Remittances: How Much Money Do Migrants Send Home

This article covers:

Migrant workers have always sent money home to support family and friends. But in recent years, these remittances, as they are known, have reached record highs.

What is a remittance?

A remittance is a transfer of money by a foreign worker to their home country. These peer-to-peer transfers of funds across boarders are important for the global economy, especially for the developing countries that receive them.

For millions of families globally, remittances are the only source of income, which helps them to get necessities as well as access to health care and education. If these remittances were to dramatically slow, then families in many developing countries of the world would face serious challenges, thus reducing the overall quality of life.

We have used the World Bank’s new estimates (April 2018) to visualise the true size and direction of global remittance flows.

In each of the moving Gifs below, the red arrows show where the money goes, and the green arrows show where the money comes from.

Australia

Australia – According to the World Bank estimates, remittances from Australia could be worth US$ 16 bn – including US$2,922 mn to China, US$ 1,944 mn to India, US$ 1,182 mn to Vietnam, US$ 1,084 mn to the UK and US$ 1,002 mn to the Philippines.

The biggest senders of remittances to Australia are the UK (US$ 446 mn), United States (US$ 289 mn), New Zealand (US$ 248 mn), Canada (US$ 98 mn) and Italy (US$ 84 mn).

United Kingdom

The UK – The World Bank estimates that the true size of flows from the UK is close to US$ 26,801 million. This would make the UK the fourth largest source of remittances, after the US, Saudi Arabia and the United Arab Emirates.

The bank estimates, in 2017, the UK sent US$ 4,119 million in remittances to Nigeria, US$ 3,941 million to India, US$ 1,782 million to France, US$ 1,689 million to Pakistan and US$ 1,258 to Germany.

The biggest senders of remittances to the UK are, Australia (US$ 1,084 mn), United States (US$ 658 mn), Canada (US$ 569 mn), Spain (US$ 322 mn) and South Africa (US$ 256 mn).

India

India – In 2017, the remittances from India totalled US$ 5,710 million. The bulk of this went to Bangladesh (US$ 4,033 mn), followed by Nepal (US$ 1,021 mn), Sri Lanka (US$ 520 mn), China (US$ 41 mn) and France (US$ 15 mn).

India is the largest receiver of remittances in the world, receiving a total of US$ 68,968 million. The biggest senders of these remittances shown with green arrows are thought to be the UAE (US$ 13,823 mn), US (US$ 11,715 mn), Saudi Arabia (US$ 11,239 mn), Kuwait (US$ 4,587 mn) and Qatar (US$ 4,143 mn).

China

China – According to the WB estimates, in 2017, China sent high remittances to Philippines (US$ 536 mn), South Korea (US$ 523 mn), Japan (US$ 295 mn), France (US$ 193 mn) and Brazil (US$ 156 mn).

China is the second largest receiver of remittances, after India, receiving a total of US$ 63,860 million. The biggest senders of China remittances are the US (US$ 16,141 mn), Hong Kong (US$ 15,548 mn), Japan (US$ 4,238 mn), Canada (US$ 4,144 mn) and South Korea (US$ 4,144 mn).

United States

United States – The US is home to the largest number of migrants from developing countries and is the largest sender of remittances in the world.

The biggest recipients of US remittances in 2017 are Mexico (US$ 30,019 mn), China (US$ 16,141 mn), India (US$ 11,715 mn), Philippines (US$ 11,099 mn) and Vietnam (US$ 7,735 mn).

The biggest senders of remittances to the US are Mexico (US$ 1,774 mn), Canada (US$ 662 mn), UK (US$ 465 mn), Puerto Rico (US$ 395 mn) and Germany (US$ 307 mn).

Germany

Germany – In 2017, Germany was estimated to be the fifth largest source of remittances, after the US, Saudi Arabia, United Arab Emirates and the UK.

The biggest recipients of Germany remittances in 2017 are France (US$ 2,124 mn), Poland (US$ 2,117 mn), Italy (US$ 1,310 mn), Austria (US$ 1,102 mn) and Czech Republic (US$ 1,034 mn).

The US (US$ 2,801 mn), Turkey (US$ 1,637 mn), Switzerland (US$ 1,480 mn), the UK (US$ 1,258 mn) and France (US$ 962 mn) were the biggest senders of remittances to Germany.

Malaysia

Malaysia – In 2017, Indonesia (US$ 2,152 mn), Philippines (US$ 1,962 mn), Thailand (US$ 586 mn), China (US$ 335 mn) and India (US$ 287 mn) were the biggest recipients of remittances from Malaysia.

The biggest senders of Malaysia remittances were Singapore (US$ 1,051 mn), Bangladesh (US$ 202 mn), Australia (US$ 136 mn), the US (US$ 62 mn) and the UK (US$ 24 mn).

Vietnam

Vietnam – In 2017, the biggest recipients of remittances from Vietnam were China (US$ 49 mn), Indonesia (US$ 14 mn), India (US$ 6 mn), Japan (US$ 3 mn) and Belgium (US$ 3 mn).

On the flip side, Vietnam is one of the largest recipients of remittances. Those sending remittances to Vietnam include the US (US$ 7,735 mn), Australia (US$ 1,182 mn), Canada (US$ 953 mn), Germany (US$ 748 mn) and France (US$ 655 mn).

Singapore

In 2017, Singapore sent remittances to China (US$ 2,763 mn), Malaysia (US$ 1,051 mn), India (US$ 886 mn), Pakistan (US$ 528 mn) and Indonesia (US$ 380 mn).

Unfortunately, the World Bank estimates don’t show the inflow amounts for Singapore.

The top 5 remittance receiving countries are India (US$ 68 billion), China (US$ 63 billion), Philippines (US$ 32 billion), Mexico (US$ 30 billion) and France (US$ 25 billion).

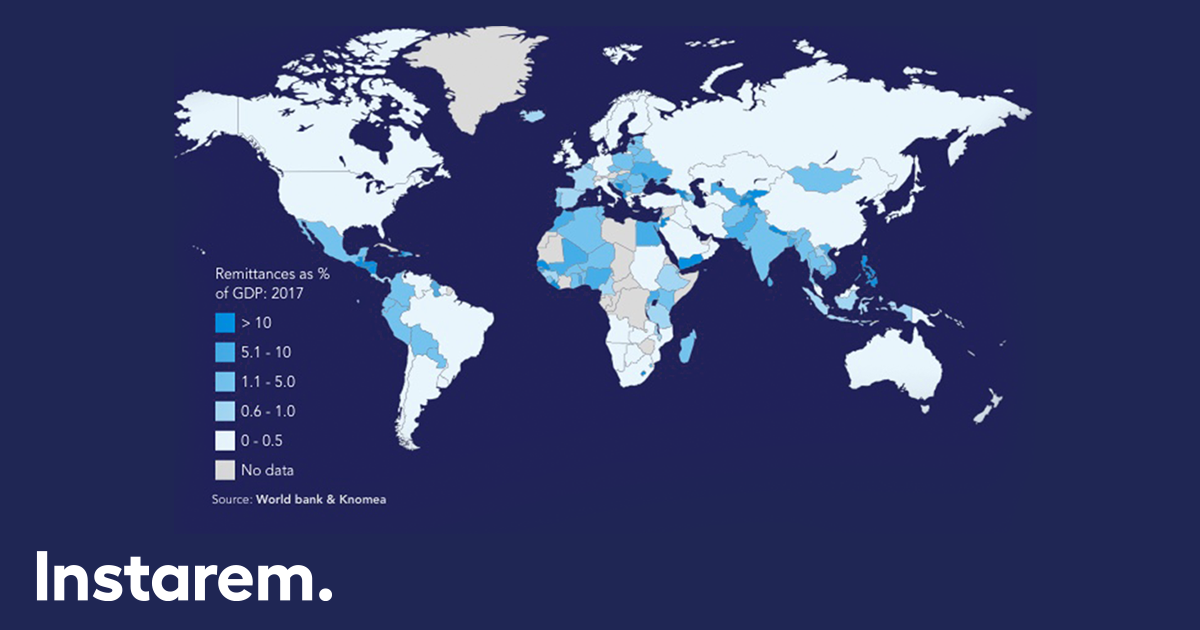

However, as a share of GDP (gross domestic product) for 2018, the top 5 recipients are smaller countries:

- The Kyrgyz Republic 35%

- Tonga 33%

- Tajikistan 31%

- Haiti 29%

- Nepal 29%

The world average of remittance as a percentage of GDPs is 0.72%, indicating that total remittance flow has a negligible role in terms of global GDP. However, the economies of low-GDP countries in Central Europe like the Kyrgyz Republic and Tajikistan are dependent on remittances from labour migrants and would find it difficult to manage without remittances. Tonga, Haiti and Nepal are some other countries that are also heavily dependent on remittances, which make up for more than a quarter of their GDPs.

Sources:

Remittance outflows and inflows World Bank

GDP prices Knoema

Tracking remittances worldwide is difficult because many countries do not track funds that are sent or received. The World Bank makes these estimates from using data from formal channels such as banks and other businesses that transfer money.