Meet Instarem’s amaze card: its features, benefits, and how you can get one

This article covers:

- Combine up to 5 of your cards into one

- Don’t have a Mastercard? Top up the amaze wallet with PayNow

- Save big with Instarem’s great FX rates

- Enjoy full control in real-time

- Enter a World of benefits with Mastercard

- And yes, the amaze card is free.

- Google Pay with amaze

- Apple Pay with amaze

- This is why the amaze card is different

- Amazed yet? Here’s how easy it is to apply and set up

- Need help? Receive assistance in 2 ways

Singapore’s first smart card is truly a game changer! Say hello to amaze – the card that does it ALL! Backed by our friends at Mastercard you can:

- Pair up to 5 of your existing Mastercard credit or debit cards,

- or top up your amaze wallet.

Oh, did we mention that you save on FX fees too?

Meet amaze

For the average Singaporean, debit and credit cards are an essential part of our everyday life. From getting rewards on our e-commerce purchases to using cards as a business cash flow tool, we have benefitted from the debit and credit cards we own.

In fact, according to a 2021 Finder article, 73% of Singaporeans own at least 1 credit card, and 10% own 6 or more1—boy, do we love our cards, but all that card-carrying can make organisation a hassle.

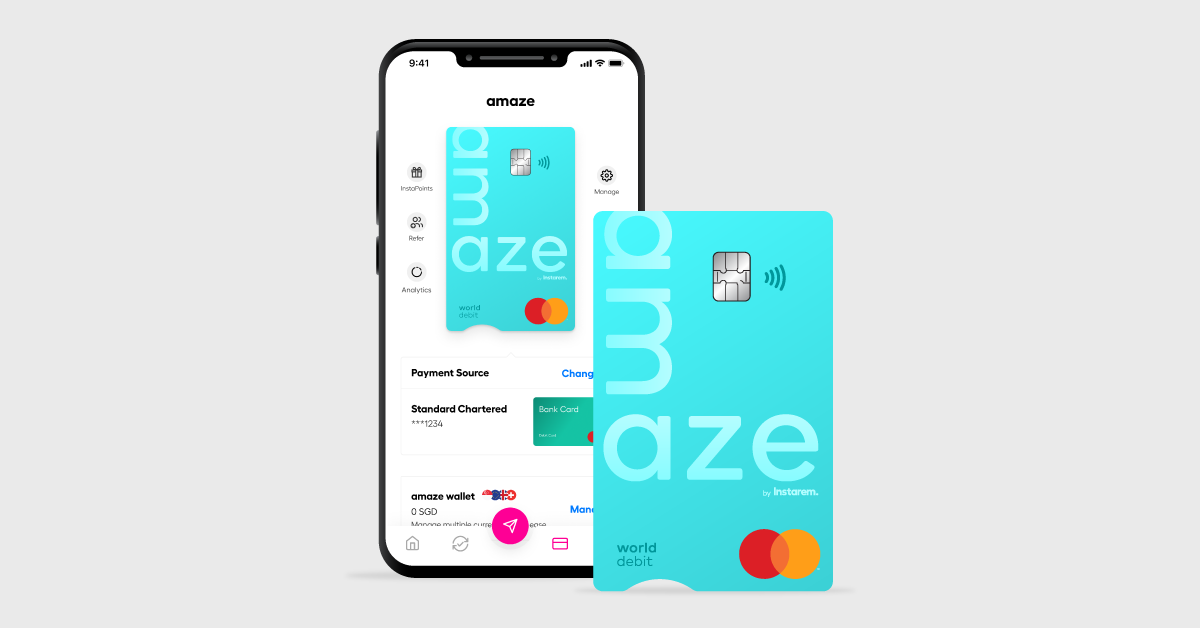

Enter the amaze card, an innovative card from Instarem that will declutter your wallet and upsize your rewards. amaze will be the region’s first-of-its-kind card for consumers, so let’s take a closer look at its benefits:

Combine up to 5 of your cards into one

The amaze card allows you to combine up to 5 of your Singapore-issued Mastercard debit and credit cards into one so you can declutter your wallet.

amaze is virtual and physical: Instead of rummaging around your bag or wallet to make payments, you can simply tap your physical amaze card over contactless card readers to pay without needing to top-up. And even before your physical card arrives at your door, your virtual card is ready for online purchases as it simply uses your selected linked card for payments.

Or continue to earn card rewards: If you have linked a rewards-based card to amaze, you will continue earning that card’s rewards** whenever you pay.

Don’t have a Mastercard? Top up the amaze wallet with PayNow

Instarem allows you to fund your amaze card through the amaze wallet via PayNow top up.

This way, you can also enjoy and earn InstaPoints, whether locally or overseas, with amaze linked to your wallet. Convert 1,200 InstaPoints to 400 KrisFlyer miles for free flights and upgrades.

Hop over to this article to learn more: Guide to overseas ATM withdrawal with Instarem’s amaze

Save big with Instarem’s great FX rates

Since amaze is part of Instarem Singapore, you can naturally save big on overseas purchases by using amaze and the Instarem app.

amaze offers competitive exchange rates, unlike banks which typically add a substantial markup and FX admin fee. Thus, you get the best possible value for your e-commerce and overseas purchases with amaze.

Folks with loved ones, businesses, or investments overseas will feel more empowered with Instarem as it sends payments to over 60+ countries in a fast, secure, and cost-effective manner. And you can rest assured you will be experiencing the same transparency and control over your transactions that amaze has.

You Might Also Want To Read: Introducing Instarem’s new multi-currency wallet

Enjoy full control in real-time

By using amaze via the Instarem app, maximise your dollar value on transactions by strategically selecting your preferred linked card for specific payments at any time. Replacing and deleting cards in-app are also super easy. The user-friendly app interface only requires you to make a few taps to complete an action.

Viewing your transactions is also child’s play on the app. Its transaction tracking feature allows you see all your expenses in one place in real-time and with full transparency.

Automatically categorised transactions: Do you like your transactions super organised? Then you’ll like that the system automatically categorises your transaction types like “Food and Dining” and “Travel” for more comprehensive spending breakdowns.

Your amaze transactions will automatically be categorised on the app by country and type of transaction, e.g., ‘Shopping’, ‘Food and Dining’, ‘Travel’, etc.

Transaction format: If you are curious how your transaction will look like via your funding cards, it will include both “amaze” and the merchant’s name. For example: “amaze*Starbucks”.

Track your spending: Get a personalised view and breakdown of your spends across all your cards in one place.

You Might Also Want To Read: How to Dispute Credit Card Charges made on Instarem’s amaze

Enter a World of benefits with Mastercard

amaze automatically comes with Mastercard’s World tier of privileges, which is better than most Platinum cards in the market.

- Zero liability protection: You won’t be held responsible if somebody else makes unauthorised purchases with your card.

- ID Theft Protection™: A service that alerts you when suspicious activity is detected on your credit file. It also offers resolution assistance for identity theft cases.

- Global Emergency Services: 24-hour global assistance for lost and stolen cards, emergency card replacements and cash advances, and more.

- Priceless Golf and City experiences: Access exclusive golf offers and experiences plus thousands of curated experiences in Singapore.

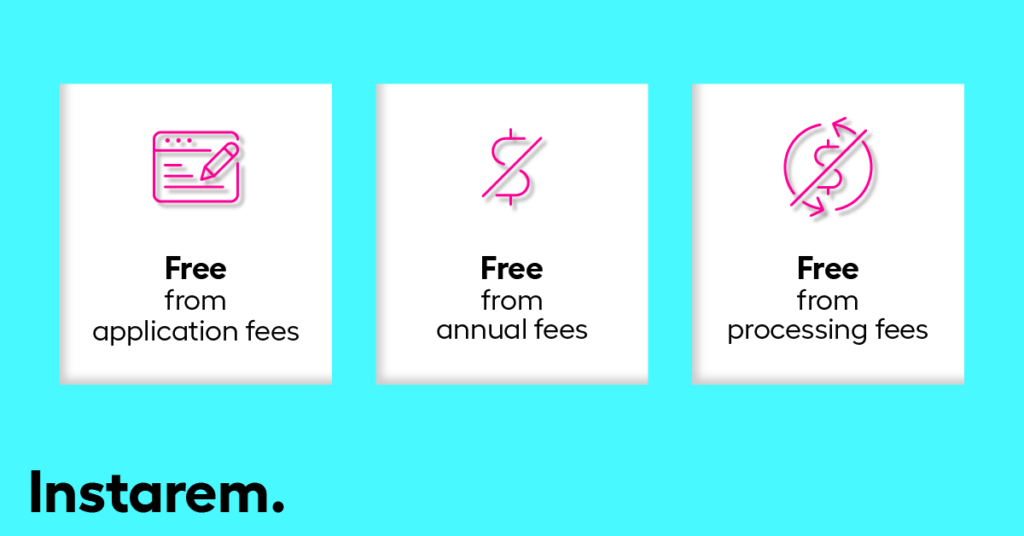

And yes, the amaze card is free.

You’ll be charged nothing for applying for an amaze card. Most importantly, there are no annual or processing fees involved with amaze–ever!

Google Pay with amaze

Android users! Heads up! You can also use amaze on Google Pay to enjoy convenient payments with your Android phone and get rewards on top of rewards.

Here’s how you can add your amaze card to Google Pay instantly:

- Log into your Google Pay app (Don’t have the app yet? Download here)

- Tap on Credit/Debit card and select “Add credit or debit card”.

- Enter your amaze card details. You can retrieve this from the Instarem app or the physical card.

- Verify OTP (if applicable)

Note: After you add your card, you might see a small temporary charge on your account from Google. This charge checks that your card and account are valid. It won’t affect your balance and will be reversed soon.

Apple Pay with amaze

Ready to use Apple Pay in Singapore and overseas? Let’s get you set up in your wallet! Here’s a simple guide that’ll walk you through the setup step by step.

On iPhone:

- Open the Apple Wallet app and tap the + sign.

- Tap ‘Debit or Credit Card’.

- Scan your amaze card or enter the details manually.

- Verify your card information and enable it for Apple Pay.

On Apple Watch:

- Open the Apple Watch app on your paired iPhone.

- In the My Watch tab, tap ‘Wallet & Apple Pay’.

- Tap ‘Add Card’ and select ‘Debit or Credit Card’.

- Follow the steps on the screen to add your amaze card.

- Verify your card information and enable it for Apple Pay.

And that’s all.

This is why the amaze card is different

It provides you with the simplicity and convenience of a wallet and still lets you enjoy the benefits of multiple cards. Digital natives and people who love discovering better deals with their cards can potentially reap the most benefits with amaze.

What’s more, sharp merchants and businesspeople can find advanced usage methods to maximise their dollar value by pairing amaze with Instarem’s global remittance services. They can spend globally and pay locally, which ultimately will open a new world of benefits for their ventures. Want the card? Apply for amaze today! Here’s how to sign up!

Amazed yet? Here’s how easy it is to apply and set up

Follow the easy steps outlined below to get hold of an amaze card once you’ve decided to take the leap.

1. Download Instarem App. For fast and easy onboarding, use the MyInfo with Singpass option to sign up.

2. After your Instarem account is approved (check your inbox for a confirmation email), tap the card icon at the bottom of your app to see this screen:

3. After entering the name you want on your amaze card, check your delivery address details. Once that’s done, click the T&C checkbox and then ‘Confirm’. The next screen will prompt you to link up with a funding source!

4. Once you are done, you’ll see the updated payment source on your amaze screen. Straightaway, you can start using your virtual amaze card for online transactions. Your physical card will arrive in 7 to 14 working days.

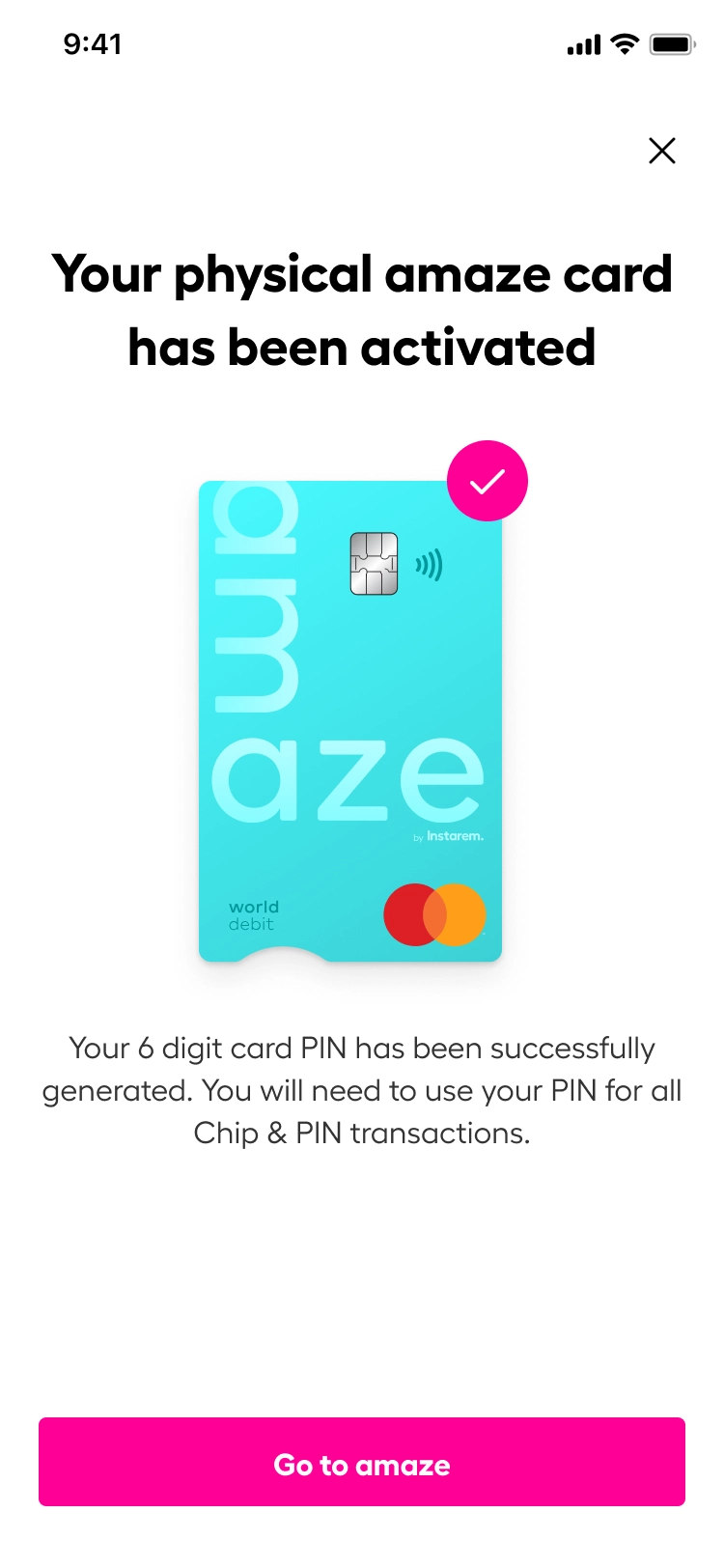

5. Once your physical amaze card arrives via snail mail, tap on ‘Activate Physical Card’ on the app and then ‘Yes’ to set a card PIN. You will then see this screen:

Your personal 6-digit PIN will be used for all Chip and PIN transactions.

6. Congrats! You should see this confirmation screen next.

Need help? Receive assistance in 2 ways

- Check out the amaze Frequently Asked Questions to troubleshoot any difficulty that you might encounter along your card application journey and more.

- Log in and get personalised help from our Help centre.

You Might Also Want To Read: 5 ways to safeguard your Instarem amaze card

Information source(s):

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Get the app

Get the app