This article covers:

Digitalization has dramatically impacted all the industries that form a part of our everyday ecosystem. The banking and financial industry is one of the major sectors that witnessed digitalization early and are now heavily dependent on it.

Wire transfer meaning

Wire transfer is a way of electronically transferring money from one individual or entity to another. It is a safe, fast, and secure way of remittance from one bank account to another for international and domestic transactions. Modern-day wire transfers are online and don’t involve the physical exchange of cash or checks. Instead, you can send the payment from the comfort of your home by using your online banking app.

How does a wire transfer work?

- Step 1: The sender provides basic information about himself and the beneficiary to his bank or third-party wire transfer provider. Information like name, address, contact details, beneficiary bank account details, routing number, SWIFT or BIC code (for international transfer), amount and reason for transfer, etc., are provided.

- Step 2: Whether you are transferring through bank wire or otherwise, you’ll need guaranteed funds to initiate your transfer. Thus, you must pay the transfer amount by physical cash payment to the provider, account transfer, or online.

For wire transfers online, you can log in to your net banking, enter the information, and transfer funds online without visiting a branch.

- Step 3: The sender’s bank gives instructions through a secure network. For example, Fedwire or CHIPS (Clearing House Interbank Payment System) is used in the US for payment clearing and settlement for domestic transfers and SWIFT for international wire transfer transactions.

- Step 4: The bank of the recipient accepts funds from the initiating bank and deposits its reserve funds into the correct beneficiary account.

- Step 5: The sending and receiving banks settle the wire transfer transaction.

Wire transfer example

Let us look at a few examples of using this money transfer method.

- When you need to transfer funds urgently: With wire transfers, most domestic transfers can happen within a day, and international transfers can be processed within two to five business days, depending on the country. If you need to send funds to family members during a medical emergency, this method is preferred for moving money.

- When you need to transfer large amounts of money: Although there may be limits to the amount of the transfer depending on the provider, typically, these limits are pretty high. Hence, this type of transfer is common for business entities that have to pay invoices or other business expenses or anyone involved in high-value transactions.

Benefits of wire transfer

- Convenience: Wire transfers are a convenient way to transfer money or pay bills to a beneficiary who may hold an account in a different bank than the sender.

- Quick processing: Setting up a wire transaction takes just a few steps. Once done, the processing of the transaction is quick and hassle-free. The recipient, thus, may not have to wait for days to claim the money.

- Security: Since these electronic transfers are administered through banks or responsible transferring agencies, they are considered secured money transfer tools.

- Reliability: Wire transfers can only be processed if the sender has sufficient balance in his account, unlike checks which may bounce due to insufficient funds.

Types of wire transfer

Domestic wire transfers

Domestic wire transfers occur between two banks or institutions within the same country. For example, a wire sent from a bank in San Francisco to another in New York is considered a domestic wire transfer.

International wire transfers

International wire transfers are when the sending and receiving banks are located in different countries. For example, a wire sent from a New York bank to a Belgium bank is considered an international wire transfer.

Wire transfer charges

Generally, wire transfers incur processing fees. The wire transfer charge or fee depends on the following:

- The bank or the agency

- Type of transfer (domestic or international)

- Charges may also differ depending on whether the sending and the receiving bank are the same or an intermediary bank is involved.

- The transfer amount

Alternatives to wire transfers

The words wire transfers are primarily used for electronic transfers. But electronic transfers may not always be processed through banks or non-banking networks. Thus, some of the alternatives to wire transfer are:

- Peer-to-peer (P2P) payment tools: They allow you to send money fast, directly, and with small or zero fees. You also do not require a bank account for this.

- Online payment: Many banks offer online bill payment and transfer services instead of you using P2P payment tools.

- Cheque/check: The traditional way to make payment, cheques/checks are still a safe and convenient method to send money.

Wrapping up

Wire transfers are essential for anyone wishing to transfer funds safely and quickly, especially when they are in a different location.

You can send a wire transfer from your bank or financial institution, provided you mention the required personal and banking details.

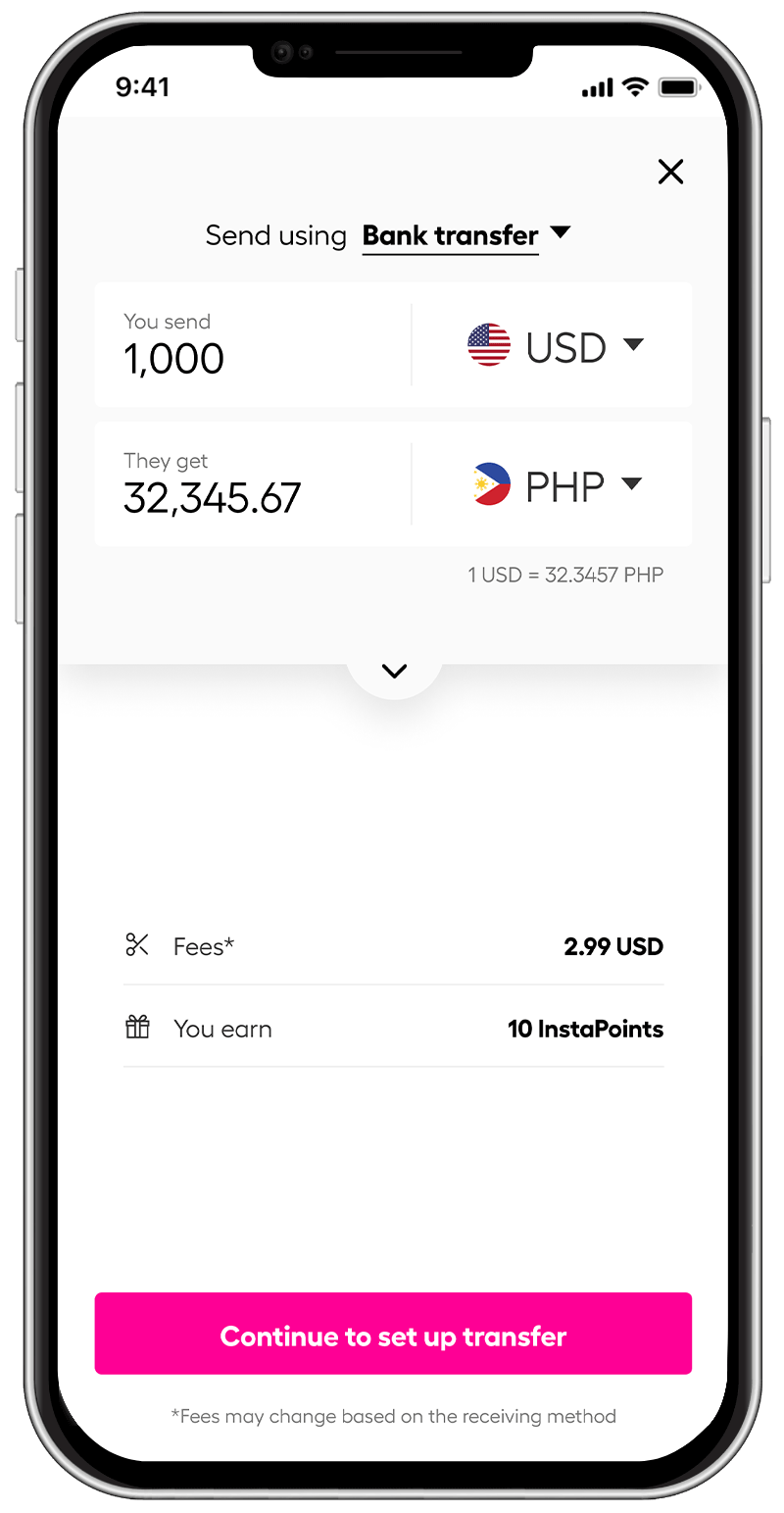

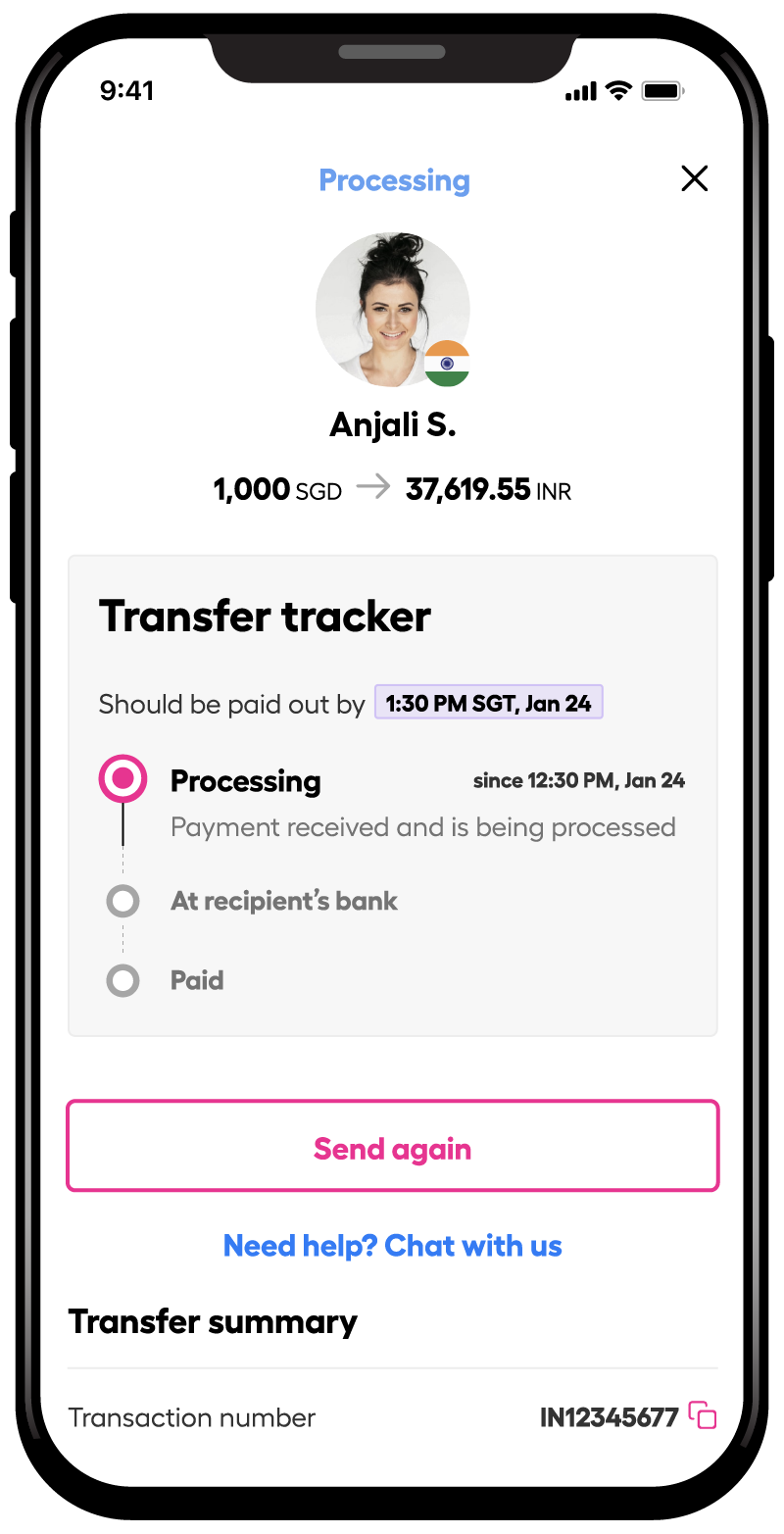

Instarem helps make an international money transfer to more than 60 countries a breeze.

*rates are for display purposes only.

Our smarter, faster, and more secure technology helps you get better exchange rates, complete transparency, and easy money tracking.

Indeed, we call it Money Simple!

Download the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

Get the app

Get the app