The Now, The Next & The How: Coping Strategies For Small Businesses In A Post-COVID World

This article covers:

The COVID-19 pandemic has swept across the world and created a ‘new normal’ that would’ve been unimaginable even a year ago. Still, a few countries have fared better than others, especially those that took early action. Singapore is one such example. The country’s well-coordinated COVID-19 response included a systematic 3-phased ‘circuit-breaker’ programme to control the pandemic, minimise social and business disruption and keep its economy afloat.

Although COVID-19 has adversely affected businesses – especially SMEs – all over the world, there are measures that they can take to cope with its effects and ensure business continuity. In this article, we will address some of these coping strategies. Access to credit and healthy cash flow are important aspects of this continuity, so we will also talk about how SMEs can ensure both by leveraging the power of Instarem BizPay.

The NOW: The Lessons That Global SMEs And Governments Can Learn From Singapore

In Singapore, the phase-wise easing of the circuit-breaker in early June provided the impetus to many businesses to resume operations, albeit with some caveats. During Phase 1 (‘Safe Reopening’), the country identified several Safe Management Measures to enable businesses to reopen. Under these measures, Singaporean companies must:

- Declare their manpower strength within two weeks of resuming operations

- Appoint a safety management officer(s) to assist in the implementation of these measures

- Reduce physical interaction and ensure safe distancing among employees

- Implement staggered working and break hours

- Ensure that all employees wear masks at the workplace

- Refuse entry to those who are unwell

- Regularly monitor the health of workers

- Use the SafeEntry QR-based digital check-in and check-out system, especially if there is a higher risk of non-transient contact on the SME’s premises (e.g. malls)

These measures provide some great lessons for SMEs in other countries looking to safely restart their operations in a post-COVID-19 world. Governments too can embrace some of the ideas implemented by the government of Singapore to restart the economy. These measures support SMEs in 3 main areas:

- Improve their financial health and cashflow

– Corporate income tax rebates/payment deferments

– Rental waivers on government properties

– Financing grants and schemes

– Support for businesses with debt and cash flow issues

– Temporary relief for businesses unable to fulfil contractual obligations

– Relief on government fees and charges

- Lower their manpower costs

– Higher government co-funding ratios for wage increases

– Salary support schemes (JSS and CSP) to help businesses hire and retain local staff

- Manage their employee training needs

– Funding support for training local employees

The NEXT: Business Recovery & Continuity Planning In A COVID-19 World

All over the world, more and more countries are opening their economies, even as they try to minimise the impact of COVID-19 on their populace. In addition to putting into practice the lessons we discussed in the earlier section, it is crucial that businesses invest time and effort in Business Continuity Planning (BCP).

BCP can help organisations, including SMEs, minimise their downtime and optimise their productivity. It can also:

- Mitigate business and financial risk

- Help to build customer trust and confidence

- Build confidence among the company workforce

- Improve organisational decision-making

- Provide a competitive advantage

And one of the best ways to ensure BCP is through technology. Here are 3 ways technology enables SMEs to improve their business and operational continuity:

- Tools For Remote Working

Due to COVID-19, more and more firms are implementing communications and video conferencing tools like Zoom, Cisco Webex and Google Hangout, and workstream collaboration tools like Microsoft Teams and Slack. These tools enable:

- Efficient collaboration and communication

- Facilitate file sharing

- Encourage person-to-person connectivity even while working remotely

- Manage projects

- Resolve business challenges

- Boost productivity

So, if your firm has not embraced these tools yet, now is a great time to start.

- Cloud-Based Office Applications

With limited access to the infrastructure needed to work from the ‘office’, many SMEs are moving to the cloud to enable their staff to work from home. This is a great way to ensure business continuity.

For example, Desktop-as-a-service (DaaS) enables employees to access a cloud desktop from anywhere with an Internet connection through their own personal devices. Cloud-based video collaboration helps maintain a sense of ‘business as usual’ among employees. Solutions like Microsoft 365 allow employees to access emails and other applications from anywhere and at any time. A host of other business-critical activities including file sharing, resource access, project management and data analytics, can also be carried out in the cloud.

- Singapore Quick Response Code (SGQR)

A uniquely Singaporean innovation, SGQR simplifies QR-based e-payments in Singapore for both consumers and merchants. It combines multiple e-payment solutions into one QR code that shows all the QR payment options that a merchant accepts.

With SGQR, QR payments could be made through an e-wallet or funded by a credit/debit card. This gives consumers the flexibility to choose their funding option. For merchants, it means less clutter and faster payments from consumers.

- Embracing eCommerce

As more consumers move online in reaction to Coronavirus restrictions, traditional ‘brick and mortar’ shopping has taken a backseat. Therefore, companies are increasingly focusing on fortifying their web presence and even building online businesses. This enables them to reach a wider audience and to level the playing field with larger competitors.

SMEs that conduct business online can make and receive payments faster – but only if they use the right payments solution. Instarem BizPay is one such solution.

The HOW: Overcoming Challenges and Restarting Your Business In A Post-COVID World With Instarem BizPay

Traditionally, securing loans or credit has never been easy for SMEs, even under ‘normal’ circumstances. This is true in many countries – both developing and developed. Even in Singapore, where SMEs are such a critical element of the national economy, a whopping 61% of SMEs had low credit ratings towards the end of 2019, i.e. before the COVID-19 pandemic hit. Even in other economies, less than 15% of SMEs (May 2020) can access the credit they need to scale their businesses. This unmet financing need of SMEs is already a massive US$5.2 trillion every year. When cash flow is curtailed, SMEs struggle to expand their operations or meet their financial obligations to creditors, vendors or suppliers. This further affects their business profitability which once again affects their ability to stay afloat. These problems create a vicious circle that then becomes very difficult to break. Furthermore, this serious paucity of capital is further aggravated by delayed customer payments. COVID-19 has just made these problems worse.

So, what can SMEs do to access some much-needed credit to jumpstart their businesses in a post-COVID world?

One option is card-based payments, both to extend payment terms and to keep operations going. However, the high transaction fees and FX mark-ups act as strong deterrents for both payers and beneficiaries. So obviously, this is not an optimal solution.

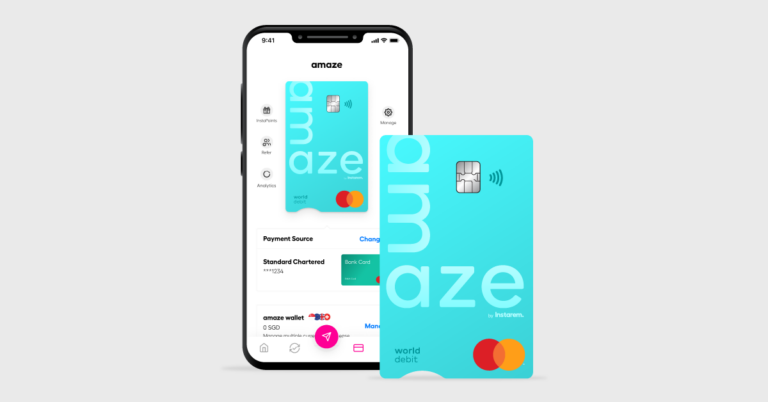

Instarem BizPay provides a user-friendly, affordable and quick way to boost business cash flow by using existing credit resources. With Instarem BizPay, SMEs can convert their corporate credit cards (and unused credit limits) into cash that they can use to pay bills (e.g. rent and utilities), vendors and suppliers. These SMEs include those that have established eCommerce platforms and expanded internationally.

For a very small transaction fee, SMEs can pay any corporate entity in a currency of their choice, and across multiple geographies. All they need do is sign up on Instarem BizPay, enter the beneficiary’s name, the amount and currency of payment, and then charge the whole payment to their corporate card for funding. Hassle-free, quick and convenient – these are just some of the benefits of Instarem BizPay.

Instarem BizPay offers interest-free credit for up to 55* days on both domestic and international payments. Plus, SMEs can also save up to 0.75% on borrowing costs and processing fee charges using their corporate credit cards. And because Instarem BizPay provides a way to use existing credit card limits optimally, SMEs can save a lot on international FX conversion, transaction and other fees. This means that Instarem BizPay can be much cheaper than borrowing from banks or other financial lenders – national as well as international. This can be the game-changer for SMEs that need to make cross-border payments to vendors, suppliers, staff or contractors.

In a post-COVID world, small and medium enterprises with a passion to grow their business beyond borders need support with credit access and cash flow. Instarem BizPay provides this support to SMEs in Singapore and abroad.

To know more about Instarem BizPay, visit

Singapore: https://www.instarem.com/en-sg/business/

Australia: https://www.instarem.com/en-au/business/

*55 days are indicative for reference purposes only. The actual number of days may vary as per the terms and conditions of an individual’s card issuing bank.

Get the app

Get the app