Podcast: How Using Your Credit Card As A Tool For Cash Flow Can Help Your Business

This article covers:

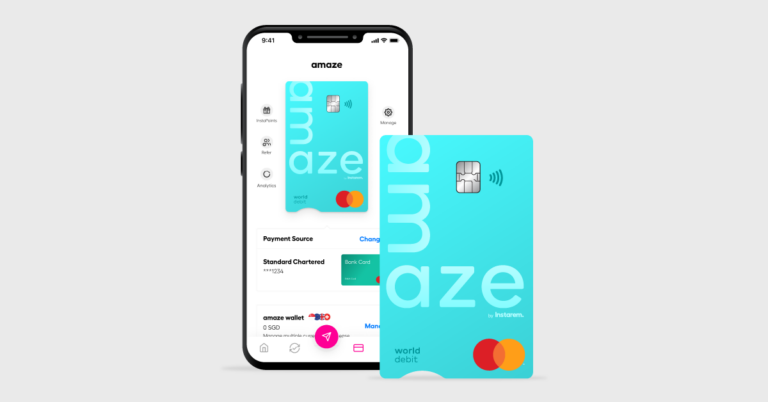

When you run your own business, you have a lot on your mind. And maintaining positive cash flow is one such worry that keeps business owners up at night. But not anymore! Instarem’s BizPay is a unique solution that helps small and medium businesses convert their existing credit card limit into working capital, to make local and cross-border supplier payments.

So, how exactly does Instarem BizPay work? Nium’s Global Head of Commercial Payments, Sanjiv Razdan, explains it all in this interview with Taneia Bhardwaj, Content Head & Thought Leader – SME at Nium. Listen to the podcast above or listen on Spotify, Breaker or Pocket Casts.

Here’s an excerpt from the interview:

Taneia Bhardwaj: What problem does Instarem BizPay try to solve?

Sanjiv Razdan: Businesses have a host of expenses such as payroll, rent, tax, insurance, utility bills and supplier invoices. Instarem BizPay enables businesses to tap into the unused credit card limit to pay off these expenses.

One of the biggest problems that businesses face with using a credit card for business expenses is low acceptance from suppliers for card-based payments.

Reason: Credit card payments often come with processing fees that suppliers are reluctant to bear. Besides, even if the suppliers are willing to move to a card-based payment platform, setting it up can be quite laborious.

Businesses too have to bear additional costs on exchange rates and fees when it comes to cross-border payments.

What Instarem BizPay is trying to do is expand the usage of credit cards beyond travel and entertainment. Our platform enables a business owner to use their corporate credit card to pay their suppliers, including the ones who do not accept credit card payments.

Here’s a quick look at how Instarem BizPay benefits small and medium businesses:

To know more, visit

SG: https://www.instarem.com/en-sg/business/

Get the app

Get the app