How to be prepared for a layoff while working abroad

This article covers:

Retrenchment can be a difficult experience, no matter where you are. But take it from us expats—dealing with an unexpected layoff can be even harder when it happens abroad! Navigating your unemployment options in an unfamiliar country is complicated enough without the added stress and worry of not being able to go back home ‒ especially if you’re dealing with visa restrictions.

Whether we like it or not though, retrenchment is still a reality for many living and working overseas. So let’s start having those tough conversations now about how to prepare for the unexpected layoff so that you don’t end up hitting rock bottom abroad.

Here’s our guide on surviving retrenchment abroad: strategies to prepare for the unexpected layoff and make sure this storm passes quickly and smoothly!

Define retrenchment

Retrenchment is a fancy word used to describe lay-offs. It’s the practice of reducing staff to cut costs, typically by eliminating whole departments or roles.

Although it may sound like a tidy solution to budgetary woes, it often saddles anxious workers with considerable financial hardships and stress, not to mention the lack of security that comes hand-in-hand with job loss.

What does it mean for expats?

Working abroad as an expat and uprooting your life to the other side of the world is quite an adventure, but many expats don’t realize what could go wrong – layoffs.

This unwelcome shock can affect both your wallet and morale as you immediately become significantly less mobile than during your regular job.

The money saved during your time abroad vanishes in a flash, and it suddenly becomes difficult to get right back up and move on to another country. The sense of wanderlust that had been fuelling you seemingly dissipates overnight, sending any adventurer into a state of despair!

This includes having their visas revoked to needing to pay expensive repatriation fees. The last thing you want to imagine when you’re settling into life in a new country is packing up again after losing your job.

5 things to start doing in advance to help prepare yourself for the unforeseen situation

Relook at your expenditure

If you can hear the sounds of looming job losses in the wind, it might be a good idea to take a long hard look at your expenditure! You can start by saying goodbye to those pricey nights out and costly subscriptions.

Get to budgeting – because if there are layoffs, you’ll need that money to escape your current living arrangement. Are you stuck on a pricey lease? Well, time to work out how much it would cost to move and break it off.

In any case, reducing your spending now is an investment for later – who knows, it may just offer you much-needed financial stability when the chips are down!

Build an emergency fund

Setting up an emergency fund in case of retrenchment may seem like a no-brainer- after all, who wants to be left stranded without any money in the bank?

However, more often than not, most people procrastinate on doing it because ‘it won’t happen to me’. Unfortunately, life is unpredictable and job security is never 100% guaranteed. Having some savings put away for such an unforeseeable event will prove to be lifesaving. It’s just common sense if you want a sense of security during stressful times.

After all, who knows if the search for another job will take 6 weeks or 6 months?

Make sure you have something prepared in case times get tough, so investing a little bit each month in good old ‘rainy day’ savings could really be your saving grace.

Update your resume

Although we’d all rather climb a mountain (or two) than update our resumes, it’s essential for ensuring success when looking for our next job.

Keeping things current is especially important right now, even if you’re currently employed – after all, we never know who might be retrenched tomorrow! If you want to increase your chances of getting hired by future employers and make it much easier to land another job while you’re still in one, dust off that old resume and spruce it up.

You can also reach out to your connections who may be aware of opportunities you could explore. So before the heavy roller of retrenchment catches with us, start applying for jobs right now – you won’t regret it!

File for unemployment allowance from the government

Before we get into the allowance part, it is important to take note that according to the regulations, the layoff must be a temporary situation and the employer has to have endeavoured other options before resorting to laying off.

Losing a job can be one of the most challenging situations someone can find themselves in; however, there is hope.

Many governments have come up with a provision to provide an unemployment allowance to those affected by layoffs. This allowance offers a much-needed financial cushion while they look for another job.

To qualify, it’s important to check if you are eligible for any such benefits from the government and file for unemployment as soon as possible. It is vital to understand the rules that apply when applying for the benefit so that your efforts are fruitful and therein lies hope for a smooth future ahead!

Find out visa status in case of a layoff

If you are worried that a layoff will interfere with your visa status es, you should know that there are many options for those who find themselves in this situation. Fortunately, some visas allow their holders to remain in the country even if they lose their job.

Other visas require the holder to make a change as soon as they become unemployed– typically finding new employment quickly or transferring to another visa status. It is important to research and understand which visas offer leeway and which may not be as forgiving when it comes to job loss.

Additionally, certain government programs are available that can offer guidance and assistance so that visa holders can still maintain long-term legal immigration status despite going through a layoff. Even though the uncertainty of a layoff can feel overwhelming, there is hope for maintaining your visa status while searching for your next opportunity.

Keep your health insurance intact

If you have health insurance tied to your job, then now is the best time to avail yourself of all care you need by scheduling appointments and filling any prescriptions.

Confirm with your Human Resources (HR) department if they have been deducting your insurance every month. Once you’ve established that everything is running smoothly, look into all the options available to maintain your coverage, like any discounts or public programs.

For example in the United States, your rights are as per COBRA – the Consolidated Omnibus Budget Reconciliation Act (COBRA), which states that you have the right to choose to pay for and keep maintaining the same health insurance plan through your employer.

Take this time to explore various other avenues or plans as well to weigh out every possibility of getting an affordable health plan.

Be prepared to head home

The end of an expat journey can be a difficult pill to swallow. After all, it’s hard to say goodbye to experiencing new cultures and adventures abroad. But if your journey needs to come to a premature closure due to the unfortunate circumstances of retrenchment, don’t despair just yet!

Going back home doesn’t necessarily mean that you have reached the end of your expat story – with each experience comes new knowledge and empowerment. As daunting as it may seem at first, use this opportunity as a chance to rejuvenate and reflect on all that has been learnt during your time away. Countless opportunities await your return, so have faith in yourself and use this experience as a launching pad towards even greater success.

Before you go…

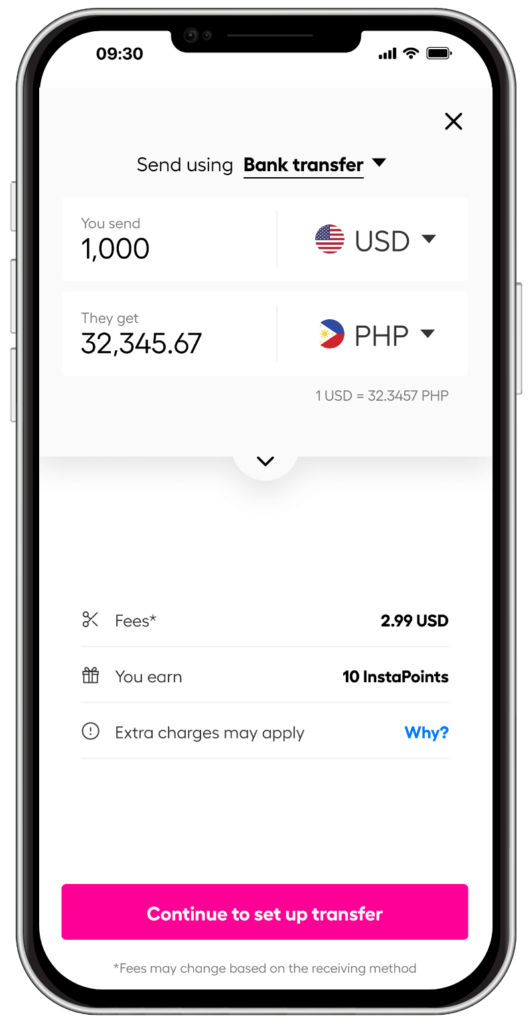

When retrenchment looms, the integrity of one’s financial stability is at stake. No matter if you are staying on or moving back home, the cost will always be an inevitable concern for most of us. Don’t let this period of uncertainty burden you financially – let Instarem help you save costs on international money transfers!

*rates are for display purposes only.

Instarem offers a very competitive exchange rate that is close to the mid-market rate and each transfer comes with a small transparent fee, which means you get the most out of all your transfers.

Besides that, you are also entitled to earn InstaPoints when you sign up and start making transactions or successfully referring your friends to explore Instarem.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app