What is the relationship between interest rates & exchange rates?

This article covers:

- Do higher lower interest rates cause currency appreciation or depreciation?

- What happens to the value of the currency when interest rates rise?

- How do interest rates affect exchange rates?

- How to take advantage of interest rate changes

- 2) Buy low, sell high on the stock market

- 5 ways to take advantage of high & low exchange rates

This article is the second and final part of the series ‘Understanding The Relationship Between Interest Rates & Exchange Rates’. Read Part I

When it comes to economics, interest rate and exchange rate are two of the biggest elephants in the room. Their impact on the economy can be huge – which is why understanding the relationship between them is so essential.

If there’s one thing economists know, it’s that interest rate and exchange rate relationship have an intricate dance of their own; changing this way and that in response to each other’s movements.

In this blog post, we will explore how you can take advantage of both interest rate and exchange rate.

By understanding these concepts, you’ll be better equipped to make informed decisions about your personal finances or your business’ financial health!

Do higher lower interest rates cause currency appreciation or depreciation?

The answer is yes. Interest rates and currency are very much related. High and low exchange rates effect the value of the currency.

If you’re looking for your currency’s value to skyrocket, keep an eye on interest rates – the higher they rise, the higher your money’s worth!

What happens to the value of the currency when interest rates rise?

Higher interest rates are like a superpower for the currency – they make it more attractive and valuable.

How do interest rates affect exchange rates?

Curious to know how do interest rates affect exchange rates? The answer is simple: you get more bang for your buck! Interest rates play a significant role in the attractiveness of a country’s currency; high-interest rates lead to more foreign capital, which leads to an increase in exchange rates and consequently, a strong currency.

With that said, if you’re looking for solid returns on your investments, don’t be afraid to take a risk and go invest in countries with higher interest rates; you may just find yourself swimming in money (figuratively speaking of course!).

How to take advantage of interest rate changes

1) Understand your own profile – are you a borrower or a lender?

![]()

You might be wondering who are the lenders. They are basically people who invest in some form of stocks, bonds, or fixed deposits.

When interest rates are high, it is good for lenders and bad for borrowers.

They can invest in fixed-income securities like corporate/government bonds or deposits that lock in the high interest rate so they can earn more on their investments even if interest rates eventually fall. They will also gain more through loans and credit card payments as both become more expensive.

So, if you’re a lender, this means more money in your pocket.

However, it’s the opposite for borrowers, who will be paying more interest on their loans. So, if you’re considering taking out a loan, it might be time to start looking for a new line of credit.

Borrowers will only benefit when interest rates are low. If you’re a borrower, now is the time to refinance your loans and lock in a lower interest rate. You should also try to pay down your debts as quickly as possible to save on interest payments.

Remember, whether you’re a lender or a borrower, it’s important to stay informed about interest rate changes so that you can make the best financial decisions for your situation.

2) Buy low, sell high on the stock market

![]()

Interest rates have a big impact on how businesses and consumers spend money.

High interest rates usually lead to less spending by businesses and consumers. This is because when interest rates are high, it becomes more expensive to borrow money.

As a result, businesses will often turn to the stock market to raise capital, which can lead to a fall in stock prices.

When interest rates fall, firms turn to debt financing instead of equity financing. In other words, they will borrow more from banks and less from the market (for example stockholders).

If you are looking to invest, this can also be a good time to buy stocks, as you may be able to get them at a bargain price.

And when stock prices go up, you are more likely to earn a profit by selling. Do keep an eye on interest rates if you want to earn some bucks.

You might be interested in: The best brokers for international stocks trading

5 ways to take advantage of high & low exchange rates

Now that we’ve been schooled on the ins and outs of how do interest rates affect exchange rates, let’s get to thinking of ways to capitalize on it.

1) Hedge your bets: buy or sell foreign currency

If you’re looking to make some money off exchange rates, you’ll need to be aware of how they work. Simply put, exchange rates fluctuate based on the relative value of two currencies.

For example, if the US dollar is strong relative to the Canadian dollar, then the exchange rate will be higher. To put it simply, you’ll get more Canadian dollars for your US dollars).

If you think a currency is going to appreciate (increase in value), then you can buy it now and sell it later when the exchange rate is higher.

On the other hand, if you think a currency is going to depreciate (decrease in value), then you can sell it now and buy it back later when the exchange rate is lower.

You might be interested in: Best places to exchange currency while travelling abroad

2) Buy or sell foreign goods: think like importers & exporters!

For instance, let’s say you’re thinking about buying some foreign goods. If the currency of the country you’re buying from is weaker than your own, then it’s a good time to do it.

Example as of 4th April 2023, USD1 gets you SGD1.33. So, if you have USD100, you can buy SGD133 worth of goods.

You’ll get more bang for your buck, so to speak.

On the flip side, if you’re thinking about selling goods in a foreign country, it’s a good idea to wait until their currency is stronger than yours. For example, the falling value of the INR makes Indian exports to the USA more competitive.

Because Indian exporters are paid in USD (which is now more valuable), their profits increase – more money for same amount of goods.

Of course, there are other factors to consider as well, such as the stability of the country’s currency. But if you’re paying attention to exchange rates, you can give yourself a little bit of an advantage.

3) Make foreign investments

In theory, money should flow to currencies that provide the best returns. However, in practice, exchange rates are often more influenced by political and economic stability.

When a country is in political or economic turmoil, its currency usually weakens. This makes the country’s assets (example stocks and real estate) cheaper for foreign investors.

Foreign investors are then willing to put more money into the country for higher potential returns.

So, if you are looking to invest in foreign assets, it’s a good idea to consider how strong or weak the foreign country’s currency is against your home currency. That way, you’ll might be able to benefit from a lower purchase price and selling higher (eventually).

You might be interested in: Foreign transaction fee in overseas spending: what does it mean to consumer

4) Invest in hedged instruments

Hedging is a way to protect yourself from the risks of exchange rate fluctuations.

For example, as of 4th April 2023, USD1 gets your EU0.92 and you’re a US company that exports to Europe.

You’re worried that the value of the euro will fall against the dollar, which would reduce your profits. So, you decide to hedge your exposure by buying euros with US dollars at EU0.92.

If the euro falls below EU0.92 against US dollar, you’ll still have the euros that you previously purchase at EU0.92. And if the euro rises against the dollar, you’ll make a profit on your hedging transaction.

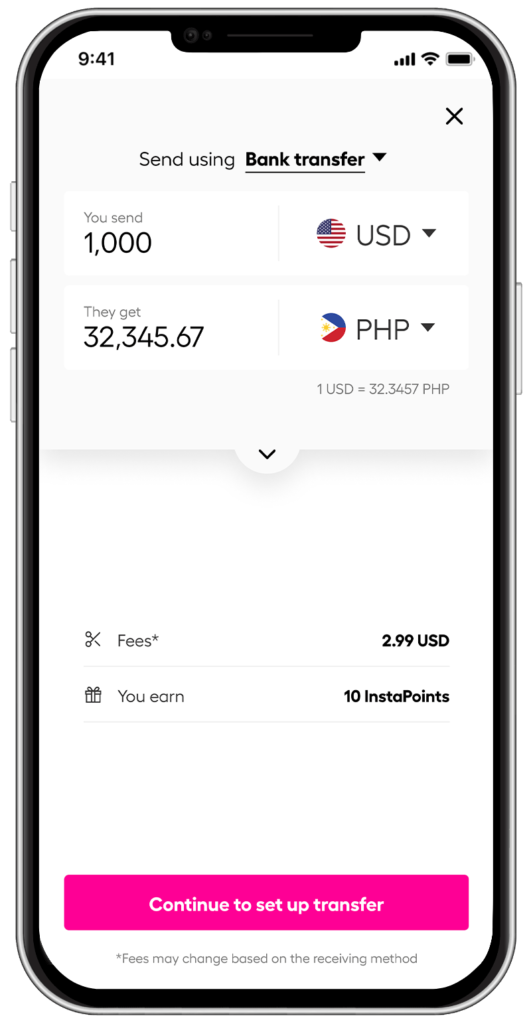

5) Use a low-cost remittance service like Instarem to transfer money abroad

You may love swapping stories with friends about your travel experiences, but if you’re sending money overseas, the story that matters most is the interest rate and exchange rate relationship.

When it comes to overseas money transfers, exchange rate volatility is not the only loss-inducing factor. Such transactions can involve hidden costs and telegraphic transfer (TT) fees which can increase the burden on the sender.

That’s why you should consider using Instarem to facilitate low fees, competitive FX rates and fast money transfers.

*rates are for display purposes only.

Instarem helps you send money abroad to over 60 countries. If you’re looking for an easy and affordable way to send money to your family or friends or even for business transactions, Instarem is the perfect solution.

With our simple platform, you can make a transfer in just a few clicks. Plus, we offer competitive rates and low fees so you can get the most out of your money.

Download the app, sign up on the web, or create a business account and see how easy it is to send money with Instarem.

So, there you have it – five ways exchange rate and currency can affect you. By being aware of how these rates work, you can make smarter decisions with your money and hopefully end up ahead!

*Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.