Money transfer made simple: Options for sending money from Singapore to India

This article covers:

Sending money to India from Singapore has become increasingly important in the interconnected world we live in. Whether it’s for helping out a friend or family member during times of need, or simply supporting them financially, having the ability to transfer funds quickly and easily is essential.

Fortunately, there are several methods for sending money to India including bank transfers, online money transfer services and money transfer agents. Each option comes with its own advantages and disadvantages which should be weighed carefully when deciding on how best to send your funds.

With the right knowledge and understanding of the remittance options from Singapore to India, and how each method works, you can make sure that your hard-earned cash reaches its intended destination safe and sound.

Bank transfer

In today’s globalized world, sending money from one country to another has become a common practice. One of the most popular ways of transferring money is via a bank transfer. This method involves sending funds directly from your bank account in Singapore to your recipient’s bank account in India.

While bank transfers are a secure and reliable way for sending money to India from Singapore, they also come with their own set of advantages and disadvantages.

Advantages of bank transfer

Convenience: One of the biggest advantages of using a bank transfer is its convenience. You can initiate a transfer online or through your bank’s mobile app from the comfort of your own home, without having to visit a physical bank branch. This is especially useful for those who lead busy lives and may not have the time to visit a bank in person.

Security: Bank transfers are a secure and reliable way to transfer money. Your bank’s security measures will ensure that your money is protected during the transfer process, reducing the risk of fraud or theft. Banks use various security measures to protect their customers’ money, such as encryption, two-factor authentication, and transaction monitoring.

Transparency: Bank transfers are a transparent way to transfer money. You will receive a receipt or confirmation from your bank once the transfer has been initiated, which will include details such as the amount transferred, the exchange rate used, and the fees charged. This level of transparency allows you to track your money and ensure that it reaches the intended recipient.

Wide reach: Banks have a wide network of branches and partnerships with other banks, which allows them to transfer money to a wide range of countries and recipients. This means that you can send money to India from Singapore, even if the recipient’s bank is not located in Singapore.

Large transfer limits: Banks often have high transfer limits, which can be useful if you need to transfer a large sum of money. This is especially useful for business transactions or sending money to support family members.

Disadvantages of bank transfer

Cost: One of the main disadvantages of using a bank transfer is the cost. Banks often charge a fee for international money transfers, which can be quite high, especially if you are transferring a large sum of money. Additionally, banks often offer less favourable exchange rates compared to other money transfer options.

Time: Bank transfers can take several days to complete, which may not be suitable if you need to send money urgently. The time it takes to complete the transfer can vary depending on factors such as the countries involved, the banks used, and any intermediary banks involved in the transfer process.

Bank restrictions: Some banks may have restrictions on the amount of money that can be transferred or the countries that they can transfer money to. This can be a problem if you need to transfer a large sum of money or if the recipient’s bank is not supported by your bank.

Hidden fees: In addition to the upfront fees charged by banks for international money transfers, there may be hidden fees involved, such as intermediary bank fees, which can add to the total cost of the transfer.

Exchange rates: Banks often offer less favourable exchange rates compared to other money transfer options, which means that you may receive less money than you expected. It’s important to compare the exchange rates offered by different banks to ensure that you are getting a fair rate.

While bank transfers have advantages such as convenience, security, and wide reach, they also have disadvantages such as high fees, slower transfer times, and less favourable exchange rates that should be considered when deciding on a method to transfer money from Singapore to India.

If you decide that a bank transfer is the best option for you, it’s important to compare the fees and exchange rates offered by different banks. This will ensure that you are getting the best deal for your money. You should also be aware of any hidden fees or restrictions that may apply to your transfer.

Here is a comparison of different banks and their fees for sending money to India:

| Bank | DBS | UOB | OCBC |

| Fees | S$20 | S$30 | S$20-25 |

| Exchange rate (1 SGD → INR) | add a significant margin | add a significant margin | add a significant margin |

| Transfer speed | 1-2 business days | 1-5 business days | 1-2 business days |

| Transfer limit | Varies by account type | Varies by account type | Varies by account type |

Note: The fees and transfer limits may vary depending on the account type and currency of the sender and recipient.

*Info is taken from relevant websites on 27 Apr 2023

When comparing different banks, it’s important to consider not only the fees, but also the exchange rates, transfer speeds, and transfer limits. While some banks may offer lower fees, they may have less favourable exchange rates, which can affect the amount of money received by the recipient.

Additionally, transfer speeds and transfer limits may also vary depending on the bank and account type used. By comparing the fees, exchange rates, transfer speeds, and transfer limits of different banks, you can choose the one that best suits your needs and budget.

If you need to transfer money urgently or if you are looking for the cheapest way to send money to India from Singapore, you may want to consider other money transfer options such as online money transfer services or traditional money transfer agents.

Online money transfer

Online money transfer services have become an increasingly popular way to transfer money from one country to another. With a few clicks of a button, you can send money from Singapore to India using online money transfer services. These services allow you to transfer money quickly and easily, with competitive exchange rates and low fees.

However, like any other financial service, there are advantages and disadvantages to using online money transfer services.

Advantages of online money transfer

Convenience: Online money transfer services provide a convenient way to transfer money from one country to another. You can initiate a transfer from your computer or mobile device at any time, without having to visit a physical location. This is especially useful for those who lead busy lives or live in remote areas.

Speed: Online money transfer services are generally faster than traditional methods of sending money. Many services offer near-instant transfers that can be completed within minutes, while others take a few hours to a few days, depending on the service used and the recipient’s bank.

Competitive exchange rates: Online money transfer services often offer competitive exchange rates, which means that you can transfer more money for your dollar. This can save you money in the long run and ensure that the recipient receives the most money possible.

Low fees: Online money transfer services often have lower fees compared to traditional methods of sending money, such as bank transfers or traditional money transfer agents. This can make online money transfer services an affordable option for sending money to India from Singapore.

Wide range of options: There are many online money transfer services available, each with its own unique features and benefits. This gives you a wide range of options to choose from, ensuring that you can find the best service to suit your needs and budget.

Disadvantages of online money transfer

Security concerns: Online money transfer services require personal and financial information, which can make some users wary about the security of their data. It’s important to choose a reputable service that uses encryption technology and other security measures to protect your information.

Transfer limits: Many online money transfer services have transfer limits, which may be lower than what you need to send. This can be a problem if you need to transfer a large sum of money.

Technical issues: Technical glitches, system maintenance, or internet connectivity issues can affect the speed and reliability of online money transfer services. This can be frustrating for users who need to transfer money urgently.

Hidden fees: Some online money transfer services may have hidden fees, such as fees for using a credit or debit card, or fees for converting currencies. It’s important to read the fine print and understand all fees associated with the transfer.

Limited cash pickup options: While online money transfer services offer convenience and speed, they may not be the best option for recipients who prefer to receive cash. Many services have limited cash pickup options or require the recipient to have a bank account.

While online money transfer services offer many advantages such as convenience, speed, competitive exchange rates, and low fees, they also have some disadvantages such as security concerns, transfer limits, technical issues, hidden fees, and limited cash pickup options that should be taken into account when deciding on a method to transfer money from Singapore to India.

To help you make an informed decision, it’s important to compare different online money transfer services and their fees for sending money to India. Some popular options include Wise, Remitly, Instarem, and Xoom, among others. Each service has its own set of fees, exchange rates, and transfer limits, so it’s important to compare them and choose the one that best suits your needs and budget.

Here is a comparison of money transfer options to India via online money transfer.

| Service | Instarem | Wise | Remitly | Xoom |

| Fees | S$5 | ~S$7 | ~S$4 | The transfer fee is included in the exchange rate quoted |

| Exchange rate (1 SGD → INR) | Close to the mid-market rate | Exchange rates include a markup | Exchange rates include a markup | Exchange rates include a markup |

| Transfer speed | arrive in 24 hours | 2-3 business days | minutes to 5 business days | minutes to 2-3 business days |

| Transfer limit | Varies by country and currency | Varies by country and currency | Varies by country and currency | Varies by country and currency |

*Info is taken from relevant websites on 27 Apr 2023

With the right online money transfer service, you can transfer money to India quickly, easily, and affordably.

Money transfer agents

Money transfer agents are companies or individuals who specialize in transferring money between countries, and they can be found in many locations around Singapore.

Money transfer agents offer a convenient way to send money, with the option for the recipient to pick up cash in India. However, like any other financial service, there are advantages and disadvantages to using money transfer agents. So, if you’re considering using a money transfer agent, read on to learn about the advantages and disadvantages of this traditional method.

Advantages of money transfer agents

Cash pickup option: Money transfer agents provide a cash pickup option for the recipient in India. This can be especially useful for those who don’t have a bank account or prefer to receive cash.

Convenient locations: Money transfer agents can be found in many locations around Singapore, making it easy to find a nearby agent for sending money.

Quick transfers: Money transfer agents offer quick transfer times, with many transfers being completed within minutes to a few hours.

Flexibility: Money transfer agents often have flexible transfer limits, allowing you to transfer smaller or larger amounts of money as needed.

Established network: Many money transfer agents have an established network in India, making it easier for the recipient to receive the money.

Disadvantages of money transfer agents

Higher fees: Money transfer agents typically charge higher fees compared to online money transfer services or bank transfers. This can make it a more expensive option for sending money.

Less competitive exchange rates: Money transfer agents often offer less competitive exchange rates, which means that you may receive less money compared to using other methods.

Limited transfer options: Money transfer agents may have limited transfer options, such as only allowing cash pickups in certain locations or only allowing transfers of certain currencies.

Security concerns: Money transfer agents require personal and financial information, which can make some users wary about the security of their data.

Limited customer support: Money transfer agents may have limited customer support options, which can be a problem if you encounter any issues or have questions about the transfer.

In summary, while money transfer agents offer advantages such as cash pickup options, convenient locations, quick transfers, flexibility, and established networks, they also have some disadvantages such as higher fees, less competitive exchange rates, limited transfer options, security concerns, and limited customer support that should be taken into account when deciding on a method to transfer money from Singapore to India.

Comparing different money transfer agents and their fees for sending money to India is crucial for making an informed decision. Popular money transfer options include Western Union, MoneyGram, and Ria Money Transfer, and each agent has unique fees, exchange rates, and transfer options. By comparing these options, you can choose the agent that best fits your needs and budget.

| Money Transfer Agent | Western Union | MoneyGram | Ria Money Transfer |

| Fees | No transfer fees, but there is an exchange rate margin of around 0.53% | Starts at S$3 | Starts at S$2.89 |

| Exchange rate (1 SGD → INR) | Exchange rate includes markup and varies by payment type | Exchange rate includes markup and varies by payment type | Exchange rate includes markup and varies by payment type |

| Transfer speed | In few minutes | 1 working day | 3-5 working days |

| Transfer limit |

S$5,000 online – higher transfers may be available from some agent locations |

Limits depend on a broad range of circumstances | 999.99 USD per day |

Note: The transfer fee and exchange rate can vary depending on the transfer amount, payment method, and location. Transfer time can also vary depending on the transfer method and location. It’s important to check the latest fees and exchange rates before making a transfer.

*Info is taken from relevant websites on 27 Apr 2023

In a nutshell, there are several methods for sending money to India, each with its own perks and quirks.

Bank transfers offer safety and dependability, but they can be a bit of a pain in the wallet and take a while to get the job done.

Online money transfer services are fast, convenient, and easy on the wallet, but some folks worry about security and there might be tech glitches to contend with.

Money transfer agents are a bit more old-school, but they offer the classic option of cash pickup and often have an established network in India. However, the fees can be a bit higher and you might not get the best exchange rates.

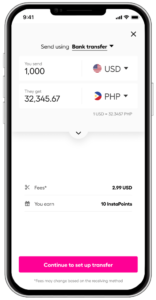

Consider Instarem

Instarem may be the best way to transfer money from Singapore to India. Our exchange rates are top-notch, the fees are low, and we don’t waste any time getting your money to India. Plus, our customer service is fantastic and our platform is super user-friendly.

*rates are for illustration purposes only.

But no matter which method you choose, always make sure to do your homework and compare fees, exchange rates, and security features. It’s also crucial to make sure you have accurate recipient details and use a reputable service to avoid any hiccups or headaches.

At the end of the day, sending money from Singapore to India can be a breeze if you use the right method and take the necessary precautions. So, go ahead and give it a shot – you’ll be sending money to your loved ones in no time!

Download the app or sign up on the web and see how easy it is to send money with Instarem.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app