Optimise Your Business Cash Flow With Instarem BizPay

This article covers:

Businesses around the world have been hit hard by the COVID-19 crisis. With operations coming to a grinding halt across several sectors, many companies are reeling under the effects of reduced demand, supply chain interruptions and economic uncertainty.

These challenges are more pronounced for small and medium businesses (SMBs) which have always grappled with short-term cash flow and debt exposure concerns irrespective of the pandemic.

Even as the world prepares to get back to the ‘new normal’, many businesses will not be able to operate at their usual capacity for quite some time to come. They, therefore, must reassess their approach and explore innovative solutions to navigate the ‘new normal.’ Instarem BizPay is one such novel platform for businesses to boost their cash flow. SMBs can now leverage this service to generate funds by utilising their unused corporate card credit limit.

Surviving The Cash Crunch

Securing loans or credit has never been easy for SMBs — the absence of a stable and profitable portfolio is seen as a drawback by banks and financial institutions. Even before the pandemic, 61% of SMBs in Singapore held low credit standings [1] and not more than 15% of SMBs in fast-growing economies had access to the credit they required.

[2] The additional delays in payments induced by the pandemic have only aggravated this paucity of capital. [3] While businesses may look to card-based payments to extend payment terms, the high transaction fees and FX markup act as a deterrent for payers as well as the beneficiaries.

Optimising Credit Lines With BizPay

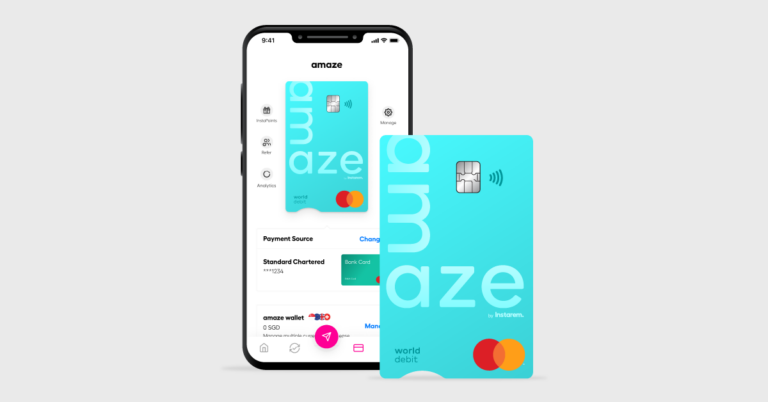

Instarem’s new service, BizPay, is a unique solution that addresses cash flow challenges, by turning corporate credit cards into a funding source, without even a bank application. It enables businesses to convert unused corporate credit card limits into cash flow for their business without any interest for up to 55 days*.

The unutilised credit card limit can be converted to working capital and used to pay local and international vendors, including those who do not accept card payments. It enables businesses to pay salaries, rent, utility bills, suppliers and other business expenses, while saving on expensive FX conversion charges on international transfers. What’s great is that there is no need for the beneficiary to accept cards or to be onboarded as part of the payment process. Once a credit card is added as a payment source, payments can be made to any corporate entity, across multiple geographies.

Even borrowing becomes simpler with BizPay. SMBs can save up to 0.75% on borrowing costs and processing fee charges using their cards.**

Win-Win Situation For Businesses & Banks

At a time when optimisation of resources is the key to survival, the opportunity to boost cash flow using existing resources is invaluable. Most companies have an existing corporate credit card system that is used only for travel and expenses. With the virus bringing travel and business entertainment to a standstill, BizPay gives businesses a chance to utilise their credit lines optimally, while also creating a differentiated value for banks and financial institutions looking to generate usage of their corporate credit cards.

For business entities around the globe, surviving the pandemic isn’t the only challenge; sustaining thereafter is a prospect they must prepare for. At a time when declining cash flow is going to be a mainstay for businesses, Instarem’s BizPay could give businesses the edge they need to survive in the post-pandemic world.

To know more, visit:

SG: https://www.instarem.com/en-sg/business/

AU: https://www.instarem.com/en-au/business/

*Actual number of days available may vary across card-issuing banks

**Savings calculation based on the assumption that your current cost of funding is at 5% p.a. and that you utilize maximum card credit period of 55 days available from your bank.

Get the app

Get the app