Sending Money to Australia: A Guide For Soon-To-Be International Students

This article covers:

Did you know there were over half a million international students in Australia last year alone? It’s unsurprising when you consider all the land down under has to offer — an amazing wildlife, rugged outback and a strong university reputation (plus plenty more). One can see a rising trend of international students enrolling in Australia right from 1994 to 2016:

But tuition fees and the cost of living in this sunburnt country don’t come cheap. According to the official site of Australian government, Study in Australia — International students spends anywhere between:

$15,000 to $33,000 for Bachelor’s Degree

$20,000 to $37,000 for Master’s Degree and

$14,000 to $37,000* for Doctoral’s Degree

So, if you’re planning a stint as an international student soon, you’ll need to figure out how you’re going to transfer money from your home country to Australia.

As you’ll soon discover the process couldn’t be easier, as Rebeccah Elley lifestyle and money editor, at financial comparison website Mozo.com.au runs us through the three simple steps below:

Step 1: Open an Australian bank account

Unless you can stomach the high foreign exchange fees that generally apply with overseas purchases, opening an Aussie bank account is essential for international students — you can even apply before you leave home.

Here’s a list of the banks in Australia that offer student accounts to help you narrow down your options:

- Westpac — “Choice Student”

Money Transfer Fee: $20

- ANZ — “Student Access Advantage”

Money Transfer Fee:

$12 for transfers more than AU $10,000

$18 for transfers less than AU$10,000

$32 for transfers via phone/branch/foreign exchange centre

- Commonwealth Bank — “Student Smart Access”

Money Transfer Fee: $22 per transfer via NetBanking

- NAB — “Classic Banking”

Money Transfer Fee:

$22 per transfer via NetBanking

Over the Counter: $30

- Citibank — “Plus Everyday Account”

Money Transfer Fee: Varies from $17 to $25

*Kindly note that the above-mentioned rates are indicative. Please contact the bank for exact transfer fee they charge.

Once you’ve picked a student-friendly bank account, you can fill out your application from the comfort of home. The bank will ask you for your passport number, university enrollment details and arrival date (if you know where you’re going to live, feel free to disclose that too). The time it takes for banks to process a new bank account in Australia is around three days.

Step 2: Transfer funds to Australia

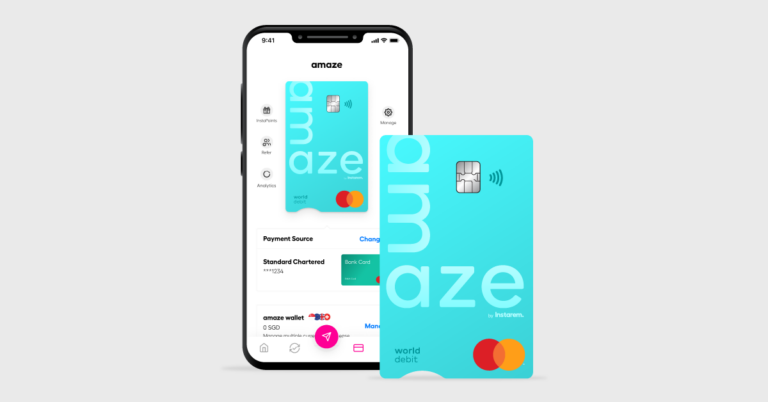

The next thing you’ll need to do is choose a foreign exchange provider like InstaReM, which doesn’t charge any transfer fees from Australia and process the money transfer at close to live FX rates to transfer your funds into your new Australian bank account. Of course, your local bank may offer to do this for you but it’s always a good idea to shop around for a better deal (as banks generally offer poor exchange rates compared to other providers that carry out the same services).

The next thing you’ll need to do is choose a foreign exchange provider like InstaReM, which doesn’t charge any transfer fees from Australia and process the money transfer at close to live FX rates to transfer your funds into your new Australian bank account. Of course, your local bank may offer to do this for you but it’s always a good idea to shop around for a better deal (as banks generally offer poor exchange rates compared to other providers that carry out the same services).

To set up the money transfer you’ll need to create a customer profile on the IMT specialist’s website, by providing your personal information such as your name/address and passport number.

Once your account is set up with the FX provider, you’ll have the ability to make your first transfer. Simply login to your account, select the currency you want to convert your money to (example: AUD to INR, AUD to USD, AUD to PHP) and submit your transfer. Depending on the foreign exchange provider and the receiving bank, the funds will land in your Australian bank account usually within 1–3 business days.

Step 3: Visit your New Bank

When the day comes for you to say G’Day to Australia in person, you’ll definitely need a debit card to pay for your student lifestyle. Simply visit your new bank to get the paperwork sorted if need be and collect the card.

When the day comes for you to say G’Day to Australia in person, you’ll definitely need a debit card to pay for your student lifestyle. Simply visit your new bank to get the paperwork sorted if need be and collect the card.

And that’s it, you’ll have access to the cash you need to discover everything Australia has to offer! All the best with your studies and feel free to visit the Mozo student section for tips and tricks for financially surviving university in Australia.

Rebeccah Elley is the lifestyle and money editor at financial comparison site Mozo which helps everyday consumers get a better deal on everything from their travel money to savings accounts. Whether it’s an in-depth guide or quick blog, Rebeccah loves nothing more than passing on her money saving tips to everyday Aussies.

Get the app

Get the app