Emergency fund: Why an expat needs one and how to get started

This article covers:

You know the old saying, “never put all your eggs in one basket”? Well, the same goes for your money. You never know when an emergency will pop up, so it’s always a good idea to have a little bit of extra cash on hand – an emergency fund.

An emergency fund is vital to your financial security as an expat.

When you’re living in a foreign country and don’t have the safety net of family and friends nearby, it’s essential to have money saved up for those unexpected emergencies that always seem to crop up.

In this blog post, we’ll discuss what an emergency fund is, how much you should have in it, where to keep it, and the rules for using it. We’ll also share some situations where an emergency fund would be handy!

What is an emergency fund?

What is an emergency fund? According to the dictionary, an emergency fund is “a sum of money set aside for unexpected expenses.” But what does that mean?

An emergency fund is a financial safety net that you can fall back on in case of an unexpected expense.

So, how do we define an emergency? Well, it depends on who you ask.

For some people, an emergency is a true life-or-death situation. For others, it’s anything that requires immediate attention, regardless of the consequences.

But as far as we’re concerned, an emergency is not buying a new pair of shoes or booking a last-minute vacation.

It should be something that sits outside your yearly budget. A few examples are medical bills, job loss, or emergency home repairs. These are the situations where you need access to cash quickly and unexpectedly.

How much emergency fund should I have?

Ideally, your emergency fund should be enough to cover 3-6 months of living expenses. There are online emergency fund calculators you can use. In general, these are the categories of expenses that one should consider.

Take Samantha who is currently an expat in Malaysia. This is her current monthly expenditure*:

Categories | Amount in MYR |

Monthly rent or mortgage payment | $2,275 |

Utilities | $243 |

Phone plan and internet | $108 |

Transportation | $300 |

Food | $1000 |

Insurance premiums | $1000 |

Other debts | $300 |

Other monthly expenses | $250 |

Total | $5476 |

* This is just an example of how to calculate. Monthly expenses vary depending on a person’s financial situation.

An emergency fund that can sustain Samantha for 6 months is therefore $5,476 x 6 = $32,856.

If you are wondering how much to save for an emergency fund, the general rule is to start saving 10% of your monthly income. If you don’t have any other obligations related to debts or family expenses, you can increase that percentage until you have a solid cushion in place.

That way, if you do have an unexpected financial emergency, you’ll have the money you need to get through it.

Where to keep emergency funds?

Now that you know what an emergency fund is and how much you should have, let’s talk about where to keep it. The best place to store your emergency fund is in a separate bank account or savings account that is out of reach. That means it shouldn’t be linked to any other accounts or used for regular expenses.

But for expats, the question of where to keep an emergency fund can be a bit more complicated.

After all, you’re not just dealing with one currency – you’re dealing with multiple currencies and possibly even multiple bank accounts. So what’s the best way to safeguard your emergency fund as an expat?

One option is to keep your emergency fund in a local bank account. This way, if you do have an emergency, you’ll have quick and easy access to the funds you need. However, this does come with some risks. For one thing, if your local currency fluctuates in value, you could lose money on your emergency fund. And if your local bank account is suddenly inaccessible (due to political instability or other factors), then your emergency fund may not be of much use.

Another option is to keep your emergency fund in a foreign bank account. This can help to protect your emergency fund from currency fluctuations, and it may also give you better interest rates. However, it’s important to make sure that your foreign bank account is accessible in case of an emergency. Otherwise, you could find yourself in a difficult situation.

Ultimately, there’s no right or wrong answer when it comes to where to keep your emergency fund as an expat. It’s important to weigh the pros and cons of each option and choose what makes the most sense for your situation.

Rules for using your emergency fund

An emergency fund is like the chocolate stash in your room – it’s there for when you need it, but it’s so tempting to dip into it when you’re feeling a bit stressed or bored. It’s easy to justify using emergency money for non-emergency purchases but doing so can quickly deplete your savings and leave you in a difficult financial situation.

That’s why it’s important to have rules in place when using your emergency fund.

Here are a few guidelines:

Only use your emergency fund for emergencies that cannot be avoided.

This may seem like obvious advice, but it’s important to remember that an emergency is something that you can’t afford to pay for with your regular income or savings. If you’re facing a large unexpected expense, such as a medical bill or car repair, then your emergency fund can be a lifesaver.

However, if you’re simply short on cash for one month, it’s better to dip into your savings than to deplete your emergency fund.

You need to pay off snowballing interest payments

The reality of losing your income doesn’t mean that your bills will stop.

Having a cushion of cash on hand can help you avoid going into further debt – specifically those with rolling interests.

If you have high-interest debt, such as credit card debt, consider using your emergency fund to pay it off. This can save you a lot of money in interest charges over time. Plus helps to reduce stress and give you peace of mind.

Refill the emergency fund as soon as possible after using it

Once you’ve used your emergency fund, it’s important to start saving again right away. Otherwise, you’ll be left high and dry the next time an emergency strikes. As soon as you receive the money to pay off a bill or cover an expense, deposit some of it into your emergency fund.

Some people might be tempted to think that lightning never strikes twice. But hey, life has a way of giving you surprises when you least expect them. So it’s better to be safe than sorry, and make sure your emergency fund is always well-stocked. That way, you’ll be prepared for whatever life throws your way.

Real-life situations that will make you wish you had an emergency fund

Now that you know why every expat needs an emergency fund, and how to build yours, let’s look at some situations where having an emergency fund would be extremely helpful.

- Losing a job

If you lose your job or have to take a pay cut, an emergency fund can help you stay afloat financially until you’re able to find new employment.

- Unexpected medical emergency

Unexpected medical bills or treatments can also be covered with emergency funds. This is especially true if you don’t have health insurance coverage in the country that you’re living in.

- Home emergency repairs

Home emergency repairs can be costly, and an emergency fund can help you pay for them without having to take out a loan or put the expense on a credit card.

- Pet Emergency

Emergency vet visits can also add up quickly, so it’s important to have some money set aside just in case your fur baby falls ill.

- Natural disaster

Natural disasters are also unpredictable and expensive to repair. Having emergency funds on hand can make the process of getting back on your feet much easier.

It’s never too late to start

By now, you’re probably sold on the idea of having an emergency fund. Start saving 10% of your monthly income today and you’ll be well on your way to having the emergency funds you need to stay secure during tough times.

Good luck!

Before you go

While everyone knows that it’s important to have an emergency fund, not everyone knows the best way to save up for one. It gets even more complicated for expats who are dealing with foreign currencies.

Traditional banking methods of sending to your savings account can work, but there’s a better way.

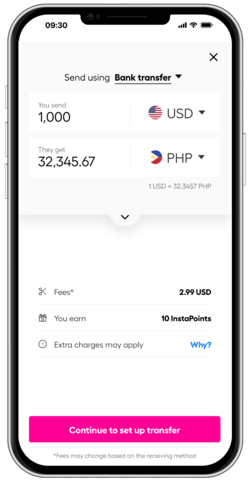

That’s why you should consider using Instarem to facilitate fast and easy international money transfers with low fees and competitive FX rates.

Instarem helps you send money abroad to over 60 countries. If you’re looking for an easy and affordable way to send money to build your emergency fund, Instarem is the perfect solution.

*rates are for display purposes only.

With our simple platform, you can make a transfer in just a few clicks. Plus, we offer competitive rates and low fees so you can get the most out of your money.

Download the app or sign up on the web and see how easy it is to send money with Instarem.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app