UOB Singapore overseas money transfer: Everything you need to know

This article covers:

Founded in 1935, United Overseas Bank (UOB) is the third-largest bank in Singapore and one of the most widely used banks across Asia Pacific region. It offers a wide variety of financial services for both personal and commercial clients, including overseas transfers from Singapore to most of the major currencies in the world.

The following is a concise and straightforward guide to using UOB Overseas Money Transfer as well as any important points to note.

How much does it cost to transfer money internationally with UOB?

When sending money overseas from Singapore, UOB users are subjected to certain fees and commissions that include:

- A 0.125% cut on all overseas transfers. Min S$10 and max S$100 per transfer, plus cable charges and agent charges, if any.

- A fixed S$30 cable charge for all countries, except for Malaysia with a lower S$20 cable charge.

- Possible agent charges or correspondent bank fees by third-party banks that act as a middleman if UOB needs to send money to a bank with no established relationship. When you make your telegraphic transfer, you will have an option of whether you want to bear all of these fees (OUR), share the charges with the recipient (SHA), or put the full cost on the beneficiary (BEN)

Other charges for remittances:

- S$10 + cable charge + agent charges + all out-of-pocket expenses for amendment or cancellation of telegraphic transfers

- Request for credit/debit advices

- Free for transactions done in the last 3 months added

- S$20 for transactions done more than 3 months

- $30 per month (MT103 BIBPlus) or S$20 for payment confirmation (MT103 Fax Copy)

UOB foreign exchange rates

Banks in Singapore such as UOB add a significant margin to the foreign exchange rate which is often hidden as it may not be UOB that converts your money from Singapore dollars to another currency. Often, on an international money transfer, it’s actually the intermediary or recipient bank that makes the switch.

UOB does offer a wide variety of currencies but the exchange rate might not be favourable for most as they charge a markup on top of the mid-market rate. The difference is collected by the bank even if it isn’t stated on paper. The margins are typically within 1.00% & 2.00% but nevertheless the costs add up when taking into account multiple annual transfers.

Total costs to sending money overseas

All things considered, UOB’s fee schedule may make the bank a costlier option to perform an international money transfer transaction. Here’s an example of online bank transfer sending S$1,000 to Malaysia:

Provider | Fee | Exchange rate | Total cost |

UOB | S$10 fees + S$20 cable charge | 3.4932* (higher mark up to exchange rate) | S$30 + exchange rate markup + fees from intermediary & recipient banks |

Instarem | $7.50 | 3.5356 (close to mid-market rate | $6 + small exchange rate markup |

* The exchange rate is true as of 5th of Feb 2024

Even though UOB appears to have much higher fees, customers are willing to pay for the ease of accessibility and all things considered.

How long does a transfer take?

Payment generally reaches the beneficiary within 1 to 5 business days, varies according to the country and beneficiary bank to which payment is made. The cut off time is fixed at 1600 hours for all electronic transfers and 1500 hours for all manual transfers irregardless of the beneficiary bank country.

You can get a list of specific cutoff times and how long each route will take for different countries on the UOB website.

What is the process to make an international money transfer with UOB?

There are a total of 3 ways to transfer money out of your UOB bank account.

1. Personal internet banking

Perhaps the most convenient and common way to make an overseas transfer is via personal internet banking. All you need to do is:

- Login to your UOB internet banking portal.

- Click “Pay and Transfer”, then click on “Overseas Transfer.”

- Enter and submit the recipient’s information as required by UOB along with their banking details.

- Select your account, enter the currency, and the amount you’re to transfer.

- Enter the 2-factor authentication PIN to ensure your transaction, and you’re good to go!

2. Using your UOB account online through Instarem

Aside from UOB overseas transfer and remittance services, you can also choose to employ money remittance services such as Instarem to help transfer your money overseas. Instarem is simple and easy to use. All you need to do is:

- Visit instarem.com

- Choose your local currency and the currency of your recipients.

Make sure you’re satisfied with the cost and exchange rate - Sign up for an account by filling up necessary personal information and documentation.

- Enter your recipient’s local banking info.

- Choose payment option “bank transfer” to send the money.

3. Visit the nearest UOB branch

You can also visit the nearest UOB branch to send money overseas. All you have to do is just fill up a telegraphic transfer form and hand it over to the teller with your identity card or passport, along with your passbook or ATM card.

UOB overall

To sum it up in a nutshell, UOB’s overseas money transfer is a straightforward but secure way to send or remit money to foreign countries. This greatly enhances businesses that have and require offshore financial transactions. This also helps foreign workers and expats to send money to their loved ones in record time.

However, these may come at the cost of higher charges, every transaction is charged a percentage of the overall transfer amount, and any transfer in Indian rupees or Philippine peso requires a minimum transfer amount of $200.

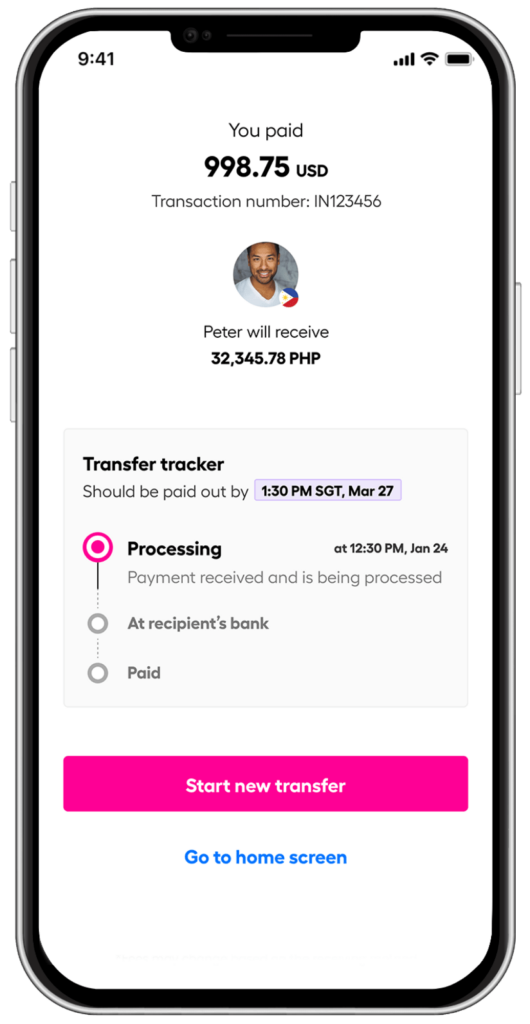

A better way to send money overseas: Instarem

Instarem is a digital overseas money solutions provider concepted in Singapore. It serves a plethora of markets including South-East Asia, America, Europe and Asia Pacific.

On Instarem’s platform, you don’t have to bear hefty transfer fees, cable charges and SWIFT charges as it is only one fee and a small one. The markup on exchange rate is still applicable but it is still very close to the mid-market rate.

On top of that, you are also entitled to earn InstaPoints when you sign up and start making transactions or successfully referring your friends to explore Instarem. Lastly, Instarem provides fast transfers which translates to one business day on average.

Try Instarem for your next transfer.

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app