This article covers:

- The financial trade-offs: It’s not just about the paycheck

- Quality of Life: Where a pay cut starts to feel like a bargain

- Dollars, hours, and happiness: Let’s do the math!

- What kind of expat are you? (find your tribe!)

- Career growth: Play the long game

- Does this move align with your big life goals?

- Sometimes, you don’t have to go far to make a big change

- The bottom line: It’s your call

- Before you go…

Ah, the thrill of moving abroad! New adventures, fresh culture, career growth, and that oh-so-coveted better quality of life. But let’s not sugarcoat it: reality often smacks you right in the face when the financial picture rolls in. Salaries might dip, costs might spike, and suddenly, that pay cut you’re eyeing becomes a real trade-off for those lifestyle dreams.

And let’s be honest, if you’ve ever asked yourself, “Should I really take this pay cut to move abroad?”, you’re not alone. A quick scroll through expat forums will give you a buffet of mixed opinions. Some say, “Do it for the experience!”, while others will sternly remind you that “Only money will never let you down”.

At the heart of it, this isn’t just about crunching numbers— it’s about you trying to imagine all the possible scenarios with minimal risk of failure. So, if that golden expat offer has you excited but a little twitchy about the paycheck, let’s break it down.

Here’s when it actually makes sense to take a pay cut for expat life.

The financial trade-offs: It’s not just about the paycheck

Cost of Living vs. Pay Differences

What’s the first thing we all do when we see that shiny offer? Compare salaries, right? “Oh no, this is way less than what I make now!” But here’s the truth: it’s not an apples-to-apples comparison.

Expat salaries are usually based on local market rates, not your cushy home-country paycheck.

Example: Earning $88K in Korea might give you the same quality of life as earning $130K in the U.S.

Spoiler alert: It’s not just about cost of living—it’s about market pay as well.

The “Set-Up” Shock: It costs more than you think

Let’s get real—moving abroad will burn a hole in your wallet faster than you can say “furniture deposit.”

Housing deposits, buying furniture, visa fees, transportation, and don’t forget lifestyle adjustments.

Oh, and those sneaky costs you didn’t think of—like converting your savings to the new currency or language classes to figure out what the heck “Wasser” means.

You need a solid financial buffer to float these costs. Otherwise, those first few months might have you sweating bullets.

Taxes and benefits: Blessing or pinch?

Moving from a low-tax country to a high-tax one? Oof, you’re going to feel it. But wait—before you freak out, remember where those taxes go:

- Universal healthcare?

- Paid parental leave?

- Loads of paid time off?

Sure, your take-home pay and savings might take a hit, but you’ll gain a safety net that’s chef’s kiss.

Pro Tip: Don’t forget to calculate your annual leave. More holidays = better life balance.

Quality of Life: Where a pay cut starts to feel like a bargain

Work-Life Balance: You Deserve to “Turn Off”

If you’re tired of endless emails at midnight and proving you’re “always on,” a country with better work-life balance could be your saving grace.

Europe, for instance, is famous for:

- Shorter working hours

- 21+ days of vacation

- One-month summer breaks? Yes, please!

- And—get this—it’s illegal to email you after hours in some countries.

Slow work pace? Maybe. But you’ll actually have time to live—not just survive.

Your mental and physical health deserves better

Stress can knock you flat—physically and mentally. And no paycheck can make up for burnout.

Living in a walkable city with parks and fresh produce? Yes.

Affordable healthcare without fearing bankruptcy? Sign me up.

Time to cook, relax, and breathe? Priceless.

Sometimes, a lower salary buys you a healthier, happier version of yourself. That’s worth every penny.

Lifestyle priorities: Your life stage changes the equation

The pay cut decision depends a lot on you—where you are in life:

- Single? You’ve got flexibility to chase experiences and start fresh if things flop.

- Attached? Is your partner on board to move or do long-distance? Relationships are part of the cost equation.

- Married or with kids? Loans, childcare, education—these priorities might mean you can’t afford to take the hit.

Wherever you are, lifestyle factors can outweigh the paycheck. It’s not just numbers—it’s your happiness.

Dollars, hours, and happiness: Let’s do the math!

So, you’re staring at that job offer abroad and wondering, “Is this pay cut worth it?” Here’s a quick hack: do the Hourly Rate Reality Check.

Take your new salary, divide it by your expected working hours, and BAM—you’ll see what you’re actually earning per hour.

Fewer hours + lower salary? The trade-off might be smaller than it looks.

Overworked and underpaid right now? A little pay cut for fewer hours could actually improve your hourly rate—and your sanity.

But hey, life isn’t just about numbers, right? Maybe you’re at that stage where:

- You’re hustling now for those big bucks to take a breather later.

- You’re craving time to heal, travel, or focus on your mental health.

- You want your kids to have better education or simply need more family time.

No matter where you are, the trade-off has to make sense for your happiness, not just your bank account.

What kind of expat are you? (find your tribe!)

Not all expats are created equal—there’s a type for everyone! So, where do you fit?

The short-term adventurers (1-3 Years)

You’re in it for the thrill: new culture, career boost, and a killer adventure story. If it doesn’t work out? No worries—you can hop back home and pretend it never happened.

The comfortable middle (5+ Years)

You’ve settled in, mastered the basics of expat life, and the ups and downs no longer faze you. Pay cut? Meh, you’ve got savings and stability to ride the wave.

The long-haul settlers (10+ Years)

You’re not “expat-ing”—this is just home. You know the language, the customs, the best grocery stores, and you’re too integrated for a pay cut to shake your roots.

See? Whether you’re testing the waters or going all-in, there’s a version of expat life for you.

Career growth: Play the long game

Here’s the thing about pay cuts: sometimes they’re stepping stones. That new role might be a huge career shift—more learning, more challenges, and way better prospects down the line.

But be careful:

Add career adjustment + culture shock + language barriers? That’s a lot of spinning plates.

- Promised promotions? They’re great… when they actually happen. If that “future pay bump” isn’t in writing, don’t bank on it.

If the risks stack up too high, the payoff might not feel worth it. But hey, even if you misstep, you can always find another job in your new country—expat life is unpredictable, but sometimes unpredictability is part of the fun.

Does this move align with your big life goals?

Everything we’ve discussed so far ties back to this: what do you actually want?

It’s not just about dollars and cents—it’s about your life vision.

Short-term vs. long-term plans

Are you dipping your toes into expat life for 1-3 years, just to check off the “cool adventure” box? If so, a pay cut might be worth the experience alone.

If you’re in it for the long haul, though, the equation changes:

- Savings goals

- Buying a house

- Starting a family

In that case, financial security starts to matter more—and that pay cut needs to fit your long-term plan.

Living abroad vs. travelling abroad

Let’s be real: living abroad ≠ vacationing abroad.

Daily life means adapting to a new culture, not just sightseeing.

BUT, if you have more time off and cheaper travel options, imagine the adventures you’ll have exploring nearby countries!

Sometimes, those experiences can be worth more than a fatter paycheck.

Retirement and Savings

If you’ve got your finances sorted—like a cozy retirement fund or savings that let you sleep easy—you might see that pay cut as a trade-off for:

- Lower stress

- More time for yourself

- A lifestyle you actually enjoy

Because at the end of the day, happiness doesn’t always have a dollar sign attached.

Sometimes, you don’t have to go far to make a big change

Here’s a little secret: you don’t need to cross oceans to shake up your life.

Think about it—would you expect the same paycheck in Manhattan and Chicago? Nope! And here’s why:

- Cost of living in Chicago is 52% cheaper!

- $130K in New York City feels a lot like $62K in the Windy City. Same quality of life, way less stress on your wallet.

By simply moving cities instead of countries, you can dodge some of the big expat headaches:

- Visa stress? Nope.

- Language barriers? Pass.

- Culture shock? Minimal—we’re still talking deep-dish pizza vs. bagels here.

Think of it as a mini move before your big move abroad. You get the benefits of a new adventure with fewer bumps along the way. Who says you have to leave the country to shake things up?

Sometimes, going just far enough is all you need to recharge, reset, and get ready for your next chapter—whether that’s across the state or across the globe!

The bottom line: It’s your call

There’s no “right” answer here. Whether you’re chasing a better lifestyle, career growth, or a personal dream, a pay cut can still be a step forward—if you see it as an investment in yourself.

Moving abroad isn’t just a financial decision. It’s about:

- Prioritising your happiness

- Building a life that aligns with your goals

- Creating memories and experiences that money can’t buy

So, if you can float the finances and that new life promises balance, fulfilment, and growth, don’t let a smaller paycheck hold you back.

Sometimes, a little less money buys you a whole lot more life. Ready to trade dollars for happiness? Go for it! Because this might just be the best investment you’ll ever make.

Before you go…

Let’s be real—moving abroad is a huge life move. And if you’re taking a pay cut, every dollar (or euro, yen, or peso) counts, especially when sending money back home to your loved ones.

But here’s the thing: moving money doesn’t have to be as stressful as moving your life.

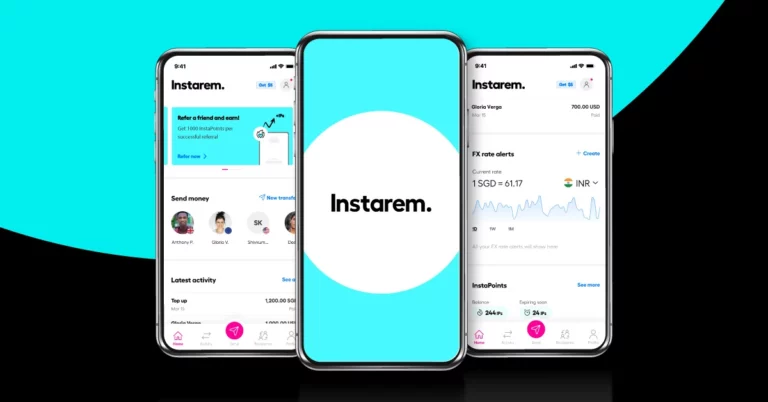

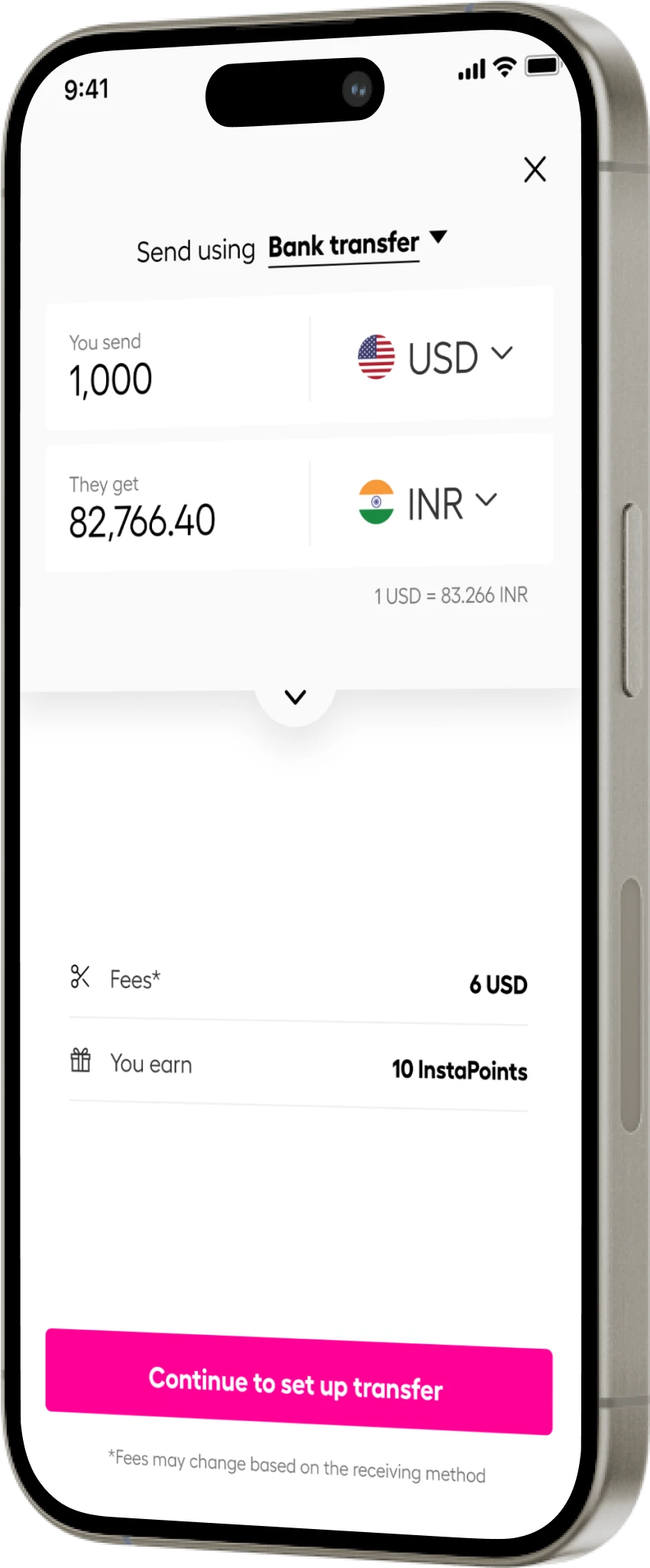

Enter Instarem—your new best friend for zipping money across borders. No matter where your friends or family are, Instarem makes sending and receiving money a total breeze.

*rates are for illustration purposes only.

Here’s why it’s a no-brainer:

- Better exchange rates—more bang for your hard-earned buck.

- Lower fees—because every penny saved is a win.

- Real-time tracking—know where your money is at all times. (No more nail-biting!)

So why not give it a whirl? Moving abroad is exciting—sending money home should be, too.

Get the app

Get the app