How to open a bank account in Singapore for foreigners

This article covers:

- Key Takeaways

- Types of Bank Accounts for Foreigners in Singapore

- Bank Requirements For Foreigners: What Documents Do You Need?

- A Step-by-Step Guide to Opening a Bank Account in Singapore For Foreigners

- Top 3 Foreigner-Friendly Singaporean Banks To Choose From

- DBS Bank Account For Foreigners

- UOB Bank Account For Foreigners

- OCBC Bank Account For Foreigners

- A Good Starter: Instarem Account For Foreigners in Singapore

- Frequently Asked Questions

Key Takeaways

Eligibility/Bank Requirements

- Must be at least 18 years old.

- Have a valid Singapore-issued pass (e.g., Employment Pass, Student Pass, Long Term Visit Pass) or in-principle approval (IPA) letter.

- Provide proof of identity (passport) and address (utility bills, bank statements).

Step-by-Step Instruction for Opening a Bank Account:

- Gather paperwork, choose a bank and account type.

- Submit documents online or through a representative.

- Activate the account upon approval.

Top 3 Foreigner-Friendly Banks:

- DBS: Offers various accounts; apply through mobile app.

- UOB: Multi-currency options; apply in person with a reference letter.

- OCBC: Allows remote account opening for select non-residents.

Considered the top financial centre in Asia, Singapore has become one of the most popular destinations for foreigners and expats. The country, despite its small size, has a top-notch and diversified banking system that plays a huge role in its global financial success.

This is why Singaporean banks have made it easier for foreign non-residents to open an account. Whether you’re moving to Singapore for work and study or, opening a personal bank account as a foreigner can be a straightforward process.

You just have to meet eligibility requirements and present official documents—then, you’re good to go.

In this guide, we’ll discuss the types of bank accounts available, a step-by-step guide to opening an account and foreigner-friendly Singaporean banks you can choose from. We’ll also explore additional options, like opening an Instarem account online.

Types of Bank Accounts for Foreigners in Singapore

Singapore’s banks offer a diverse range of bank accounts for foreigners. If you’re new to the country, retail banking terms may differ from what you’re used to in your hometown.

To help you get started, here’s a quick rundown of the most common options for foreigners you should know:

Savings Accounts

This type of bank account for foreigners has a withdrawal cap, allowing you to earn interest. With this, you can start saving more money in the long run and still have cash in the bank.

Checking Accounts

Designed for everyday banking needs like paying bills and depositing money, checking accounts typically come with a debit card and cheque book. People who make frequent payments prefer this type of account since it’s less expensive than buying a money order.

Foreign Currency Accounts

These bank accounts usually have different currencies other than the Singaporean dollar. Both onshore and offshore banks can maintain them.

Although the US dollar is the most widely used currency for foreign exchange accounts in Singapore, other currencies like the British pound, the Australian dollar and the Hong Kong dollar are also common for transactions.

Bank Requirements For Foreigners: What Documents Do You Need?

Opening a bank account with most of the major banks in Singapore can be simple, especially if you have the right paperwork and can visit a branch in person. Keep in mind that the process and required documents may vary from bank to bank, so it’s best to do your research beforehand.

But regardless of which bank you choose, these requirements are a universal must for opening an account:

- You must be at least 18 years old.

- Proof of legal status in Singapore – Student Pass, Employment Pass, Long Term Visit Pass or in-principle approval (IPA) letter

- Proof of identity – a valid passport, or national identity card

- Proof of residential address – phone bills, local utility bills or bank statements

Some banks may also require you to submit a referral letter from a former bank. You might also be obliged to provide proof of income or investment experience if you’re planning to open an investment account.

We highly advise you to double-check your requirements before setting an appointment with your preferred bank. For example, you might need a passport valid for at least six months, and proof of address might only be accepted if you’re from a FATF member country.

A Step-by-Step Guide to Opening a Bank Account in Singapore For Foreigners

Now that you know the banking requirements and types of bank accounts, dive into our step-by-step guide to opening a bank account in Singapore as a foreigner:

Step 1: Gather All The Necessary Paperwork

Before visiting a branch, ensure you have all the required paperwork. This includes your passport, employment pass and proof of residence, among others. We also recommend getting in touch with the bank you’ve chosen and asking for a complete list of requirements.

This way, you won’t have to worry about being unprepared and potentially facing delays.

Step 2: Choose a Bank And Type of Account

Pick a bank and type of account that ticks all your boxes. Don’t forget to consider interest rates, fees, minimum balance and additional features you might need soon.

Keep in mind that most banks in Singapore don’t levy monthly service fees, but they do apply a ‘fall below fee’ when the required monthly balance falls below a specific threshold, ranging from S$1,000 to S$5,000.

Step 3: Submit Your Documents

Once you’ve gathered all your requirements and decided on the bank & type of account, submit them to the bank through the representative you’re in touch with. You can also check if the bank allows online submission of documents in case visiting a branch isn’t convenient for you.

The onboarding (pre-approval stage) will then start. Your selected bank will communicate the status of your application status.

Step 4: Activate The Account

Upon approval of your application, you will receive your account details. You’ll also be required to activate the account before you can access the bank’s services and set up an online banking account.

Top 3 Foreigner-Friendly Singaporean Banks To Choose From

Singapore has several banks that are known to be foreigner-friendly, offering services tailored to the needs of expats and non-residents. This includes DBS, UOB and OCBC, to name a few.

Take a look at these quick highlights of some of the major banks in Singapore. We’ll dive deeper into each bank’s specifics later on.

DBS | UOB | OCBC | |

Eligibility |

|

|

|

Required documents |

|

|

|

Minimum deposit | No minimum deposit | S$1,000 | S$1,000 |

Card availability | Debit card and credit card (VISA / Mastercard / AMEX) | Debit card and credit card (VISA / Mastercard) | Debit card and credit card (VISA / Mastercard / AMEX / UnionPay) |

Currencies available | 13 currencies (SGD, CAD, AUD, CNH, EUR, HKD, JPY, NZD, NOK, GBP, SEK, THB & USD) | 10 currencies (AUD, CAD, CNH, CHF, EUR, GBP, NZD, USD, JPY, HKD) | 10 currencies (AUD, CAD, CNH, CHF, EUR, GBP, NZD, USD, JPY and HKD) |

DBS Bank Account For Foreigners

Recognised as the safest bank in Asia, DBS (Development Bank of Singapore) offers a range of accounts, such as current and saving accounts—usable in both Singapore dollars and foreign currencies.

The good news is that most accounts are open to foreigners, except the DBS Multi-Currency Autosave, which is only for Singapore citizens and permanent residents. A good choice for foreign non-residents is the multi-currency Multiplier account.

How To Open a DBS Account

- Check your eligibility for the type of DBS account you need.

- Download the DBS Digibank mobile app and navigate to the application type. You will be directed to a page showing all the products you can apply for.

- Click the one you prefer. Once done, follow the instructions when entering your personal details. You can also use your Singpass for instant application.

- For foreigners, you will be required to upload a photo of your passport and other documents. Make sure that you also prepare your FIN number and Singapore (+65) mobile number.

- Register for Singpass online if you don’t have it. Choose face verification for speedy registration.

UOB Bank Account For Foreigners

UOB (United Overseas Bank) is Singapore’s third-largest bank, with over 500 branches and offices in 19 countries and territories in Asia Pacific, Europe and North America. Aside from Singapore dollar accounts, the bank offers multi-currency options, making it one of the most popular banks among foreigners.

One of the best products offered by UOB is the UOB One Account. It is a flexible SGD account that lets you earn up to 2.5% savings interest and get 3% cash back on eligible card spend. There’s also a S$1,000 minimum balance to avoid monthly fees.

Unfortunately, UOB requires you to be in Singapore to start the application process. Eligible non-residents will also need the assistance of an introducer.

How To Open a UOB Account

- Since there’s no online application available for foreigners, you should visit a UOB branch in person.

- If you frequently visit Singapore without living or working there, you may qualify to open an account by attending a meeting at a UOB branch.

- Gather important documents, such as proof of address and proof of identification.

- Obtain a reference letter from your current bank or an existing UOB customer.

- Visit a UOB branch to submit your application.

- Remember that UOB evaluates every application individually, so prepare the required paperwork ahead of time.

OCBC Bank Account For Foreigners

Also known as Oversea-Chinese Banking Corp, OCBC Bank is one of the largest banks in the Asia-Pacific region. It allows non-residents and expats from Hong Kong, Malaysia, Indonesia and China exclusively to open savings, chequing and foreign currency accounts in Singapore.

What makes OCBC Bank ideal is that you can open an account remotely. You don’t have to physically visit a branch to start the process, which is good if you’re still in your home country finalising relocation.

How To Open an OCBC Account

- Download the OCBC Digital app.

- Click on the ‘Sign Up’ button and select ‘Foreigner with e-passport.’

- Have your e-passport and ID card ready for verification.

- Easily open your account online within minutes.

Once your application is approved, you can enjoy a range of convenient digital banking services through OCBC Digital. This enables you to:

- Check your account balances and transactions

- Make payments

- Transfer money

- Convert foreign currency

A Good Starter: Instarem Account For Foreigners in Singapore

While opening a bank account in Singapore as a foreigner can be straightforward, their requirements and timelines can be daunting. This is especially true when you’re new in the country. Did you bring enough proof of identity? Are these bills in the right language? How do you choose the right bank?

Language and cultural differences also make it more challenging, and you might feel anxious about not understanding financial terms.

Thankfully, Instarem provides a favourable starting point for foreigners. We can be your ideal first step for managing your finances as you settle into a new country.

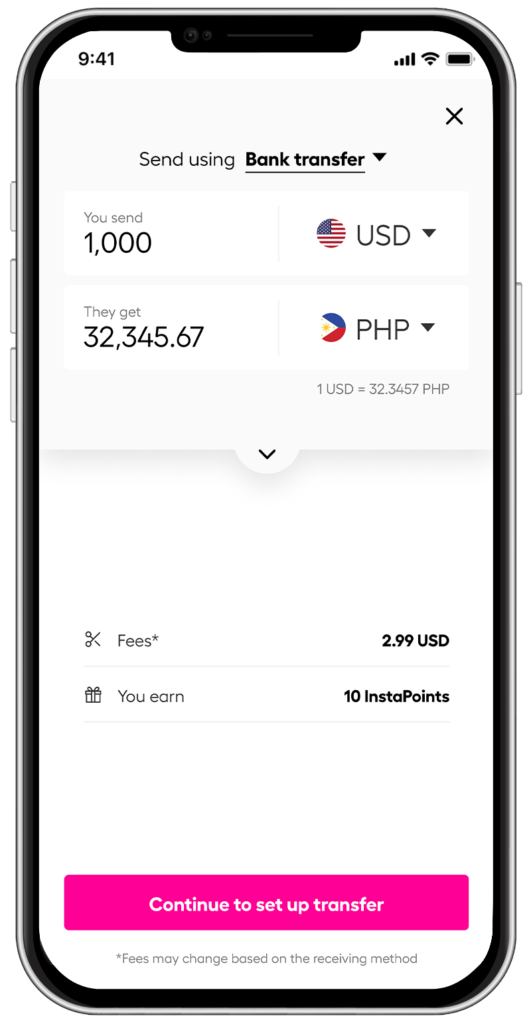

- Fast and Easy Setup: Ditch the paperwork and lengthy application processes. Instarem lets you open an account online within minutes, often ideal for urgent financial needs.

- Accessibility for Foreigners: No minimum income or employment proof is required, making it accessible for newcomers settling in or short-term residents.

- International Money Transfer: Send and receive money internationally with competitive rates and transparent fees.

- Mobile-First Convenience: Manage your account on the go with our user-friendly app, eliminating the need for frequent physical branch visits.

- InstaPoints: Earn with each transfer and use them to save up on future payments.

However, it’s still important to note that while Instarem may be a convenient option, the decision ultimately depends on your specific banking needs as a foreigner in Singapore. For instance, if you prioritise comprehensive financial services and a network of ATMs, traditional banking is for you. You can explore DBS, OCBC, UOB or other banks to find the perfect fit for your long-term financial goals.

*rates are for display purposes only

Ready to take the next step? Feel free to explore what Instarem offers, and if you decide on this digital route, we’re ready to assist you every step of the way. Download the app or sign up today!

Frequently Asked Questions

Can non-residents open a bank account in Singapore?

Yes. Many banks in Singapore offer accounts for non-residents, although the process and eligibility may vary depending on the bank and your specific situation.

Which bank account is best for foreigners in Singapore?

This depends heavily on your individual needs and circumstances. Consider factors like:

- Your visa/pass: Different banks have different requirements for non-residents based on their pass type (work, student, long-term visit, etc.).

- Fees and minimum balances: Compare monthly fees, minimum balance requirements and transaction fees.

- Features and services: Do you need online banking, ATM access, debit cards and international transfers?

- Accessibility: How important is online account opening or proximity to branches?

Some popular banks for expatriates and non-residents include DBS Bank, OCBC Bank and United Overseas Bank (UOB).

Can a foreigner without a pass open a bank account in Singapore?

It’s more challenging, but not impossible. Some banks may accept proof of residency in another country alongside a valid passport. Contact different banks directly to inquire about their specific requirements for non-resident account opening without a pass.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products.

Get the app

Get the app