What is foreign exchange risk & how to minimise it

This article covers:

Put simply, forex or foreign exchange is the ‘conversion’ of one country’s currency into another currency.

Like many commodities, foreign exchange is also traded, i.e. bought and sold.

The global foreign exchange market, known simply as the forex or FX market, is the world’s most traded and most liquid market and operates 24×5/365 days a year. In this market, some of the most commonly traded forex pairs, also known as ‘major’ pairs, are EUR/USD, USD/JPY and EUR/GBP.

What is foreign exchange risk?

Like all forms of trading and speculation, the main aim of forex trading is simple – to make a profit.

A forex trader would either buy a currency at one price and sell it at a higher price or sell a currency at one price and buy it at a lower price.

However, this is an over-simplistic example of a forex transaction. Real-world transactions are much more complex, and again, like all forms of trade and investment, carry an element of risk.

Irrespective of whether your forex investments involve currency buying/selling, importing goods or investing in foreign stocks, it is incumbent upon you, the investor, to educate yourself on the risks inherent to forex investing.

To understand this risk, consider this example:

Imagine that you are an Indian importer importing 1,00,000 pairs of sunglasses from an American exporter. You will pay for these sunglasses in INR. This represents an outflow of funds from India (and an inflow to the US). If the value of INR depreciates vis-à-vis USD, you will need to either spend more INR to buy the same number of sunglasses or buy fewer sunglasses overall. In either case, imports have become more expensive for you.

On the other hand, if the USD falls in value, you can buy more sunglasses with the same amount of INR because the INR has become stronger than the USD, i.e. it has appreciated vis-à-vis the USD.

Your forex activity may differ from the above example, but before making any foreign investment, you must consider the risk of currency fluctuations and how you can minimise the effect of this volatility on your future profits.

Can foreign exchange risk be minimised?

With some research and careful planning, you can minimise your exposure to foreign exchange risk even if you cannot eliminate it entirely.

Here are some techniques that may help:

1. Do your research on currencies & countries

This may seem like an obvious idea but it is at times underappreciated and often ignored by potential forex investors.

You must do your homework on the country and the currency you plan to invest in.

Countries with low debt to GDP ratios tend to have rising currencies so you are more likely to make a profit by investing there.

Also, check the currency’s past volatility patterns and exchange rates vis-à-vis your home currency. These data points will give you a better idea of how risky or beneficial it could be for you to invest in that country’s currency.

2. Be disciplined, set your limits & stick to them!

Work out your ‘trading range’, i.e. your best and worst-case scenarios. You can do this by identifying what exchange rate limits (both upper and lower) are acceptable to you, and at what point your transaction will no longer be cost-effective. At this point, you should consider pulling out.

3. Invest in hedged investments…

Hedging adds a degree of certainty to future costs, allowing an investor to fix the purchase price and minimise the future effect of exchange rate variations.

If you have foreign investments, it makes sense to leave the exchange rate risk ‘unhedged’ when your local currency is depreciating against the foreign investment currency.

On the other hand, if your local currency is appreciating vis-à-vis the foreign investment currency, you should hedge your risk to minimise future fluctuation-related losses.

You can do this by investing in hedged overseas assets such as currency mutual funds or Exchange Traded Funds (ETFs), currency options, futures or forwards.

Currency-hedged ETFs are slightly more expensive than non-hedged ETFs, but they are also less volatile. See this site for more information on these instruments.

4. Don’t put all your eggs in one basket

Some studies have shown that investing in foreign assets improves portfolio return and reduces overall risk.

But the golden rule of investing applies here as well – don’t invest all your money in a single asset or a single currency.

Diversify across geographies and instrument types. And definitely, don’t concentrate all your investments in foreign markets.

As with any type of investing, be strategic, and avoid being carried away. And don’t be fooled by lucrative short-term rewards.

Unless you have a huge capacity to absorb short-term risks with no great effect on your wallet, you must think long-term.

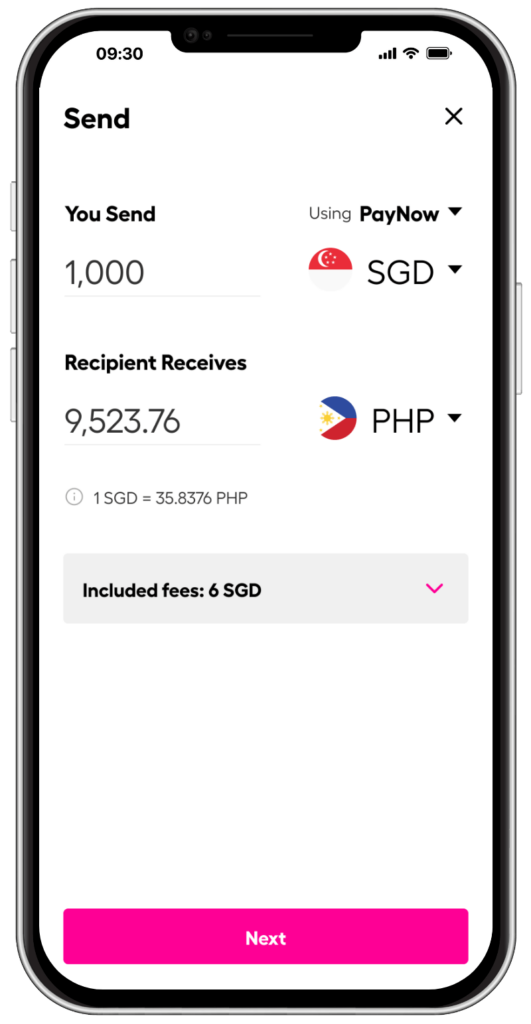

5. Save money by using a low-cost remittance service like Instarem

Overseas money transfers for forex investments can involve transaction costs that may not be immediately apparent.

Aside from the upfront Telegraphic Transfer (TT) fee, the exchange rate also includes a cost in the form of a ‘margin’, which tends to vary from one company to another and is often hidden.

These costs could make your forex investments more expensive and cut into your future profits.

Try Instarem for your next transfer.

*rates are for display purposes only.

Download the app or sign up here.

So whether you’re considering a one-off purchase from a foreign buyer or a long-term forex investment, it is possible to save money while dealing in foreign currency. Educate yourself on the risks and rewards, and don’t bite off more than you can chew.

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.