Debunked: 13 money myths that could be costing you big time

This article covers:

Ugh, if there’s one thing you really need to get your act together on this year, it’s how to manage and grow your money. Seriously, adulting is hard enough without being broke, right? Growing up, we got all these so-called “money rules” drilled into our heads—parents lecturing, friends bragging, and let’s not forget those math exam questions about compounding interest (thanks for that trauma, school).

But guess what? Not all of those “rules” are actually true. Shocking, I know. So, as we dive into 13 juicy financial myths that are totally holding you back, prepare to have your misconceptions shattered.

Because, honestly, who wants to stay stuck in the red when financial freedom is the ultimate dream? Now, without further ado (or excuses), let’s get this show on the road!

Credit cards, credit score and debts myths: Let’s clear the air

Ah, credit cards and debt—the financial soap opera nobody asked for. On one side, you’ve got people shouting, “All debt is evil!” and on the other, folks claiming, “Debt is life; keep it rolling!” Plot twist: both are dead wrong.

You don’t want to be in a toxic “till death do us part” relationship with debt, but you also don’t want to clutch your wallet so tightly that you’re practically living like a monk. And yet, here we are, swimming in a sea of wild misconceptions about how to improve your financial health. Let’s talk about some of the biggest offenders.

Myth #1: Paying debts off slowly builds your credit

Wait, what? Who spread this nonsense? Paying debt off slowly doesn’t make you some financial genius; it just makes you the bank’s favourite customer. Why? Because of all that juicy interest you’re paying them.

For example, with an average credit card interest rate of 20%, if you carry over $100 every month, by the end of the year, you’ll be paying enough to make your wallet cry. See? The only thing you’re “building” is a mountain of unnecessary payments.

And we’re not just talking credit cards—this includes student loans, mortgages, or literally anything you owe the bank. Paying slowly doesn’t boost your credit score; it just boosts the bank’s profits. Congrats, you played yourself.

Myth 2: Credit score obsession

“Help! My credit score dropped from 780 to 755!” Relax, my friend. Nobody cares—not even your bank. Once you hit 700, your score becomes less of a bragging point and more of a “meh.”

Here’s the tea: People stress over credit scores because they think a higher number magically unlocks lower interest rates. Spoiler alert: It doesn’t work like that. Lenders look at everything—payment history, credit mix, and whether you pay on time—not just your magical three-digit number.

In fact, someone with a 720 score and a solid credit history might get better rates than a 780 score with barely any credit history. So stop obsessing over the number; it’s not a video game leaderboard.

Myth #3: You can’t use more than 30% of your credit limit

Relax—it’s not like a magical penalty box appears if you hit 31%. Your credit card is there to help you manage purchases, not guilt-trip you into limiting yourself unnecessarily.

Credit cards aren’t evil. They’re actually awesome if you use them right. No balance-carrying drama—just swipe away responsibly and reap the perks. Think cashback, air miles, and rewards points. I mean, why wouldn’t you want free stuff?

So, here’s the golden rule: Pay off everything on time. That’s it. Do this, and your bank account, credit score, and future self will high-five you.

Income, outcome, and outrage: The financial myths keeping you broke

Look, we all think we’re doing great with our money—until we realise we might actually be saying no to pay raises (seriously, why?) and yes to extra expenses like it’s some kind of twisted game.

The irony? It’s these financial myths messing with our heads. Let’s unpack the madness.

Myth 1: Staying under a specific tax bracket saves you money

Ah yes, the age-old debate: taxes. Once you start making a decent amount of money, filing and paying taxes becomes your new annual hobby (yay?). Taxes fund important things like healthcare, roads, and other public goodies, so we get why they exist… but let’s talk about the myth that keeps people stuck in financial limbo.

Ever heard of people rejecting promotions or pay raises because they don’t want to “move up a tax bracket”? Yep, it happens. And if you’re thinking, “Are these people okay? Who says no to more money?”—we feel you. But let’s address the elephant in the room:

Higher pay doesn’t mean you’ll lose more money overall.

Here’s the thing: income tax brackets only apply to the portion of your income that falls within each bracket. So moving to a higher bracket doesn’t mean your entire income gets taxed at that higher rate. It’s just the income above a certain threshold. Let’s break it down with a quick example:

Example Tax Bracket (Simplified)

$0–$50,000: 10% tax

$50,001–$100,000: 20% tax

$100,001+: 30% tax

If you earn $60,000, the first $50,000 is taxed at 10%, and only the $10,000 above that is taxed at 20%. Your overall tax rate is still way lower than 20%.

Rejecting a raise to “stay in a lower bracket” is like refusing to eat dessert because you don’t want an extra spoonful of sugar. Sure, higher pay means a bit more tax, but it also means more money in your pocket overall.

So here’s the takeaway: don’t let fear of taxes hold you back. Promotions and raises are still worth it. The extra effort to increase your income pays off, even with higher taxes. (And hey, that extra cash might even pay for your new fancy coffee habit. Win-win!)

Myth 2: Saving is more important than paying off debt

We get it—seeing a fat bank balance is chef’s kiss. Who wouldn’t want an emergency fund stacked with cash? But here’s the deal: while saving is great, ignoring your debts is like trying to fill a bucket with a giant hole in it.

Remember those compounding interest math problems you hated in school? Turns out, your teacher wasn’t torturing you for fun. Debt (especially credit card debt) accrues interest at a speed your savings account simply cannot compete with.

Example: Credit card interest might be 20%, while your savings account gives you a whopping… 1%? Yeah, no contest. Pay off that high-interest debt first—it’s a guaranteed return on your money. And once that debt’s gone? You’ll have way more cash to actually save (and maybe splurge a little).

Myth 3: People are poor because they can’t manage money? seriously!

Ah, the classic tale: “People are poor because they’re bad at money.” Eye roll. Let’s talk about Linda, shall we? Linda earns just enough to cover rent and food. She has to decide between eating three meals a day or setting aside savings. Guess what she chooses? FOOD. Because you can’t survive on financial advice and good vibes alone.

Here’s the thing: poverty isn’t just about budgeting fails. For most people, it’s about low wages, sky-high living costs, and systemic issues that feel impossible to overcome. So maybe stop blaming people for being “bad with money” and start acknowledging the bigger picture.

Myth 4: Inflation going down means prices are dropping

Oh, wouldn’t that be nice? Hate to break it to you, but inflation going down doesn’t mean prices are magically falling. Let’s talk about milk.

Cue the graph nobody asked for.

Year | Average milk price by year* |

1995 | $2.48 |

1996 | $2.62 |

1997 | $2.61 |

1998 | $2.70 |

1999 | $2.84 |

2000 | $2.78 |

2001 | $2.88 |

2002 | $2.76 |

2003 | $2.76 |

2004 | $3.16 |

2005 | $3.19 |

2006 | $3.08 |

2007 | $3.50 |

2008 | $3.80 |

2009 | $3.11 |

2010 | $3.26 |

2011 | $3.57 |

2012 | $3.49 |

2013 | $3.46 |

2014 | $3.69 |

2015 | $3.42 |

2016 | $3.20 |

2017 | $3.23 |

2018 | $2.90 |

2019 | $3.04 |

2020 | $3.32 |

2021 | $3.55 |

2022 | $4.09 |

Even if inflation slows, prices are still going up—just more slowly. So while your wallet may be bleeding out less dramatically, it’s still bleeding. Inflation isn’t about making things cheaper; it’s about making them less expensive to get more expensive. Wrap your head around that one.

Myth 5: 2-3% inflation isn’t a big deal

“Only 2-3% inflation? Pfft, no biggie.” Oh really? Let’s bring back our milk analogy because it’s as relatable as it is depressing. Milk cost $2.48 in 1995. Fast forward to 2022, and you’re shelling out $4.09. Meanwhile, your salary has crawled from $2,000 to $3,500. Cute, right?

Even “low” inflation, like 3%, erodes your purchasing power over time. That small number means your money loses half its value in 24 years. So yeah, 2-3% inflation is a big deal—especially when your wallet is already doing its best impression of a black hole.

Investment Myths: When your money-growing plans are basically sabotaging you

Alright, so you’ve decided to grow your money—good for you! But let’s be real, money doesn’t grow on trees (ugh, why not though?). And sadly, these investment myths make it seem way easier than it really is. Let’s debunk them, shall we?

Myth 1: Investment isn’t necessary (or so you think)

Oh, so you think you don’t need to invest? Cute. Here’s a little reality check: your expenses are never going to stay the same. Remember milk in 1995? It was $2.48. Fast forward to 2022, and BOOM—it’s $4.09. Now imagine your salary. Let’s say you made $2,000 in 1995 and now you’re making $3,500. Sounds like an improvement, right? WRONG. Your salary is crawling while inflation is sprinting like it’s in the Olympics.

Cue the math nobody wants to see: your income can’t keep up with the rising costs of, well, everything. So, unless you want to fall behind (or, you know, skip buying milk), you need to invest. Because your savings account alone? Yeah, it’s not winning this race.

Myth 2: Trusting financial planners with all your money

Here’s a plot twist for you: not all financial planners are magical money wizards. Shocking, right? In fact, they fall into two categories: financial agents and financial planners.

Financial agents? They’re like salespeople for money products. They fill out your paperwork and introduce you to investments but don’t have a fiduciary responsibility to you. Translation? They’re not legally obligated to act in your best interest. Instead, they’re getting commission checks for selling you stuff. (Not saying they’re evil—just saying they’ve got bills too.)

On the other hand, financial planners can be helpful. But don’t hand over your wallet and call it a day. Learn the basics of managing your own money! That way, when it’s decision time, you’re choosing what’s best for you—not what’s most profitable for someone else. Knowledge = power, people.

Myth 3 : More risk = more reward

Oh, the classic “high risk, high reward” mantra. We’ve all heard it—usually from someone trying to justify YOLO-ing their savings on something questionable. Look, just because you’re young and full of bad decisions doesn’t mean you should dive headfirst into the riskiest investment you can find. That’s not “investing”—that’s gambling.

Taking on more risk without understanding what you’re investing in is like buying YOLO stocks because some random internet stranger said, “Trust me, bro”. Spoiler: that’s how you end up with regret instead of returns. Risk should come with a side of homework, not just vibes.

Bottom line: Do your research. If you’re taking on risk, make sure it’s calculated, not chaotic. And for the love of all things financially sane, don’t throw money at something you don’t even understand because Reddit told you to.

Myth 4: The magical “buy the dip” strategy

You know the friend, right? The one who smugly announces, “The market dropped, so I bought stocks, and now I’ve made a fortune!” And suddenly, it seems like all you need to do is buy low and sell high.

But reality check: timing the market is not as simple as it sounds. A “dip” isn’t always a green light to buy—there are so many factors at play. Plus, the market tends to climb over the long term, even during recessions, making this strategy… well, flawed.

Instead, think about boring-but-reliable investments like index funds. Oh, and if you haven’t met “Dollar Cost Averaging,” let me introduce you: it’s when you invest small, consistent amounts over time instead of dumping a giant chunk all at once. Less stress, more long-term gains. And hey, investing $1,000 into an index fund? Yup, that still counts as “big investor energy”.

Myth 5: Real estate always goes up

Let’s talk about the golden child of investments: real estate. It sounds amazing, right? Buy a house, turn it into a cozy nest or rent it out, and suddenly you’re free from those soul-crushing rental costs.

But then comes the twist. Picture this: you’ve got a mortgage, you’re ready to rake in rental cash, and BAM—something like Alberta’s boom-and-bust situation hits. (Google it, it’s wild.) One minute, people are buying up houses like candy, and the next? An economic downturn, rising unemployment, and… crickets. Your “guaranteed investment” suddenly isn’t so guaranteed anymore.

Lesson? Don’t assume real estate is some magical money tree. It’s great when it works, but it’s not foolproof.

TL;DR: Forget the myths. Be smart with your investments, don’t fall for the hype, and focus on strategies that actually grow your money. And please, stop listening to that one smug friend. You know the one.

Spoiler alert: Balance isn’t just for yogis

It’s not just about income = outcome. You need to know who you owe, how your money grows (or shrinks), and—most importantly—how to make your money work for you, not the other way around.

At the end of the day, money’s just a tool to help you live the life you want, not some evil overlord dictating your every move. So don’t let it stop you from living your best life.

Start small. Pay on time, keep your spending in check, and—please—we beg you, stop letting debt steal the spotlight in your financial soap opera. Because guess who’s winning when you believe these myths? The banks. Always the banks.

Before you go…

Alright, look at you! Ready to hit that shiny new financial milestone, pay off those annoying debts, or maybe even take the leap and invest a chunk of change. Feels good, right? But wait, let’s toss FX rates into the mix—because apparently, life wasn’t complicated enough.

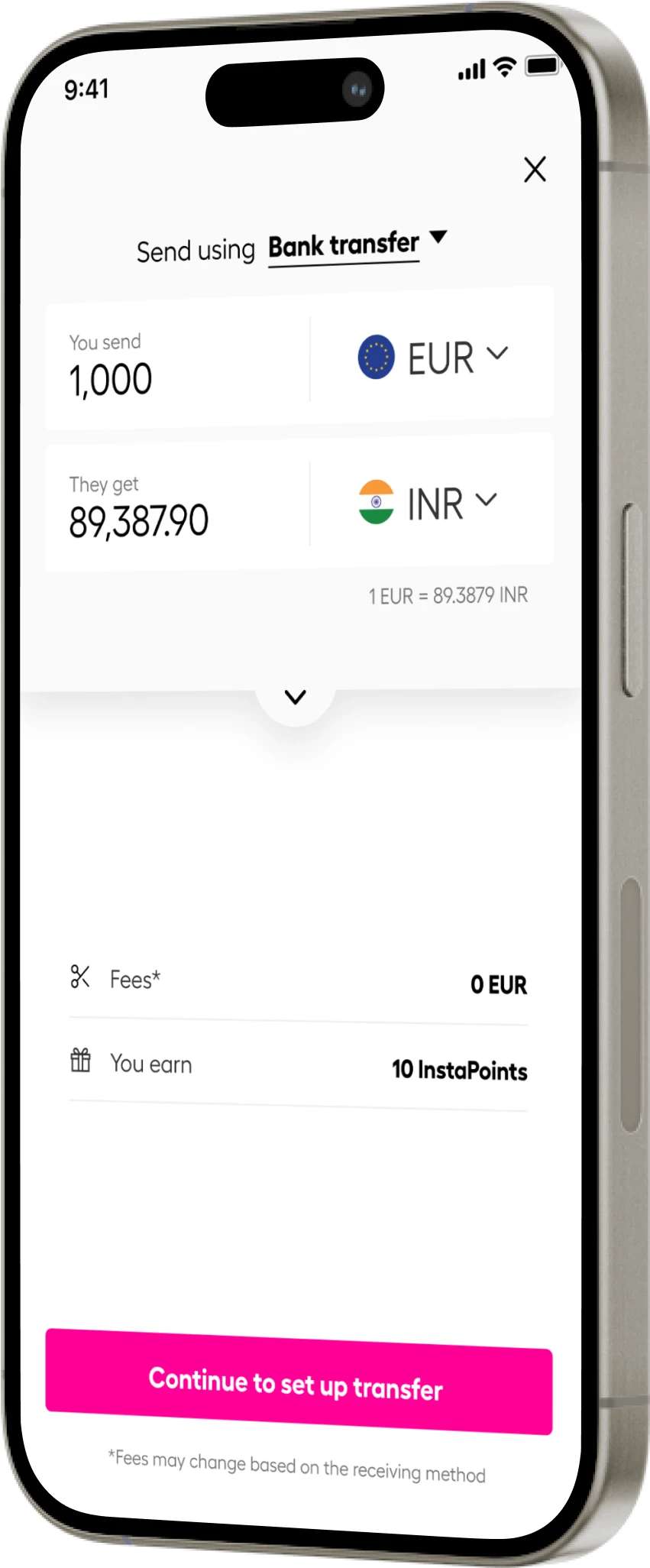

Here’s the deal: At Instarem, we’re here to help without adding to your financial headache.

*rates are for illustration purposes only.

- No hidden fees—because surprise fees are the absolute worst.

- No sneaky markups—we don’t play those games.

- Just great rates—so your money goes where it’s supposed to: your goals, not someone else’s pockets.

Sending large amounts? Easy. With our unbeatable rates, low fees, and stellar support, your transfers are smooth, stress-free, and dare we say… kinda satisfying?

Not working with a big budget? No biggie! You can send money to over 60 countries at super favourable rates—minus the sneaky fees. Download the app or sign up here.

So, whether you’re moving mountains or just pebbles, Instarem’s got your back (and your wallet).

Get the app

Get the app