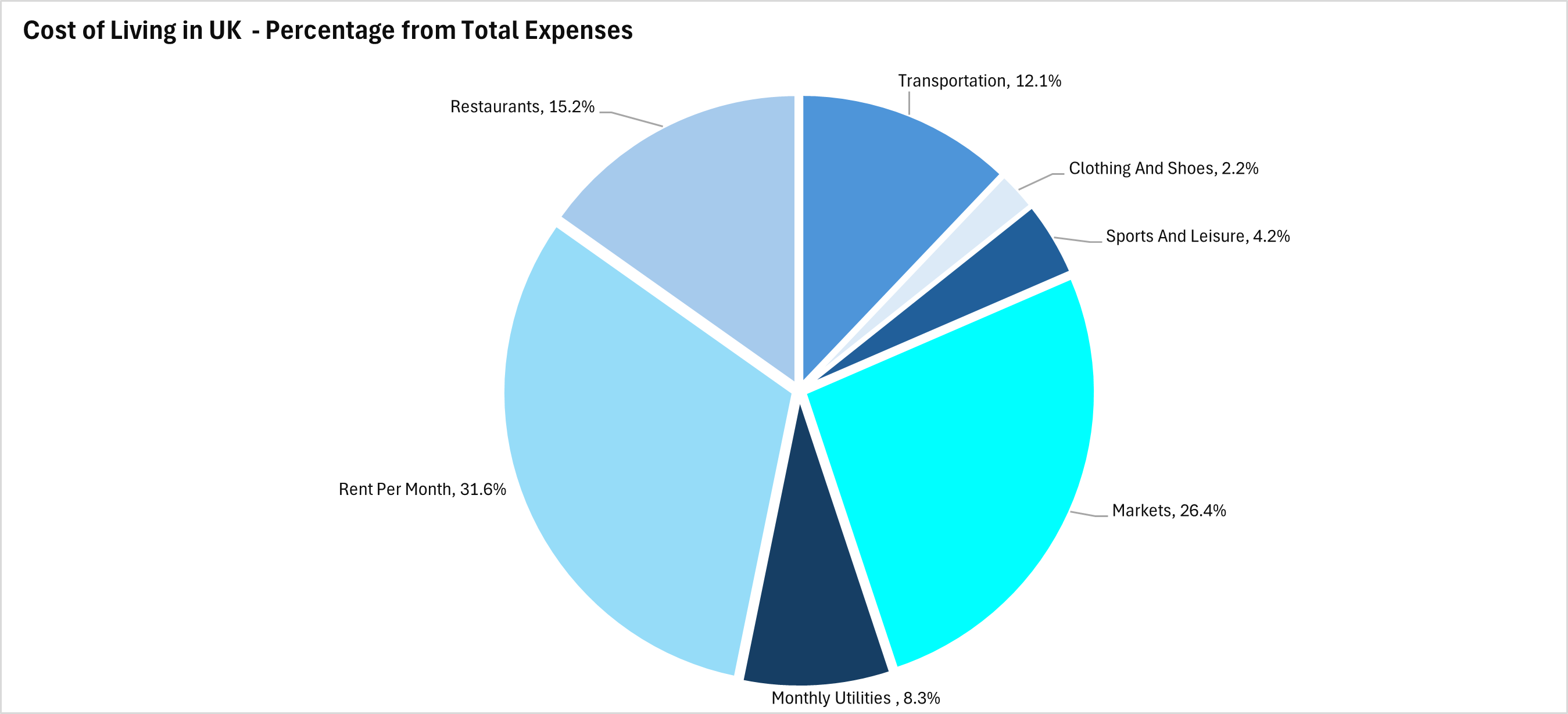

Expense Category | Percentage from Total Expenses |

Transportation | 12.1% |

Clothing And Shoes | 2.2% |

Sports And Leisure | 4.2% |

Markets | 26.4% |

Monthly Utilities | 8.3% |

Rent Per Month | 31.6% |

Restaurants | 15.2% |

Source: Numbeo

Average cost of living in the UK: Single vs student vs family

Type of expense | Avg. cost per month for student | Avg. cost per month for singles | Avg. cost per month for family |

Rent and Utilities (electricity, water, heating, etc. ) | £1200 | £1088 | £1876 |

Food/groceries | £420 | £399 | £1036 |

Transportation | £68 | £123 | £326 |

Source: Livingcost.org, Uniacco.

An overview of monthly rents in the UK

Expense Category | Item | Avg. cost per month |

Housing | 1-bedroom apartment (in the city centre) | £1,059.30 |

1-bedroom apartment (outside the city centre) | £866.40 | |

3-bedroom apartment (in the city centre) | £1,750.56 | |

3-bedroom apartment (outside the city centre) | £1,350.51 |

Source: Numbeo

The average cost of living in the UK citywise

Type of expense | London | Birmingham | Manchester | Leeds |

Avg. Monthly Salary (after taxes) | £3252 | £2425 | £2176 | £2590 |

Cost of living (single) | £2635 | £1590 | £1585 | £1486 |

Cost of living (family) | £6129 | £3785 | £3616 | £3692 |

Rent & utilities (single) | £1760 | £944 | £955 | £829 |

Rent & utilities (family) | £3109 | £1546 | £1484 | £1499 |

Food (single) | £456 | £380 | £390 | £386 |

Food (family) | £1181 | £999 | £1009 | £1003 |

Transport (single) | £277 | £141 | £133 | £152 |

Transport (family) | £736 | £376 | £352 | £401 |

The overall quality of life | 98 | 93 | 91 | 90 |

Source: Livingcost.org (Refer to citiwise cost of living pages)

Tax scenario

Non-residents in the UK are typically taxed only on their income earned within the country, such as salaries from UK employment. The tax amount depends on applicable income tax bands at the time of filing, along with any reliefs or exemptions under double taxation agreements with their home country.

Foreign income, like earnings from jobs performed entirely outside the UK or income from overseas investments, generally isn’t taxed in the UK unless it’s brought into the country.

Individuals benefit from a standard Personal Allowance of £12,570, which exempts this amount from tax. Tax bands are determined based on the Personal Allowance.

Tax Band | Taxable Income | Income Tax Rate |

Personal Allowance | 0 – £12,570 | 0% |

Basic Rate | £12,571 – £50,270 | 20% |

Higher Rate | £50,271 – £125,140 | 40% |

Additional rate | More than £125,140 | 45% |

Source: GOV.UK- Tax on foreign income, GOV.UK- Income Tax rates and Personal Allowances

What salary do you need to live in the UK?

Planning a budget that keeps you financially sustainable in the long run while also catering to your UK living expenses is important when you relocate to a foreign country. A great way to direct your budgeting for the UK is by researching the income levels in the UK and comparing it with the average living costs of the city or location you plan on relocating to.

The data from SalaryExplorer states that the monthly average salary in the UK is £5,940.

As mentioned earlier, the average monthly cost of living in the UK for a single person for a comfortable lifestyle is £1732, while the cost of living in the UK for a couple is £2051. On the other hand, the average monthly cost of living in the UK for a family of four is £4102.

The United Kingdom is one of the more expensive countries to live in with the average UK cost of living index ranging 2.09 times higher than the world average. Smart financial planning ensures financial sustainability in the UK. Here is an overview of budget estimates across various expenditure categories for non-residents in the UK.

Also read: How to get a job in the UK from India 2024: (6 easy steps)

What should be your monthly budget for living in the UK?

Category | Student | Single | Family |

Rent and Utilities (electricity, water, heating, etc. ) | £700 – £1500 | £900 – £1900 | £1500 – £2200 |

Groceries | £200 – £700 | £300 – £900 | £900 – £1500 |

Transportation | £40- £100 | £200 – £700 | £800 – £1400 |

Other (entertainment, shopping, personal care) | £400 – £600 | £400 – £800 | £1000 – £1200 |

Total##(approximately) | £1340 – £2900 | £1800 – £4300 | £4200 – £6300 |

##It is an approximate value based on the consumer prices and average living expenses of an individual. It is advisable to consider income level, spending habits, location, and specific monthly expenses to calculate an accurate budget.

Do’s and don’ts

Do’s

- Create and stick to a budget – Create a detailed budget to track income and expenses, identifying areas for potential savings to manage finances effectively. Consider using budgeting apps for added convenience.

- Utilise public transport – For daily commuting in London, using public transport is more cost-effective than owning a car. Consider purchasing an Oyster card for discounted travel within London or explore regional travel cards for savings on bus and train fares.

- Compare utility prices – Compare prices for utilities such as electricity, gas, and internet to find the best deals. Use comparison websites to switch providers and save on your monthly bills.

- Do some things yourself – Try to handle small repairs and maintenance tasks yourself instead of hiring professionals. Service charges for such repairs can be considerably costly in the UK.

Don’ts

- Avoid unnecessary Subscriptions – If your new lifestyle doesn’t allow you to use streaming services frequently, consider postponing subscriptions until you settle in and understand your schedule and budget better.

- Avoid last-minute travel bookings – Plan your trips in advance unless absolutely necessary to save on travel costs.

- Avoid overpaying your utility bills – Stay on top of your utility bills by regularly comparing providers to maintain a sustainable budget. Check billing details to catch any errors

- Avoid dining out frequently – Cooking at home is both healthier and cost-efficient. Meal prepping once or twice a week ensures you have convenient, affordable, and nutritious home-cooked meals.

- Don’t overlook financial planning – Consistent financial planning is crucial when living alone abroad. Budgeting and managing expenses help you maximise resources, prepare for emergencies, and reduce financial stress.

Top UK cities for students and job seekers

London

London is one of the most popular cities in the world. It is home to some of the most popular universities, such as the University College London and the London School of Economics.

Moreover, the city’s diverse job market spans key industries such as finance, tech, media, and entertainment, with ample job opportunities on global platforms like LinkedIn and Indeed. However, it is essential to know about the cost of living in London before relocating.

Average cost of living per person: £2635

Manchester

Manchester offers affordable yet vibrant living standards with its lively neighbourhoods and rich cultural scene. With outstanding educational institutions like the University of Manchester, it is the ideal choice for students wanting to explore the city’s culture to the fullest.

Manchester’s job market offers lucrative opportunities for roles in industries like tech, creative and media, advanced manufacturing, finance and health and life sciences. Furthermore, Manchester’s affordable and well-connected public transport provides convenient commuting options citywide.

Average cost of living per person: £1585

Leeds

Leeds is the UK’s second-largest economy after London. Its lucrative job market is as diverse as it can be with finance and IT sectors thriving to their best capacity. Moreover, with universities like Leeds University, this city offers excellent educational amenities that attract thousands of students worldwide.

The city also offers a rich cultural scene with affordable living costs, making it perfect for job seekers and students.

Average cost of living per person:£1486

Birmingham

Birmingham is renowned for its food manufacturing industry and offers opportunities in tech, finance, and life sciences. It’s also a thriving hub for startups and a cultural hotspot, with nearly 40% of its population under 23 years old. The city hosts excellent educational institutions like Birmingham City University, making it a great choice for students.

Average cost of living per person: £1590

Also read: Top 12 money tips for students moving to the UK

Before you go…

Relocating to the United Kingdom offers abundant growth opportunities, whether you are an international student or a working professional. However, it is crucial to research the financial aspects of the relationship and make informed decisions to maintain a financially sustainable budget.

One such financial aspect is using an affordable# transaction service like Instarem for international transfers. So whether you need to send money to India from the UK or any other country, Instarem ensures that your transaction is safe, secure and cost-effective#.

Instarem offers easy currency conversions so that you get a competitive rate whenever you convert GBP to INR or any other currency. Moreover, on every international transaction through Instarem you can also earn InstaPoints that discount your future transactions.

Instarem is also now available on the App Store and Google Play ensuring convenient access to our services when you need to send money from the UK to your home country.

FAQs

Q. Is it expensive to live in the UK?

The cost of living in the United Kingdom is 2.09 times higher than the global average. Making informed financial decisions is essential for a comfortable and sustainable lifestyle.

Q. How much money do you need to live in the UK?

The average monthly budget for a single person in the UK ranges from £1800 – £4300.

Q. How much does it cost to live in the UK for International students?

The average cost of living in the UK for an international student is £1,943.

Q. Is it cheaper to live in Sydney or London?

The city of London is 21% more expensive than Sydney.

Q. What is the average room rent in the UK?

A 1-bedroom apartment in the city centre in the UK costs around £1,059.30 in rent.

Q. How much is the cost of living in the UK per month?

The average monthly cost of living in the UK for a single person is around £1732.

Q. How much is the cost of living in the UK for a couple?

The monthly cost of living in the UK for a couple is £2051.

Q. What is the cost of living in the UK for a single person?

The average monthly cost of living in the UK for a single person is around £1732.

Q. What is the cost of living in the UK for a family?

The average monthly cost of living in the UK for a family of four is £4102.

Q. What is a good salary in the UK?

The average monthly salary in the UK is around £5,940.

Other Related Articles

Disclaimer:

- This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

- Prices mentioned in this blog are subject to change.

- ** Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

- # When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

- The prices were taken on the 1st and 2nd of July 2024 from different sources and are subject to change.

Citations:

[4]https://happiness-report.s3.amazonaws.com/2024/WHR+24.pdf

Get the app

Get the app