Understanding credit scores: Your adulting report card explained

This article covers:

Just when you thought you’d finally escaped the clutches of GPAs and report cards, bam—welcome to adulthood, where your shiny new report card comes with a fancy name: credit score and report.

Don’t know what we are whining about? No worries. If you’re one of the fresh baby birds fluttering into the chaotic world of adulting, buckle up. And if you’re a seasoned bird, well, you already know how this tiny report card somehow runs your life.

But for the newbies, we’ll break it all down—what a credit report even is, how it’s calculated, what a “good” score looks like (spoiler: it’s not 4.0), and why it actually matters.

Oh, and don’t worry, we’ve got tips to help you fluff up that credit score too.

Let’s dive in before the adulting anxiety kicks in!

What is a credit score?

Alright, let’s break this down in a fun, no-headache way:

A credit score is basically your financial selfie, but in three digits. It’s a number between 300 and 900 that shows how financially fit you are, based on your money moves in the past. Over time, this score can go up or down, depending on how you handle your loans and payments—so, no pressure, right?

Now, while your credit score is like the highlight reel, it doesn’t tell the whole story. That’s where a credit report steps in. Think of it as the behind-the-scenes documentary of your financial life. It spills the tea on all sorts of details—how many accounts you’ve got, your loan history, repayment track record, any defaults (yikes!), balances, even your date of birth. Oh, and it also includes that all-important credit score.

So, how do they get all this juicy info? Your lenders send your credit records to a credit bureau, and these bureaus crunch the numbers to come up with your score. For example, in India, there are four RBI-approved credit score whizzes: CIBIL, Experian, Equifax, and CRIF High Mark.

Out of these, CIBIL tends to be the go-to for most banks and financial institutions. Its report, known as the Credit Information Report (CIR), is like the OG financial file.

Free credit score tools

Here are some free tools where you can check your credit score:

- CIBIL (TransUnion CIBIL) – You can get your free CIBIL score once a year. Just sign up on their website to view your score and credit report.

- Experian – Experian offers a free credit score and report once every month. You just need to create an account.

- Equifax – You can check your credit score and report for free with Equifax once a year.

- CRIF HighMark – CRIF HighMark also offer a free credit score check once a year.

- Banks and credit card providers – Many banks and credit card companies offer free access to your credit score as part of their services. For example, HDFC Bank, ICICI Bank, and Axis Bank provide free credit score access for their customers.

How is credit score calculated?

Ever wondered what goes into that magical three-digit number that decides your financial fate? Credit bureaus like CIBIL whip it up using a secret recipe (okay, an algorithm) and a mix of key ingredients:

- Your credit history & repayment habits: Did you pay on time or were you fashionably late? This carries a hefty weight—30% of your score!

- Credit utilisation: How much of your available credit have you been using? This accounts for 25% of the total score.

- Available credit balance : What’s left in your credit limit tank?

- Number of accounts: From loans to credit cards, how many accounts are in your name?

- Credit mix & duration: Are you balancing secured and unsecured loans like a pro?

- Recent credit applications: Applying for too many loans or cards in a short span? That’s a red flag.

Once the credit bureau collects all this info, it pieces it together into your credit report and calculates your score. They also keep tabs on your financial game by tracking your bill and loan repayments for the past three years — monthly!

Importance of credit reports alongside credit scores

Alright, here’s the deal. Your credit score? It’s just your financial vibes in three digits—aka the “Can you pay me back or nah?” number. It’s based on stuff like how many loans you’ve juggled, how many credit cards you’re swiping (responsibly, hopefully), how consistent you’ve been with repayments, and, oh yeah, if you’ve ever flaked out on paying up (gulp).

But here’s the kicker: when you go applying for a loan, lenders don’t just glance at your score and say, “Sure, take my money!” If your score’s too low, they might slam the door in your face. And if it’s just meh, get ready to pay higher interest rates because apparently being “OK” costs extra now.

So yeah, your credit score isn’t just a number—it’s your financial GPA. Keep it cute, or lenders might ghost you faster than your last situationship.

What is a good credit score?

In the world of credit scores, bigger is definitely better. A high credit score screams, “I’m trustworthy with money!” which makes lenders breathe easy knowing you’re less likely to default. Translation? Your loan or credit card application is way more likely to get the green light.

In India, credit scores range from 300 to 900. But here’s the tea: anything below 750 is a bit of a red flag. Scores over 750? That’s the sweet spot! It says, “I’m responsible and low-risk,” which means lenders are way more eager to roll out the red carpet for you.

Now, let’s talk numbers because this gets interesting:

- Between 740 and 800? Meh, no huge difference—kind of like two equally good slices of pizza.

- Between 720 and 740? There’s a slight shift—think regular coffee vs. a latte.

- But between 650 and 720? We’re talking a massive glow-up—like going from “meh” to “day made.”

- And 550 to 650? That’s an enormous leap—basically, you went from being ghosted by lenders to maybe getting a second glance.

Now, here’s the juicy question: What’s the point of maintaining an “excellent” credit score if anything over 720 gets you in the door? Honestly? Not much.

Limits of high scores

Once you hit 780, you’re golden—you get the best mortgage rates, and even your insurance premiums might chill out. Beyond that, it’s just for bragging rights.

But hey, having a high score doesn’t exactly take sweat equity. Just don’t miss payments for a decade—it’s not like we’re asking you to climb Everest or anything.

Why credit scores matter (and when they’re just annoying)?

Let’s face it: having a good credit score is like being the teacher’s pet of the financial world. It comes in clutch when you’re trying to do grown-up stuff—like buying a house, getting a car loan, or even renting an apartment. Lenders are more likely to give you those sweet, sweet low-interest rates if they think you’re not going to ghost them on payments.

Here’s a fun little dose of financial pain: a 1% difference in your home loan interest rate could cost you tens of thousands of dollars. Yep, you read that right. For example, let’s say you buy a $400K house with a 20% down payment. The difference between a 7.5% and 8.5% interest rate? Over $80,000 in additional payments over the life of the loan. That’s like buying another house—just one you can’t live in.

But wait, there’s more! A good credit score isn’t just about loans:

Job hunting? Some employers might peek at your credit score to decide if you’re responsible enough to handle money—or compliance stuff—at work.

Buying insurance? Your score might sneak into your premium calculation. Because apparently, your ability to pay bills on time determines whether you’re a safe driver? Insurance companies, explain yourselves.

Renting a place? Landlords might use your score to decide if you’re trustworthy. While it’s not super common in India yet, it might become a thing as we go full-on cashless economy mode.

Basically, having a high credit score gets you discounts all over the place. And with big loans or long-term commitments, those discounts can pile up into serious savings.

What if you don’t have a credit score?

Honestly, it’s not that big a deal. Sure, it’s harder to get a car loan, but buying cars with cash is better anyway (looking at you, depreciating-asset-plus-interest).

Renting without a credit score? You might have to deal with larger security deposits or stick to renting from humans instead of corporations. But guess what? People do it all the time.

And then there’s job hunting. Some companies like to check credit scores during hiring.

Finally, mortgages. If you don’t have a credit score, some lenders will still work with you through something called manual underwriting. Basically, if you’ve got a solid financial situation (good income, no debt, and no liabilities), lenders will go old-school and review your actual financials. It’s extra paperwork, but it works.

Bottom line: credit scores are useful, but they’re not the be-all and end-all of adulting.

What can drag your credit score down?

Your credit score is like your financial reputation, and a few missteps can seriously dent it. Here’s a quick rundown of what not to do if you want to keep your score looking sharp:

- Late payments: Whether it’s a loan or a credit card bill, paying late is a surefire way to ding your score.

- Defaults on debt: Not paying your dues at all? That’s a big red flag.

- Maxing out your credit cards: Using most or all of your credit limit makes lenders nervous about your financial habits.

- Too much debt: A heavy debt load, especially if it’s mostly unsecured (like personal loans), can make you look risky.

- Frequent credit inquiries: Too many lenders checking your credit can make you seem credit-hungry, even if you’re just shopping around.

- Settling debts instead of repaying fully: While settling might seem like a win, it tells lenders you couldn’t repay in full—ouch!

- Negative status accounts: Terms like “written off”, “suit filed”, or “account sold” on your report? These scream financial trouble.

- Defaulting on joint or juaranteed Loans: Even if you’re not the primary borrower, missing payments on loans where you’re a co-signer or guarantor can hurt your score.

In short, staying on top of your payments, managing your debt wisely, and avoiding those “uh-oh” moments can keep your credit score smiling. Don’t let the financial hiccups pile up—they can cost you more than just your score!

Should debts be paid fully and earlier, even if it affects credit scores?

Have you ever heard someone say, “Don’t pay off your loans fully, or your credit score will tank!”? Yeah, we’ve all seen that advice floating around online. And while it’s mostly nonsense, there’s actually a little bit of truth behind why this happens. So, let’s break it down.

First, let’s get real about what credit scores actually are. They’re not there to help you. Nope, they exist to help lenders decide if lending you money is a good idea—or a total disaster. And those scores? They’re calculated by a super-secret algorithm. No humans are sitting there to evaluate you. It’s all math, and they keep the details under wraps so people can’t cheat the system.

Now, here’s the thing about paying off loans. To show you’re good at managing credit, you need to, well, have credit to manage. The algorithm wants to see that you can handle different types of credit, like a credit card (short-term) and a car loan or mortgage (long-term). But when you pay off a loan, that long-term credit disappears from your profile. The system can’t judge how you manage that kind of credit anymore, so it might temporarily view you as a bigger risk.

And there’s another layer to this: if you’re not making any payments, the algorithm assumes you’re probably looking to take out more credit soon. Why wouldn’t you? If you’re debt-free, you’ve got room for new loans. But historically, some people “celebrate” paying off a loan by immediately taking out another—sometimes one they can’t afford. The algorithm doesn’t know your plans; it just sees patterns based on years of data and plays it safe.

Here’s the good news: paying off loans is usually great for your credit. If your score dips at first, it’s usually a short-term thing. In the long run, the fact that you successfully paid off that loan will boost your score higher than if you hadn’t finished it. So, don’t stress. The system will catch on to how awesome you are at handling your finances.

How can I improve my credit score?

In a world where cash is slowly going extinct and credit is king, your credit score is the financial selfie everyone’s judging you by.

The good news? With a little planning and discipline, you can whip your credit score into shape in 6 to 12 months (sometimes even sooner). Ready to tackle it? Let’s dive in:

1. Stay ahead of the game: check your credit report

Think of your credit report as your financial report card—but sometimes, it’s filled with mistakes that aren’t your fault. Errors, missing payments, or even fraudulent loans you didn’t apply for can sneak in and drag your score down like an anchor.

Step one? Grab your credit report and give it a thorough read. Found something fishy? Dispute it with the credit bureau—it’s like hitting the undo button on unfair points. If you’re in India, sign up as a CIBIL member to get your report and start fixing the mess.

2. Pay like a pro: bills, EMIs and debt

Paying on time isn’t just polite—it’s the biggest slice of the credit score pie. Late payments? They’re the financial equivalent of stepping on Legos—painful and hard to forget.

Here’s the drill:

- Pay your bills on time. Always.

- Pay in full—not just the minimum due. Partial payments = interest traps.

Skip those tempting “one-time settlements”. Settling debt at a discount may sound great now, but your credit report will label it as “settled” instead of “paid,” which is a big no-no for your score.

Moral of the story? Pay on time, pay in full, and keep your record sparkling clean.

3. Keep your credit card in check

Just because your credit card has a high limit doesn’t mean you need to treat it like Monopoly money. Avoid impulse purchases, skip the non-essential splurges, and never spend more than you can pay off in full by the due date. Basically, if you wouldn’t buy it with cash, don’t buy it with credit.

4. Stop the credit card grab-athon

If your credit score is already hurting, applying for multiple loans or credit cards all at once is like yelling, “I’m desperate for money!”—not a great look. Lenders might see you as risky and reject your applications. And every rejection? It’s another ding to your score.

Also, every time you apply, lenders check your credit score. Too many checks in a short time? That’s another red flag for the algorithm. So, take it slow. Space out your applications, and focus on improving your current score first.

5. Keep a healthy mix of credit

Think of your credit profile like a balanced meal—you want a little bit of everything. Secured loans (like home loans) are the nutritious veggies of your financial diet. They build long-term assets and boost your credit score. Unsecured loans (like credit card debt or personal loans) are more like dessert. They’re fine in moderation but can wreck your credit health if you don’t pay them off on time and in full. The key? Balance!

6. Think twice before co-signing

Being a co-signer, joint account holder, or guarantor might seem like a nice gesture, but it’s a risky game. If the primary borrower misses a payment—or worse, defaults—you’re on the hook. And your credit score will take the hit right alongside theirs. Unless you’re 100% sure you can step in if needed, it’s best to politely decline and keep your credit report drama-free.

Final thoughts: don’t stress, just do your best

Your credit score is only a big deal when you’re borrowing money, which most people don’t do every day. Freaking out over small dips isn’t worth it unless you’ve got a loan or credit card application coming up soon.

Here’s the bottom line: borrow when you need to, pay your bills on time, and don’t let debt pile up. Yes, credit scores matter, but they’re not the be-all and end-all of your financial life. As long as you’re handling your money responsibly, you’ll be just fine. No need to obsess!

Before you go…

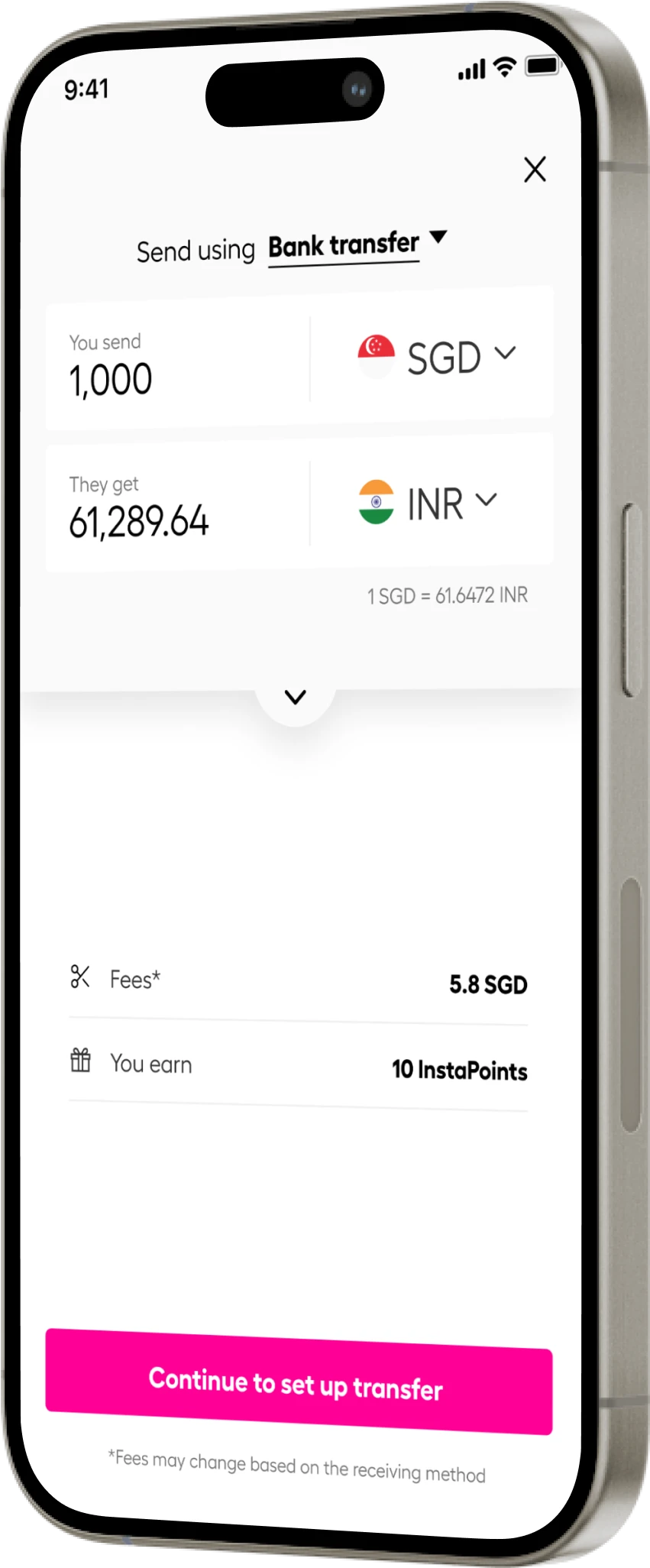

Well, look at you, slaying those debts like a total champ! Feels amazing, right? But if you’re planning to pay off debts in foreign currency, you’ve probably noticed how quickly those sneaky fees and pesky rates can gobble up your hard-earned cash.

Don’t worry, though—we’ve got your back! No stress, no drama, just the support you need to keep your finances on point.

*rates are for display purposes only.

Here’s what we promise:

- No hidden fees

- No sneaky markups

- Just great rates

Sending a big chunk of cash? No sweat. With unbeatable rates, low fees, and stellar support, your transfers will be smooth, hassle-free, and dare we say… weirdly satisfying.

Working with a smaller budget? No problem! Send money to over 60 countries at super-friendly rates—minus the sneaky fees. Whether you’re moving mountains or just pebbles, Instarem’s got your back. And your wallet. Download the app or sign up here.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app