Sending money to the Philippines? Your guide to cashing out money in the Philippines

This article covers:

Working abroad as an Overseas Foreign Worker (OFW) is a tough choice that many Filipinos make for the benefit of their families. Sending money back home provides a way to improve their standard of living, but it can be challenging if your loved ones don’t have a bank account in the Philippines.

To face this challenge, Instarem has introduced cash pick-up services in the Philippines, making it convenient for Filipino customers to send and receive money in the Philippines from anywhere in the world.

If you’re new to Instarem’s remittance services, this blog will reveal everything you need to know about sending and receiving money in the Philippines including a step-by-step guide to ensure ease and convenience every step of the way.

- Send money to Philippines

- Receive money in Philippines

Send money to Philippines

As a first step, simply download the Instarem app and sign up for an account. It’s totally free and only takes a few minutes. The online verification process available in some countries, like Singpass in Singapore, makes the process even faster without the need to upload any verification documents.

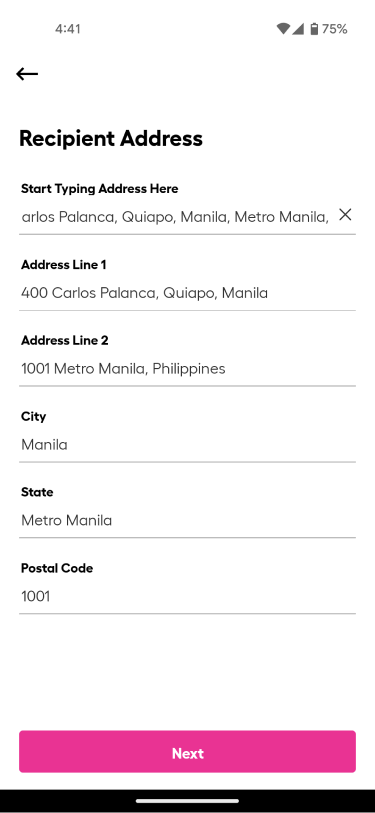

Once you have completed the registration process, add a recipient (to who you would like to send money) including the following details:

- Fill in your recipient’s name and phone number. Make sure that the name matches their ID (exactly) and that their number is accurate.

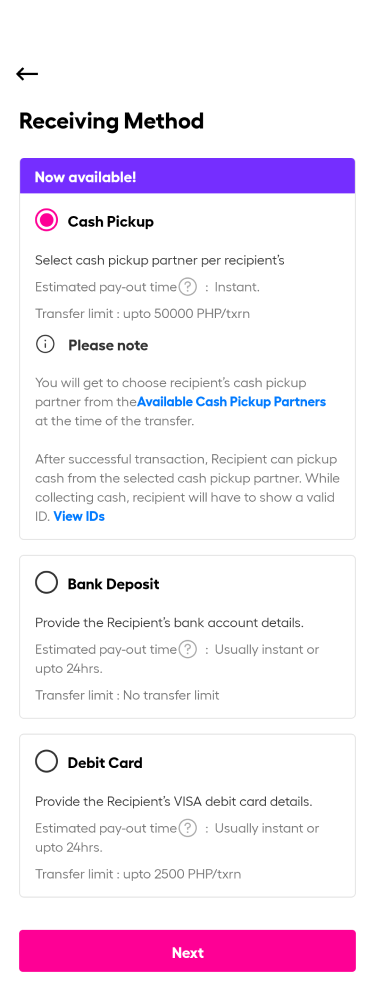

- Choose “Cash Pick Up” as their receiving method

- Input their address

Make your first transfer to the Philippines

Now that you are done with your recipient’s info, it’s time to set up a transaction!

- Go to ‘Send’

- Select your recipient (the one you just set up)

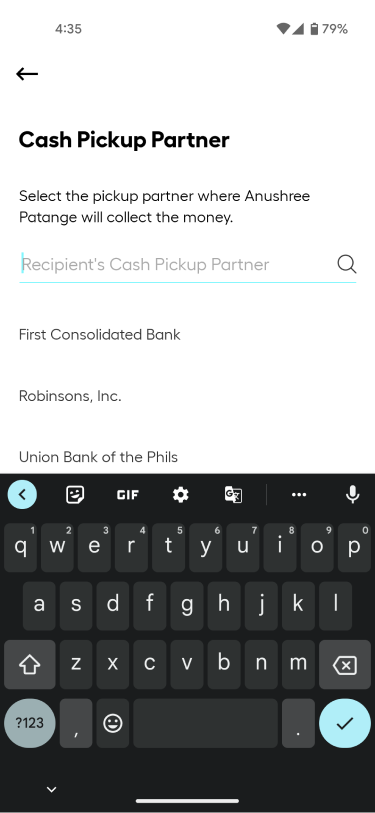

- Select your recipient’s location for picking up the money.

The options available for cash pick up are:

|

Cash collection partners |

Branch locators |

|---|---|

|

Bank of the Philippine Islands (BPI) |

|

|

Cebuana Lhuillier |

|

|

LBC |

|

|

M Lhuillier |

|

|

Palawan Pawnshop & Palawan Express Pera Pedala Outlets |

|

|

PeraHub |

The recipient can collect the funds at BPI branches from 9:00 am to 4:30 pm, Monday to Friday.

Other cash pick-up partner outlets extend their services until 7:00 pm on both weekdays and weekends, excluding public holidays.

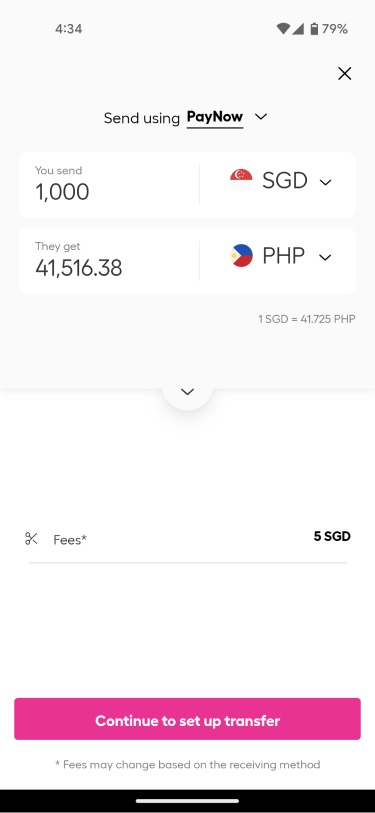

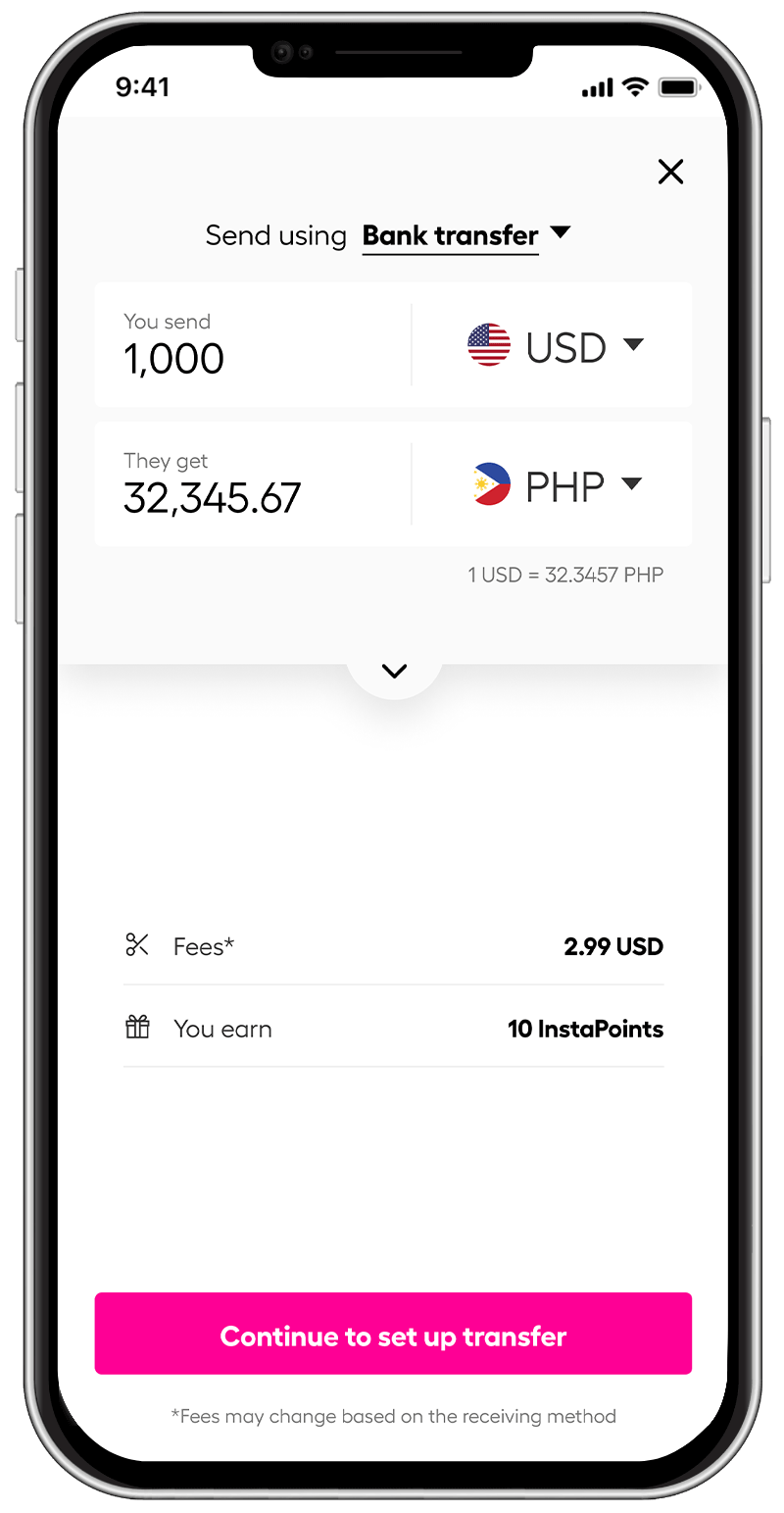

4. Choose your funding method (this is how you pay for your transfer) and input the amount* you want to send.

*rates are for display purposes

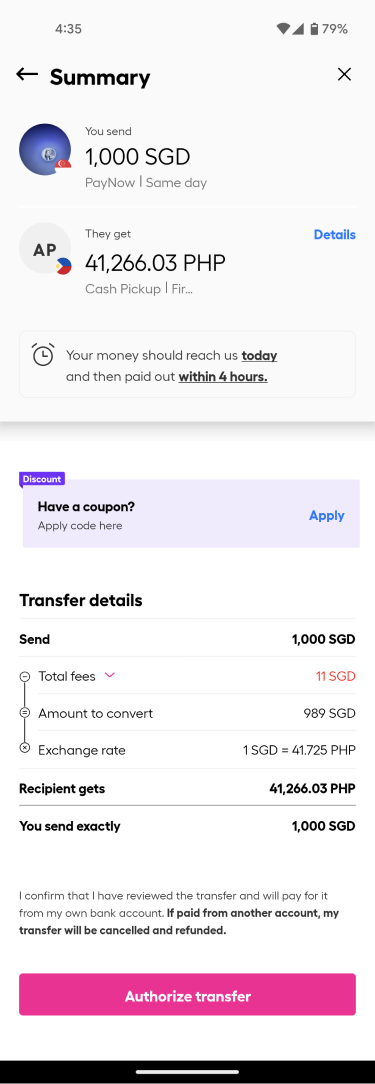

5. Confirm your transaction details and authorise the transaction

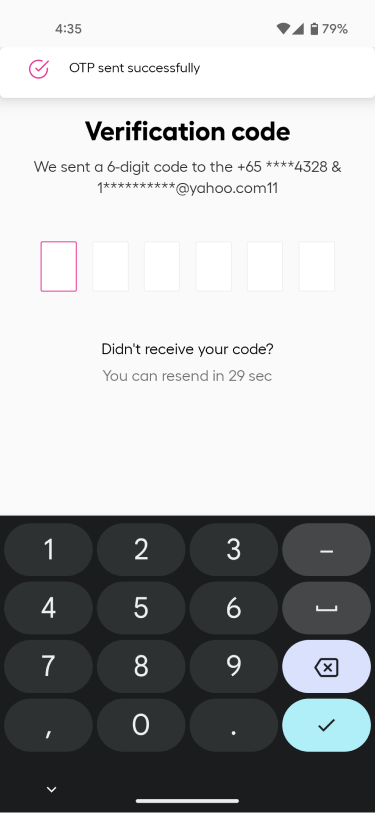

6. Key in the verification code sent to you, and… you are done!

It’s that simple!

**The maximum amount your recipient can receive through cash pick up in the Philippines is 50,000 PHP.

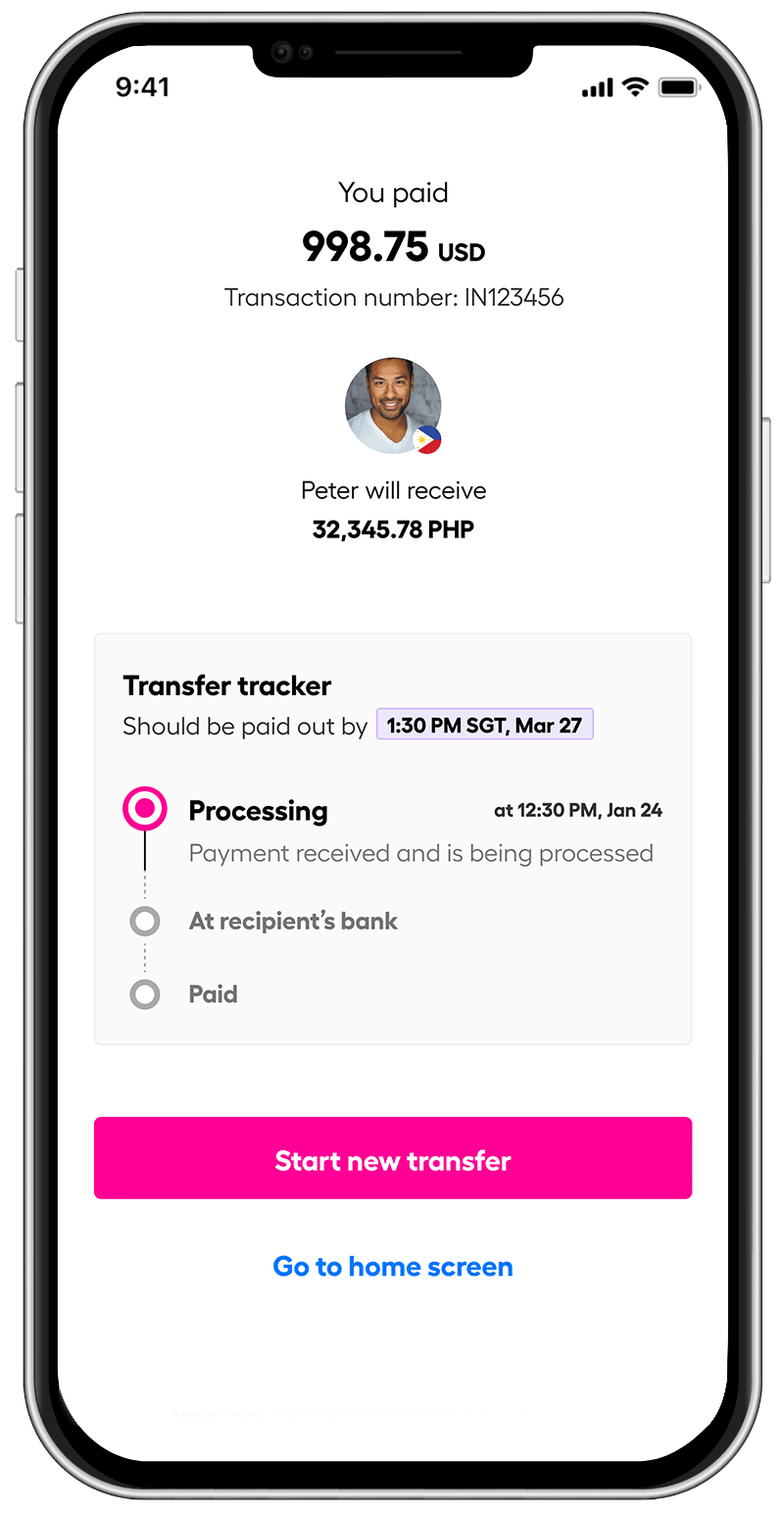

Enjoy peace of mind with Instarem’s transaction timeline

Sending money to your loved ones can be an anxious experience. We understand. That’s why with Instarem’s transaction timeline, you can track your transaction every step of the way.

Instarem’s process is simple and intuitive with funds usually available within 2-3 business days*** for collection. We also keep both you and your recipient informed via email or app notifications, every step of the way.

Once your transaction is successful, we’ll notify you that the money is ready for cash out. You can then let your recipient know the transaction ID and location for them to pick up the cash.

***In some instances, however, we may require additional information from you for your transaction to be processed.

Receive money in Philippines – Guide to cash out your money

Now that you have seen how simple it is to send money to the Philippines, let’s see how your recipient picks up the cash.

When it’s time for cash collection, we’ll send your recipient an email notification. They will be informed about the location, transaction ID and any other additional information they’ll need for a quick and simple cash pick-up.

Getting ready to cash out

All your recipient needs to do is show up at the designated location you selected when you set up the transfer with two things:

- Valid photo ID:

- Phil ID and/or e-Phil ID

- Driver’s License issued by LTO

- Government Service Insurance System (GSIS) ID

- MARINA ID

- Overseas Filipino Worker (OFW) ID

- Overseas Workers Welfare Administration (OWWA) ID

- Pag-IBIG ID (with photo)

- Passport

- Person With Disability (PWD) ID issued by NCDA

- PhilHealth ID (with photo)

- Professional Regulation Commission (PRC) ID

- Senior Citizen ID

- Social Security System (SSS) ID

- Tax Identification Number (TIN) ID

- Unified Multi-Purpose ID

- Voter’s ID

- National Bureau of Investigation (NBI) Clearance

- Police Clearance Certificate

- Postal ID

- Barangay Certification

- Armed Forces of the Philippines (AFP) ID

- Home Development Mutual Fund (HDMF) ID

- Certification from the National Council for the Welfare of Disabled Persons (NCWDP)

- Department of Social Welfare and Development (DSWD) Certification

- Integrated Bar of the Philippines ID

- Company ID issued by private entities or institutions registered with or supervised or regulated either by the BSP, SEC, or IC

- Seaman’s Book and Seafarer’s Registration Certificate

- Alien Certification of Registration/Immigrant Certificate of Registration

- The transaction ID: You can find it in the email that was sent to you.

What if my recipient can’t go and pick up the cash immediately? Don’t panic!

Life is unpredictable and sometimes, it can get really busy. Don’t worry, Your money is in safe hands and won’t go anywhere.

Your recipient has 00 days to pick up the money. And if your recipient can’t pick up the cash by then either, you will receive your money back.

Why Instarem is the best option to send money to Philippines?

Are you still on the fence about using Instarem to send money to the Philippines? Here are some compelling reasons why we truly believe it’s the best option out there.

***Low fees and great exchange rates

When it comes to transferring money overseas, it’s natural to feel concerned about the potentially high fees and unfavourable exchange rates. They can quickly eat up your savings.

With Instarem, you get significantly low fees and highly competitive exchange rates, with a very minimal markup or close to the actual exchange rate you see on Google.

Know exactly what you’re paying

*rates are for display purposes only.

With upfront pricing, you can rest easy knowing that all fees are disclosed before you make a transfer. This means that you won’t be blindsided by hidden charges or surprises when you send money. It’s also easy to calculate the total cost of your transaction, including the exchange rate and fees, so you can be sure exactly how much your recipient will receive.

Safe and secure transfer

When it comes to online financial transactions, security is of the utmost importance. And at Instarem, we don’t take that lightly. In fact, we’re regulated by not one, but nine financial regulators around the world – ensuring that we abide by all the necessary rules and regulations.

We understand that your peace of mind is directly linked to the safety of your funds, which is why we pull out all the stops to protect them. From real-time fraud prevention measures to state-of-the-art encryption and security protocols, we ensure that your transactions are safeguarded.

Earn rewards and save more

Not only do we offer low fees and safe transfers, we also reward our users with every transaction through our InstaPoints programme. The higher the transaction amount, the more points you’ll earn, which can then be redeemed for discounts on future transactions. It’s like getting a bonus on top of an already great service!

****Fees are dependent on the funding method.

Ready to send money?

Try Instarem for your next transfer.

Download the app or sign up on the web now!

Get the app

Get the app