This article covers:

Over the years, India has established a strong global market position and liberalized foreign exchange transactions for its citizens. Prior to 2004, Indian residents had to undergo a cumbersome process of getting approvals and permissions from the Reserve Bank of India to send money abroad.

However, the RBI introduced the LRS scheme in 2004 to facilitate sending funds overseas and to encourage holistic economic growth of the country.

If you are not familiar with LRS, you may have several questions on your mind, like what is LRS, or who all can benefit from the LRS scheme.

In this article, we have simplified the concept of LRS for you.

LRS full form – meaning and definition

The LRS full form is the Liberalised Remittance Scheme. The RBI introduced this foreign exchange policy on February 4, 2004. As per the Reserve Bank of India guidelines, all resident individuals, including minors, can freely remit up to USD 2,50,000 in a given financial year (April to March) for any permissible current or capital account transaction or a combination of both.

If the remitter is a minor, the LRS declaration form has to be countersigned by the minor’s natural guardian. The Liberalised Remittance Scheme is available to individuals and cannot be used by corporates, partnership firms, HUF, Trusts, etc.

What is liberalised remittance scheme?

The LRS is RBI’s initiative to simplify and facilitate outward remittances by individuals in India. The scheme was recommended in 2004 by the Committee on Procedures and Performance Audits on Public Services (CPPAPS) to streamline outward remittances and was introduced the same year by the RBI.

The scheme has boosted cross-border expenses and investments made by Indians since it was introduced. In FY 2021-22, the outward remittances from the country were marked at USD 19.6 billion, which was a significant USD 7 billion more than the previous year.

Liberalised remittance scheme availability

The LRS remittance scheme is available to all resident Indians, including minors and students, as defined under the Foreign Exchange Management Act (FEMA).

To use the LRS scheme, you must have a valid PAN card, a valid passport, and a bank account in India.

The LRS is available for several categories of transactions detailed below:

- Capital account transactions:

- To open a foreign currency account with an overseas bank.

- To purchase property abroad

- To make overseas investments

- Establishing a wholly-owned subsidiary or a joint venture abroad.

- Loans to NRI relatives in the Indian currency. The definition of NRI relatives must be according to the Companies Act 2013.

- Current account transactions:

- Going overseas for employment or a private visit

- Gifting purpose

- Emigration

- Trip abroad to get medical treatment

- Maintenance of close relatives overseas

- Business trip

- Facilities for students for their higher education

Liberalised remittance scheme for NRIs

Remittance under LRS is allowed only for Indian citizens. You must have a savings account in a bank in India to benefit from the scheme. NRIs or Non-Resident Indians cannot have a savings account in a bank in India. Therefore they cannot avail of the LRS scheme.

However, NRIs can open Non-Resident Ordinary (NRO), Non-Resident External (NRE), and Foreign Currency Non-Resident (FCNR) accounts in Indian banks and remit funds according to the account type. Here are its details:

- NRIs can transfer up to USD 10,000 from an NRO account.

- There is no fund limit applicable on transfers from NRE and FCNR accounts.

Liberalised remittance scheme limit

The Liberalised Remittance Scheme has a few limits and restrictions for outward remittances by Indians. The LRS scheme limit is:

- You can remit only up to USD 2,50,000 in a particular financial year. If you want to remit a higher amount, you must get prior approval from the RBI.

- You cannot remit funds for certain kinds of activities, such as the purchase of lottery tickets, gambling, margin trading, real estate, or any other activity prohibited under FEMA.

- The beneficiary of these funds should be an individual residing outside India. Such a beneficiary should be eligible to receive funds from India as per the foreign exchange rules and regulations of the country of their residence.

Tax on liberalised remittance scheme

The LRS scheme of RBI lays down the taxation rules under the scheme as well. You must pay taxes in India on the profits you earn from investments made through the LRS scheme. The taxes vary depending on the investment’s holding period.

If the investment’s duration exceeds 2 years, it is considered a long-term investment for taxation purposes. The tax applicable on long-term investments is 20% of the total profit earned. The regular income tax slab rates apply for an investment with a duration of less than 2 years.

If you remit funds under the LRS scheme, you must pay a 5% TCS (Tax Collected at Source) if the value of the remitted funds crosses ₹7,00,000.

You can apply for a tax refund for the TCS deduction by submitting Form 26AS when you file your tax return.

Benefits of LRS

Benefits to the citizens

- Diversified investments: Indians can invest in foreign assets to diversify their investment portfolio through LRS. They can allocate funds to various asset classes, such as stocks, bonds, and mutual funds, and benefit from global economic growth through foreign stock markets.

- Medical expenses: Individuals seeking medical treatment abroad need not suffer from extensive bureaucratic or regulatory hurdles and can remit funds overseas for their treatment.

- Overseas education and exposure: LRS has facilitated foreign education for Indian students. Students can now easily remit funds to pay college fees and cover other expenses like books and accommodation. It also promotes cross-culture exposure and familiarity with foreign educational environments for Indian students.

- Travel and tourism: Indians can now remit funds without any hassle and go globe-trotting to explore diverse cultures and unexplored destinations. It promotes outbound tourism from the country.

- Business investments: Indians can invest in business ventures and start-ups overseas through LRS and expand their business globally.

- Gifts: You can give money as a gift to family or relatives abroad or donate to an overseas charitable trust through LRS.

Benefits to the economy

- Increasing foreign exchange reserves: LRS facilitates easy remittances, which has spiked the foreign exchange reserve for the country. A strong foreign exchange reserve is essential to a country’s economic stability.

- Enhancing global trade relationships: Overseas business expansion from Indian businessmen promotes healthy global trade relationships for India and helps bring back advanced technology and innovation to the country.

- Encouraging foreign investment: LRS showcases India’s liberalized economy and attracts foreign investment into the country. A liberalized capital flow encourages foreign investors to make reciprocal investments in India, which promotes the country’s bilateral trade relations globally.

- Improving the knowledge and skill level: As stated above, LRS facilitates Indian students to go abroad for higher education and skill development. These students bring back advanced knowledge, skills, and expertise to the country and promote several crucial sectors like medicine, research, information technology, etc.

- Strengthening the financial system: LRS fosters transparency and monitoring of international fund transfers. It helps track malpractices and misuse of funds, strengthening the overall financial system of the country.

Conclusion

The Liberalised Remittance Scheme is the Reserve Bank of India’s foreign exchange policy for outward remittances up to USD 2,50,000 in a particular financial year. The scheme is available for individual Indian residents, including minors. Liberalized capital flow to and from India is beneficial to the residents, the Indian economy, and foreign investors interested in expanding their operations to the country.

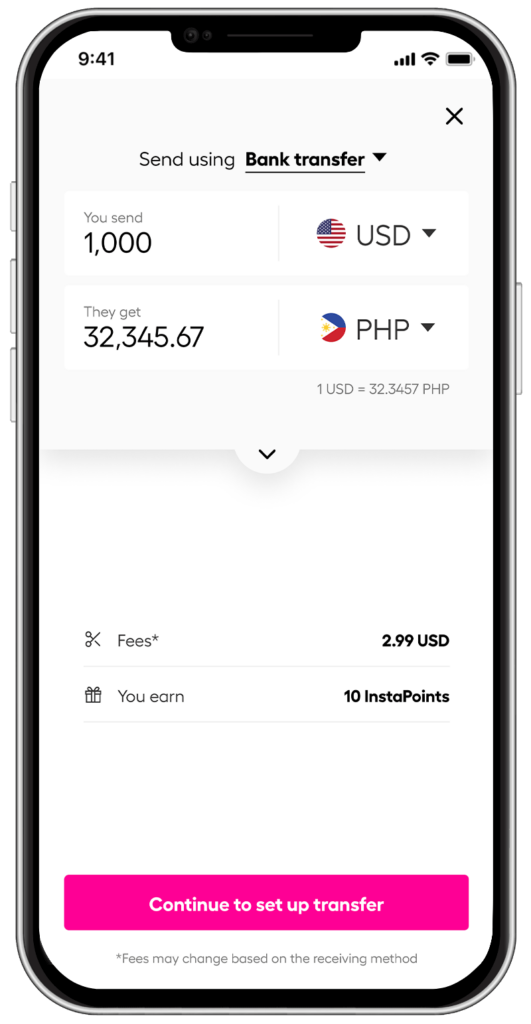

Instarem is a leading international fund transfer service provider. With us, you can transfer funds through a fast* and simple process with affordable# exchange rates and fees to more than 60 countries.

**rates are for display purposes only

Try Instarem for your next transfer by downloading the app or sign up here.

FAQs

- Is LRS taxable?

Funds remitted outside India under the LRS scheme attract a 5% TCS (Tax Collected at Source) if the value of the remitted funds crosses ₹7,00,000. You can apply for a tax refund for the TCS deduction by submitting Form 26AS when you file your tax return. - Who is eligible for LRS?

Individual Indian residents can remit funds overseas through LRS. It includes minors. However, for funds remitted by a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. - Can we receive money under the Liberalised Remittance Scheme?

No, the LRS scheme is available only for outward remittances from India and does not cover inward remittances from overseas accounts.

Disclaimers:

This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

*Fast – 75% of our transactions are completed in 15 minutes. Depending on funding method.

#When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.