International money transfer rules – Everything you need to know

This article covers:

Are you planning to transfer money overseas, whether it’s for personal or business use? International money transfer has never been easier, but before you hit that “send” button, there are a few things you should know, including international money transfer laws and rules for receiving money from overseas. From regulations to fees and risks, international money transfer can be daunting. But don’t worry, we’ve got you covered! In this article, we will provide a comprehensive guide to everything you need to know about international money transfer, including the rules & regulations governing it, the different types of transfers available, the fees and exchange rates involved, and the risks associated with the process.

Regulations governing international money transfer

International money transfer rules & regulations are in place to ensure that funds are transferred safely and securely across borders. These regulations vary from country to country and are put in place to protect both the financial system and the customers using these services. By following these money transfer rules, countries can maintain the integrity of their financial systems, prevent financial crimes, and ensure that customers can use these services with confidence.

While the money transfer rules may vary from country to country, there are some common regulations that apply in most cases. Here are some of the most common international money transfer laws:

Anti-money laundering (AML): Requires money transfer providers to verify the identity of their customers, monitor transactions for suspicious activity, and report any suspicious transactions to the relevant authorities.

Know your customer (KYC): Similar to AML regulations, KYC helps money transfer providers verify the identity of their customers and may also require proof of address and other personal information.

Transaction reporting: To further support the transaction, the following transaction information will be needed:

- Sender and recipient details

- Payment purpose

- Bank details

- Source of funds

- Relationship between sender and recipient:

- Identification details like date & place of birth, residence address, occupation and business, nationality, and place of residence

- Transaction amount

Limits on transaction amounts: Some countries place limits on the amount of money that can be sent or received through international remittance. These limits may be based on the purpose of the transaction, the type of customer, or other factors.

Let’s look at the individual country’s own international money transfer rules, especially on the limit on transaction amounts:

India

Based on Reserve Bank of India (RBI) guidelines for the transfer of money, Indian residents have certain limitations on outward and inward remittances.

For outward remittances, the limit is currently set at $250,000 per year for permitted reasons such as medical treatment abroad, overseas education fees, or supporting family members residing in a foreign country.

Inward remittances can be made through either the Rupee Drawing Arrangement (RDA) or the Money Transfer Service Scheme (MTSS), with different limitations. RDA has no maximum limit on personal transactions but has caps on inward business remittances, while MTSS allows a maximum of $2,500 per transfer and 30 transfers to a single recipient in a year.

Regardless of the route chosen, funds can only be transferred by regulated agents and must include a Foreign Inward Remittance Certificate (FIRC) as proof of legitimate and legal compliance.

For non-resident Indians (NRIs), the rules depend on the type of bank account they have.

Non-Resident External (NRE) accounts are for NRIs who earn abroad and remit money to India to hold as savings in rupees before transferring it back to their country of residence, and they have no limit on transactions.

Non-Resident Ordinary (NRO) accounts are Indian rupee-denominated accounts typically used by non-residents who have earnings in India, such as rent, pensions, or dividends. NRO accounts have fewer rules but have a limit of $1 million for remitting abroad from India per year.

Foreign Currency Non-Resident Bank Accounts (FCNR B) are foreign exchange accounts for NRIs to transfer money and limit currency conversion risks, and they have no limit on transactions, but there are restrictions on the sources responsible for the funds.

United States

When it comes to international money transfers in the United States, it’s crucial to understand the relevant laws and regulations. If your transactions involve amounts exceeding $10,000, it is your responsibility to report them to the Internal Revenue Service (IRS). Failure to comply with this reporting requirement can result in fines and legal consequences.

Financial institutions and money transfer providers are obligated to report international transfers surpassing $10,000. The Bank Secrecy Act, overseen by the Office of the Comptroller of the Currency, provides further information on these requirements. Generally, transactions below this threshold are not reported. However, banks are required to monitor transactions and report any suspicious activities. For example, if a sender splits a larger payment into multiple smaller ones to avoid the $10,000 threshold and tax obligations, it would be considered suspicious activity. Monitoring transactions helps authorities prevent illegal activities and fraudulent transfers, while also making it more challenging for individuals to use offshore tax shelters.

To fulfil their legal obligations, banks and money transfer providers will ask you to provide the necessary information before allowing you to make any transaction. The specific requirements can vary depending on the institution or service provider. Online transfers may have stricter rules, and additional documentation may be required to verify your identity. For high-value transactions exceeding $10,000, banks may request further documentation, such as proof of your source of wealth or monthly payslips.

While there is no law that limits the amount of money you can send or receive, financial institutions and money transfer providers often impose daily transaction limits. These limits vary from one establishment to another, ranging from $3,000 per day to no limit at all. It is advisable to check with your specific institution to understand their transaction limits.

Canada

There are no restrictions on sending money in and out of Canada, but a cross-border currency report is filed with the Canada Border Services Agency (CBSA) by a person entering or leaving Canada carrying a sum of currency or monetary instruments of $10,000 or more, or by a person mailing or sending such large sums into or out of Canada. The CBSA then submits the report to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

The Canada Revenue Agency (CRA) mandates that banks and money transfer providers report deposits exceeding CAD $10,000. Financial institutions are also required to report such transactions to FINTRAC. Additionally, financial institutions have the authority to report suspicious transactions to the Department of Justice for investigation. The government can track the movement of funds within Canada or abroad using unique numbering systems.

Sending gifts in and out of Canada is not subject to charges. However, if the value of gifts you have sent in your lifetime exceeds CAD $11 million, you may be liable for gift taxes. You must submit a form if you have sent gifts totalling over CAD $15,000 within the past year. A gift is considered any item of monetary value, including money itself, given to someone without expecting goods or services in return. It’s worth noting that medical expenses and gifts to a spouse may be exempt from these regulations.

United Kingdom (UK)

There is no legal limit on the amount of money you can send abroad from the UK. However, individual banks may impose their own daily limits for wire transfers.

Financial institutions, such as banks and payment service providers, must comply with regulations established by the Financial Conduct Authority (FCA) and HM Revenues and Customs (HMRC). While these regulations ensure compliance with anti-money laundering and sanctions requirements, they do not necessarily guarantee competitive exchange rates or fee-free transfers. To comply with anti-money laundering regulations, payment service providers are also required to conduct Enhanced Due Diligence (EDD) for transfers to high-risk countries or business sectors.

Although there are limits on the amount of cash you can bring into the UK without declaring it (currently set at £10,000), there is no such limit on receiving funds via wire transfer. Nevertheless, it is important to consider potential tax implications.

Australia

According to the Australian Transaction Reports and Analysis Centre (AUSTRAC), if you are travelling into or out of the country or sending/receiving money via mail, courier, air or sea freight, you must declare any combination of cash and non-cash forms of money (such as traveller’s cheques, cheques, and money orders) in Australian and foreign currency that amounts to AUD10,000 or more.

However, there is no limit on the amount of money that can be received or sent through a bank or a remittance service provider, and such transfers do not need to be declared. Additionally, there are no restrictions on the amount of money that can be travelled with, received or sent overseas. In other words, you can send money to Australia without any limit.

Singapore

Information regarding the limits for international transfers to Singapore per person per year is regulated by the Monetary Authority of Singapore (MAS).

The limits are generally set by banks and remittance companies.

Malaysia

According to the Central Bank of Malaysia, there are no limits to sending money to Malaysia. However, if you are transferring money up to a certain amount, more documents might be needed depending on the banks and remittance service providers. Another limitation is that if your recipient has a non-resident local bank account in Malaysia, they can only receive a maximum of 10,000 MYR per day. Their bank might close the account if they try to receive more than this.

Transferring money out from Malaysia, however, will need to observe the below:

Remittance performed by Malaysian or expatriates, a total transaction limit not exceeding an aggregate amount of RM30,000 per day shall be observed unless otherwise approved by Bank Negara Malaysia.

Remittance performed by foreign workers, a total transaction limit not exceeding an aggregate amount of RM5,000 per month shall be observed unless otherwise approved by Bank Negara Malaysia.

European Union (EU)

The EU Funds Transfer Regulation requires money transmitters to include certain information when funds are sent electronically to another provider. In some cases, money transmitters need to check the information given to them is correct. Details about the payer and payee must be verified if:

- The money transfer is worth €1,000 or more

- Cash or anonymous e-money helped fund the money transfer

Providers can use a range of official documents to confirm the accuracy of people’s details, including:

- Passports

- Driver’s license

- Government documents

China

China has strict rules and regulations for financial processes, and sending money in or out of China is only allowed in accordance with these rules. The People’s Bank of China (PBOC) and the State Administration of Foreign Exchange (SAFE) regulate foreign exchange and money transfer in and out of the country. All transactions, domestic or overseas, that exceed 50,000 RMB ($7,000) or $10,000 or its equivalent, should be reported. For cross-border fund transfers, money in and out of individual customers that exceed 200,000 RMB ($28,000) and foreign currency equivalent of $10,000 should be reported. The daily limit for remittance of money abroad is not more than $50,000, and remittance handling fees vary from bank to bank, but on average it’s 1% of the amount. Chinese citizens have a limit of USD $50,000 for the amount of converted or purchased foreign currency per year, and this limit also applies to money being sent out of China.

The Philippines

According to The Bangko Sentral ng Pilipinas (BSP), when it comes to international money transfer to or from The Philippines, individuals are allowed to freely bring in or take out foreign currency and other bearer monetary instruments, such as travellers’ checks, checks, drafts, notes, money orders, and bonds, up to USD 10,000 or its equivalent in other foreign currencies. However, for amounts exceeding the USD 10,000 limit, a prior written declaration is required by filling out the foreign currency declaration form.

Hong Kong

In order to comply with the international standards set by the Financial Action Task Force on Money Laundering, the government has made amendments to the relevant provisions of the Organized and Serious Crimes Ordinance. These amendments have lowered the threshold for customer identity verification and record-keeping in remittance and money exchange transactions from $20,000 to $8,000. These requirements have been in effect since January 26, 2007.

While there’s no legal limit on the amount of money you can send abroad from Hong Kong, any remittance or currency exchange transaction equal to or exceeding HK$8,000 requires the sender to provide their identity card or travel document, as well as a valid address and telephone number. The remittance agent or money changer is responsible for recording and retaining the provided identity, address, and telephone number. The same verification process applies when receiving an amount equal to or exceeding HK$8,000.

United Arab Emirates (UAE)

There are no legal limitations on sending money out of the United Arab Emirates (UAE). However, it’s important to note that when entering or leaving the UAE, individuals are obligated to declare any cash or financial instruments exceeding AED 60,000. This declaration requirement is primarily for monitoring and statistical purposes. It’s worth mentioning that there is no specific restriction on the amount of cash that you can carry with you.

In terms of electronic money transfers, commonly conducted through bank-to-bank transactions, the UAE does not impose exchange controls. This means that there are no legal constraints on transferring money electronically. However, individual banks may have their own internal limits for online transfers. These limits vary from one bank to another and are typically determined by the bank’s policies and risk management practices.

It’s important to stay informed about any updates or changes in regulations by referring to official sources such as the Central Bank of the UAE or consulting with your bank or financial institution directly. They can provide you with the most accurate and up-to-date information regarding any specific limits or requirements for sending money out of the UAE.

Types of international money transfer

With the increasing globalization of the world’s economy, the need for safe and efficient cross-border payment systems has become more important than ever before. There are several methods available for international money transfers, each with its own advantages and disadvantages. In this regard, let’s take a closer look at the various types of international money transfer methods available today.

Telegraphic Transfer

Telegraphic Transfer (TT) is a method used for international money transfer that is often used interchangeably with a wire transfer, bank transfer, or Society for Worldwide Interbank Financial Telecommunications (SWIFT) system transfer. It is a secure and fast way of transferring funds from your bank account to your recipient’s account. To make a TT, you need to have savings or a current account, preferably with online account access.

When sending money overseas, you can instantly calculate the value of your currency conversion. The amount will be directly debited from your account and transferred to your recipient’s account. However, you will be charged a small service fee for the transfer, which varies depending on your bank. Some banks also charge a fee for receiving transfers.

To make a TT, you need more information about your recipient than other transfers. In addition to the recipient’s full name and address, you will also need their bank’s address, International Banking Account Number (IBAN), and bank’s SWIFT code. The SWIFT network and Transaction Authorization Code (TAC) ensure that the transfer is secure.

Remittance transfer provider

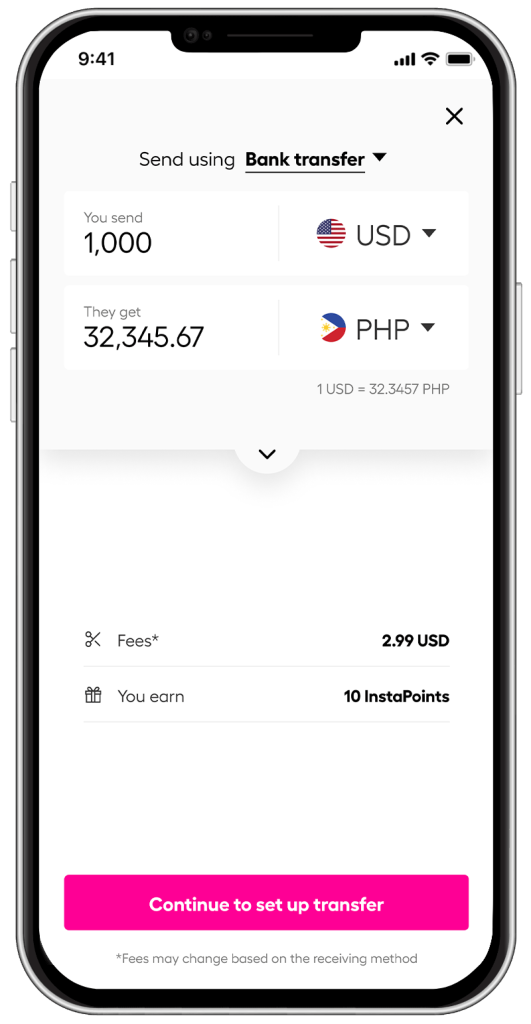

A remittance transfer provider or remittance firm is a company that facilitates the transfer of money internationally. These companies often have lower fees and offer better exchange rates than banks. Remittance transfer providers utilize their own payment network to facilitate transactions, allowing customers to make payments locally via local banking systems. This means that the funds are also disbursed locally in the recipient’s location, thereby avoiding expensive international transfer fees. One such example of a remittance transfer provider is Instarem.

Digital wallet or online money transfer services

Online money transfer services are similar to remittance transfer providers, but they operate entirely online and you pay the transfer with the balance of your bank account, debit card, credit card, or using the balance in the wallet. Such examples include PayPal, Venmo, and Payoneer. These services often have low fees and fast processing times, but the exchange rates may not be the most competitive.

Cryptocurrency transfers

Cryptocurrencies, such as Bitcoin and Ethereum, can be used to send money internationally. The sender transfers the cryptocurrency to the recipient’s digital wallet, and the transaction is recorded on a decentralized blockchain ledger. This method can be fast and cost-effective, but the volatility of cryptocurrencies means that the exchange rate can fluctuate rapidly.

Cash transfers

Cash transfers involve physically sending cash to a recipient through a service such as Western Union or MoneyGram. This method can be convenient for recipients who don’t have a bank account, but the fees can be higher.

Fees and exchange rates

The fees associated with international money transfer depends on the institution that handles your transfer. Banks and money transfer providers have varying fee structures and margins on the exchange rate. By comparing different providers before making a transfer, you could potentially save a significant amount, particularly for larger transfers. Here are some common fees:

Transfer fee

Regardless of the type of international money transfer, transfer fees are applicable. There are several factors that can affect the transfer fees, including the types of transfers, the currencies you are sending, the amount you are sending, and the payment method. There are typically three common types of fee models adopted:

- Fixed transfer fee: Every transaction is charged at a fixed rate, typically around $10 – $50.

- Variable transfer fee: Variable transfer fee charges are based on a percentage of the transfer amount, typically around 0.1% to 1% of the transfer amount.

- Fixed + variable transfer fee: A combination of both fees to complete the transfer.

Exchange rate markup

The FX Rate or Foreign Exchange Rate, refers to the value of a country’s currency compared to another country’s currency, often referred to as the base currency and the counter currency.

However, regardless of whether you are converting your currencies at banks, exchange houses or remittance transfer providers, you are unlikely to receive the market rate. Instead, banks and currency exchange providers typically add a markup to the exchange rate in order to generate a profit.

On the other hand, remittance transfer providers may offer more favourable exchange rates to their customers, as they can often provide rates that are closer to the real-time market rate.

Receiving fee

On top of transfer fees and exchange rate markup, most banks charge their customers to receive international transfers. The receiving fees are generally lower than the outgoing fees.

Most remittance transfer providers like Instarem use a global network of local bank accounts to move your money at the local level in an effort to reduce these fees.

*rates are for illustration purposes.

Meaning, your recipient may be charged less by their bank to receive the funds when you use Instarem.

Correspondent bank fee

A correspondent bank fee, also known as an agent charge or intermediary bank fee, is an additional fee that some banks may charge when a third-party bank is required to facilitate the transfer of funds from one account to another. As some banks don’t have direct access to all other banks worldwide, they make use of correspondent banks to complete financial transactions.

Moreover, correspondent banks are allowed to deduct a fee directly from the funds being transferred through the SWIFT network, without the sender or receiver’s knowledge.

To avoid these fees, it’s advisable to choose well-established multinational banks when sending money abroad or to use a money transfer provider that generally provides clear upfront information on all the fees involved in the transaction.

Cancellation or amendment fee

When you initiate a transfer, you may find yourself in a situation where you need to either cancel or amend it. In such cases, the bank or transfer provider may charge you a fee for making changes or cancelling the transaction. The amount of the fee can vary depending on the bank or provider and the specific circumstances of your transfer.

It’s important to carefully review the terms and conditions of your transfer agreement before initiating the transfer to understand the fees that may be associated with cancellation or amendment. Some providers may offer a grace period during which you can make changes or cancel the transfer without incurring a fee.

If you think you may need to make changes to your transfer in the future, it’s a good idea to choose a provider that offers flexible cancellation and amendment policies or to consider purchasing transfer protection insurance, which can cover the cost of cancellation or amendment fees.

Initiation fee

An initiation fee is a type of fee that may be charged by your bank for requesting a wire transfer in a branch or over the phone, rather than initiating the transfer online. These fees can vary depending on the bank and the type of transfer being made.

For example, a domestic wire transfer may have a lower initiation fee than an international wire transfer. Initiation fees are a way for banks to offset the costs of processing wire transfers and may be listed as a separate fee on your account statement.

To avoid these fees, it is recommended to initiate wire transfers online whenever possible. If you must request a wire transfer in person or over the phone, be sure to inquire about any initiation fees beforehand and compare them across different banks to find the most cost-effective option.

Risks associated with international money transfer

Regardless of whether you are doing an international money transfer or a normal money transfer, you are at risk of falling into scams like phishing, fake president fraud, authorised pushed payment (APP) scams, or social media scams that rely on impersonating something you are familiar with to trick you into sending money. Although this is not really a technical risk, it is worth taking note of.

In addition to fraud, currency exchange rate fluctuations can also be a risk associated with international money transfers. The value of a currency can change rapidly, leading to unexpected costs. This can be particularly problematic for people who need to send regular payments, such as expats paying bills or mortgages in their home country.

To minimize the impact of exchange rate fluctuations, it is important to research the current exchange rates and calculate the total cost of the transfer before proceeding.

Transaction delays can also occur during the international money transfer process. This is particularly true when the transfer involves multiple banks or currencies. In some cases, transfers can take days or even weeks to complete, which can cause financial stress and uncertainty. Additionally, some countries have strict regulations on international money transfers, which can make the process more complicated and time-consuming. To avoid transaction delays, it is important to understand the transfer process and any regulations that may impact the transfer.

Manage international money transfer smartly

In conclusion, understanding the rules and regulations surrounding international money transfer is essential for anyone who needs to transfer money across borders. There are various types of transfers available, each with its own advantages and disadvantages, and it’s important to choose the right one for your needs. While fees and exchange rates can vary widely between providers, it’s important to consider these factors along with the speed and reliability of the transfer.

Finally, it’s crucial to be aware of the potential risks associated with international money transfer, including fraud and scams, currency exchange rate fluctuations, and transaction delays, and take steps to protect yourself and your money.

By doing your research and staying informed, you can ensure that your international money transfers are safe, secure, and cost-effective.

Get the app

Get the app