Best way to send money (domestic and cross border)

This article covers:

The rise of digital banking apps and services has made sending money quickly to friends and family easier than ever. With an abundance of digital payment options available, choosing the best way to send money domestically and across borders can be a little tricky. In this article, we will look into the numerous money transfer services, at their fees, accessibility, payment method, and time for delivery.

Ways to send money domestically

1. PayPal

Perhaps the most popular online payment system that is vastly used by shoppers and business owners. Besides operating as a payment processor for online vendors and many other commercial users, it has been widely used to send money to friends and family members when needed. All you need to do is sign up for a free account and then link to a bank account or payment card. Sending money is made extremely easy when you only need the receiver’s email address or phone number.

Fees: it is free to send money to a PayPal account but there are fees applied for withdrawing/ transferring to bank account and cards.

Transaction limits: You can transfer up to $10,000 in a PayPal transaction, or up to $60,000 for verified accounts.

Transfer time: Typically instant.

2. Venmo

Venmo is a mobile payment service founded in 2009 and owned by Paypal since 2012. Venmo was created with the aim to let friends and family split bills with the ease of transferring funds between the Venmo apps. Signing up is easy as it only requires basic information and bank account information. Users with the Venmo app can easily transfer the balance to their linked bank accounts, debit cards, or credit cards.

Fees: Sending money from a linked bank account, debit card or Venmo balance, is free. However, sending money using a credit card will incur a 3% fee.

Transaction limits: You can transfer up to $299.99 in a Venmo transaction, or up to $6,999.99 combined spending limit for verified accounts.

Transfer time: Typically instant.

3. Zelle

Created by some of the biggest banks in America, Zelle is an instant money transfer service that works with participating banks in their respective apps. With Zelle, users can send and receive money almost instantly; with just the use of their mobile number & email address. This makes money transfers a breeze and Zelle is free, so sending money to other Zelle users will cost nothing.

Fees: Zelle does not charge users for sending or receiving money.

Transaction Limit: Banks that offer Zelle have a different sending limit, dependent on the users’ banks. For example, Wells Fargo users have a transaction limit of $2500 per week or $20,000 per month.

For banks/ credit unions that do not offer Zelle, the weekly send limit is $500.

Transfer Time: Users can send and receive money nearly instantly with Zelle. No escrow or processing period for transfers made with Zelle.

4. Cash App

Cash App was developed by Block Inc in San Francisco and it allows users to transfer money instantly between one another. The peer-to-peer service is only available in the US and UK but has received high praise from many users from both US and UK. The user only needs an email address or mobile number to send and receive cash, or access bitcoin to trading and investments on the app.

Fees: Transfers made with Cash App are free but for transactions made with credit card, a 3% fee will be charged.

Transaction Limit: $250 within any 7-day period and up to $1,000 within any 30-day period for receiving money. However, users can increase the limit by verifying their identity on the app.

Transfer Time: Typically instant. For cashouts to banks, standard deposits take 1-3 business days. Instant cash outs are subject to 0.5%-1.75% and arrive to the user’s debit card.

Ways to send money internationally

1. Wise

Formerly known as TransferWise, Wise is a money transfer service that provides good, reasonable rates on international transfers. Wise is partnered with 80 countries and prides itself on transparency and no hidden fees. Recipients of transactions do not need the Wise app or account, just a regular bank account.

This makes Wise a great option to use.

Fees: Wise charges a fee from 0.35% onwards and varies by currencies.

Exchange rate: mid-market rate

Transaction Limit: Transfer limit depends on the currencies. E.g., you can send up to 1 million SGD per transfer, depending on how you pay. If you pay by card, the limit is 16,000 SGD.

Transfer Time: 1-2 working days, including conversion.

2. MoneyGram

Based in Texas, MoneyGram is an international remittance service that has a network of 350,000 agent locations in more than 200 countries and territories. Payments can be made online, through the app, through users’ bank accounts, debit, or credit cards. However, the payment delivery is dependent on the recipient’s country. Transactions with MoneyGram are extremely fast; most transfers are on the same day with the earliest being 10 minutes.

Fees: Fees vary depending on where you are sending, how much, and how you are paying. Fees are typically lower if you pay with a bank account. If you pay with your credit or debit card, the fees are slightly higher.

Exchange rate: There is a markup on the exchange rate

Transaction Limit: For most countries, you can send up to $10,000.00 per online transfer, and up to $10,000.00 every 30 calendar days.12

Transfer Time: Transfers take minutes to complete. Transfers from bank accounts may take 3-4 business days.

3. Western Union

One of the remittance giants, Western Union services around 150 currencies across 200 countries and territories. It’s ideal for sending money anywhere, anytime, and even provides for those without bank accounts. With online and agent location services, users can choose to pay with cash, credit, debit, and bank accounts making ease of access one of Western Union’s greatest attributes.

Fees: Fees vary depending on where you are sending, how much, and how you are paying. Fees are typically lower if you pay with a bank account. If you pay with your credit or debit card, the fees are slightly higher.

Exchange rate: There is a markup on the exchange rate.

Transaction Limit: Limit depends on the sending and receiving currencies. For example, sending USD to MYR will have a 5,000 USD transaction limit.

Transaction Time: Can be from the same day to 6 business days.

4. XOOM

The international arm of Paypal, Xoom provides fast and secure international transfers to over 130 countries with multiple payout methods like Western Union. Recipients don’t need a bank account or card to receive money, cash pickup options are available. Xoom users can also pay bills, top-up their mobile balance, and track their spending.

Xoom is only available in the US, Canada, or the European Economic Area (EEA).

Fees: Fees vary, depending on where you are sending, how much, and how you are paying. Fees are typically lower if you pay with a bank account. If you pay with your credit or debit card, the fees are slightly higher.

Exchange rate: There is a markup on the exchange rate.

Transaction Limit: The limit comes in different tiers and varies based on country & recipient option.

Transaction Time: Typically minutes while some can take up to a few days.

5. World Remit

WorldRemit is a cross-border digital payments service that provides international money transfer and remittance services in more than 130 countries and over 70 currencies. WorldRemit gives wide flexibility when it comes to payout, transfer, and funding options, with multiple agent locations worldwide.

Fees: Fees vary depending on where you are sending, how much, and how you are paying. Fees are typically lower if you pay with a bank account. If you pay with your credit or debit card, the fees are slightly higher.

Exchange rate: There is a markup on the exchange rate.

Transaction Limit: Varies based on country. For example, maximum send amount per transaction from Singapore is SGD 10,000.18

Transaction Time: Within 1-2 working days.

Based on the above, there are plenty of options for you to transfer your money, be it locally or internationally. Make sure to pick the option that suits your needs and money transfer will be a breeze. Check out this international remittance provider below, we’ve added it because it deserves a special mention and is in our opinion, a better choice for you!

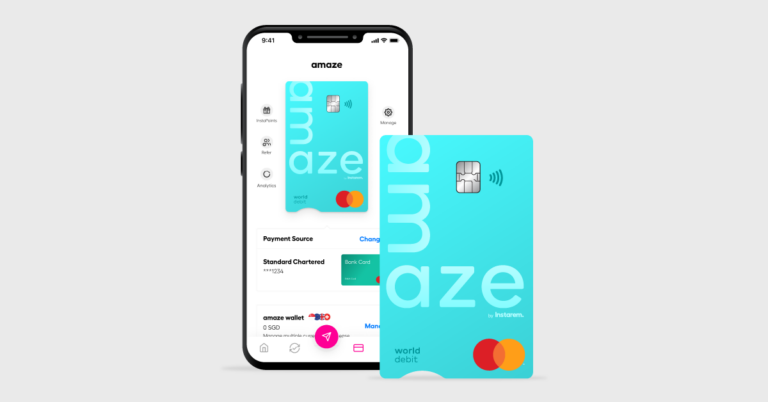

Better choice for international transfers: Instarem

Sending money to loved ones who live overseas can be a daunting task. No one wants to be swindled out of their hard-earned money or charged exorbitant fees. That’s where Instarem comes in. As a reliable money solutions provider based in Singapore, they make sending money to India and over 60 other countries a breeze.

Individuals who want wide market access and still get some benefits from being a user should definitely use this platform.

Here’s why you should use Instarem

Cost-efficient – Instarem gives some of the best rates, even competing with big banks, so you can get the best deal on your transaction.

Easy and fast – Usually instant or same-day transfer. However, for certain countries, corridors, and payment methods it could be more than 2 business days to process a transaction.

Safe and reliable– Instarem is regulated by nine financial regulators and is a trusted licensed service provider with licenses in Australia, Singapore, Hong Kong, Malaysia, India, UK, US, EU, and Canada. All its transactions are protected with the latest anti-hacking software to protect your transfer, so rest easy and Instarem it!

Transparent fees– Instarem will always display its current rates which it sources from Reuters.

Earn loyalty points– First-time users will be gifted InstaPoints, which can be used to redeem currency for later transactions. Furthermore, every transaction made on Instarem will be awarded InstaPoints. This is very helpful for frequent transactions as one can save on currency in the long term.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app