DBS international money transfers Singapore – Everything you need to know

This article covers:

If you’ve had to send money overseas, then you probably understand what a costly and complicated hassle it can turn out to be. But it doesn’t have to be that way. Nowadays, the possibilities for sending money abroad are almost endless. From the traditional Western Union wire transfers to services like DBS Remit international money transfer, consumers are presented with a wide range of options for transferring money between currencies from each respective country.

When sending money abroad, it’s always important to understand how the particular transfer works, including the time it takes to process the transaction, as well as the fees and rates involved. As Singapore’s largest bank, DBS offers an extensive suite of services so acquiring information on specific offerings may be challenging. To help you out, we’ll discuss all the ins and outs of DBS foreign money transfer here.

How much does it cost to transfer money with DBS?

There are two types of international transfers provided by DBS — DBS Remit and Telegraphic Transfer.

DBS Remit offers low costs for transfers to Australia, Bangladesh, Canada, Eurozone, Hong Kong, India, Indonesia, Japan, South Korea, Malaysia, China, Myanmar, New Zealand, Philippines, Thailand, UK, USA, UAE and Vietnam.

For transfers to Malaysia, however, there’ll be a 3 SGD service charge for amounts less than 500 SGD. Although you are presented with an attractive fee structure, you are however subjected to a higher FX rate.

For transfers to the Philippines, there’ll be 1 SGD fee incurred via GCash wallet for amounts 150 SGD and below. And recipients aged 16 years and below are not allowed to claim the remittance amount.

For countries not covered by DBS Remit, internet banking or a branch visit will be the next best option to perform an international transfer — Outgoing Telegraphic Transfer (OTT), where you will be looking at the fees structure as below:

|

Outgoing telegraphic transfer (OTT), online set-up |

Outgoing telegraphic transfer (OTT), branch set-up |

|

|

Cable/telex charges |

20 SGD |

20 SGD |

|

Handling commission for transfers up to 5,000 SGD |

5 SGD |

1/8% of the transfer amount (min 10 SGD, max 120 SGD) |

|

Handling commission for transfers up to 25,000 SGD |

10 SGD |

|

|

Handling commission for transfers above 25,000 SGD |

35 SGD |

Other fees to take note of include:

|

Utilizing services of a bank agent |

Additional fees may apply |

|

|

Fees by Sending/ |

On top of the charges from DBS, further |

|

|

Additional charges |

|

|

DBS foreign exchange rates

Banks in Singapore such as DBS add a significant margin to the interbank foreign exchange rate which could increase your final cost significantly. You may think of this as a slight devaluation of your currency in comparison to what you would see in mid-market exchange rates (the exchange rate you see on Google), with the bank profiting from that disparity.

So even if you don’t pay any fees, the markup on the exchange rate can cause transfer costs to skyrocket, and you end up paying more overall. Unspecified cost due to the deviation from mid-market rate makes the service less favourable than the rates offered by other specialised money transfer providers that provide transparent pricing structure before you perform any transfer.

How long does a transfer take?

Via DBS Remit, if the payment is made on a weekday before the cutoff time, DBS offers same-day transfer. Transfer cutoff timings differ by country, with some being earlier than others. It is important to take note if you want to send money urgently.

Here are some of the cut-off timings:

- Malaysia — 2.00 pm

- Australia — 12.00 pm

- Hong Kong — 4.30 pm

- US — 5.00 pm

- UK — 5.00 pm

- UAE — 5.00 pm

- China — 3.00 pm

- Philippines — 11:00 pm

Outgoing Telegraphic Transfer (OTT) however, will require around 2 to 4 working days for the transaction to be finalised.

What do I need to make an international money transfer?

There are several important details that you will need to send an international money transfer such as the recipient’s full name, address, bank information (SWIFT/BSB/sort/IFSC codes, if applicable) and account number (IBAN).

Next, provide the currency and amount you wish to transfer, along with any bank costs levied by the agent, and whether such charges will be imposed on the sender or the recipient.

For transactions in certain currencies, additional information may be required such as a legitimate purpose for transfer and a registered phone number.

What is the process to make a transfer through DBS?

Setting up an online Internet banking account with DBS is necessary in order to have access to their suite of overseas money transfer services. There are two ways to open an account — via digibank or online application.

If you are an existing DBS account holder, you can skip the registration process and simply log in to mobile banking or DBS Internet to access your overseas fund transfer options.

Once your account is all set up and you’ve received your security token, follow these steps to initiate a transfer:

- Access your Digibank account by logging in

- Select “Transfer” to open a drop-down menu and choose “DBS Remit and Overseas Transfer”

- Specify a country and a currency for the transfer.

- Input the amount you wish to transfer

- To use the FX watch function, check the box for “FX Watch”, enter the FX rate you wish to use, and specify when you need the funds. If you wish to use this feature, note that there is a minimum of 1,000 SGD.

An alternative way to send money overseas: Instarem

Transferring money overseas has long been thought to be an expensive process, especially if you are performing an online transaction directly from your own bank account. Generally, SWIFT is involved where intermediary banks will take a cut, resulting in a heftier fee. Not only that, banks are also making money off the markup on the foreign currency exchange rate.

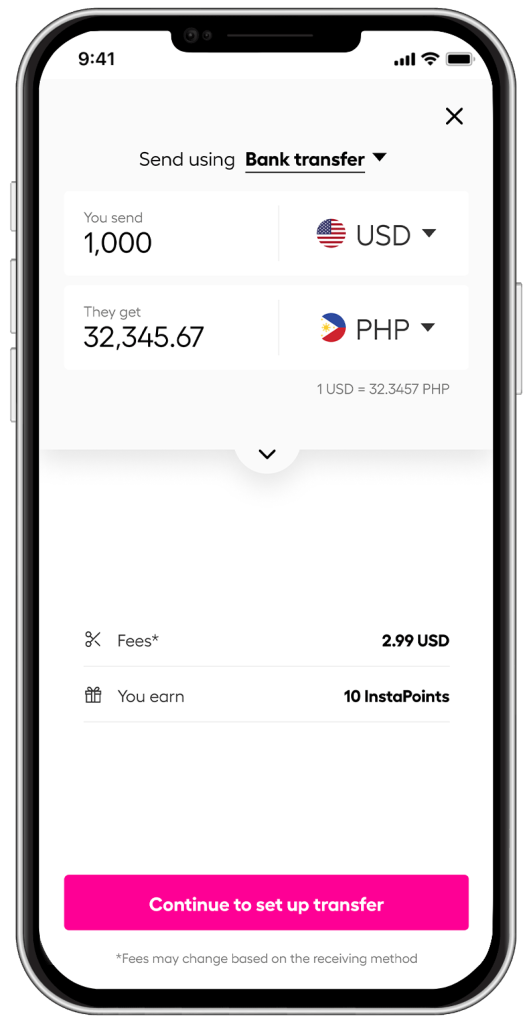

*Rates are for display purposes

With Instarem, you don’t have to bear hefty SWIFT fees as your money is being handled via local transfers. On top of that, with just a small transfer fee, you get to enjoy sending money abroad close to the mid-market rate.

Download the app or sign up on the web and see how easy it is to send money with Instarem.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app