Will The World Lose All Credit & Debit Cards In The Next 5 Years?

This article covers:

With the growing number of mobile payment options and other tech solutions to access and operate money, what is the future of physical cards? Will they also become digital and slowly we move to a cardless world?

In March 2019, Apple, the tech behemoth that often plays the starring role in case studies on everything from branding and technological evangelism to personal development (thanks to founder Steve Jobs) and disruptive innovation; announced the launch of its Apple Card in March. This virtual card is also being rolled out in a physical form in partnership with Goldman Sachs and Mastercard, one of the leaders of the global credit card industry.

So, what does it mean when a company, whose cashless payment service was often touted as a ‘credit card killer’, dips its toes into the physical card market as well?

With Apple being one of the many companies vying for primacy on the ‘virtual money’ bandwagon, what are the implications of such ‘virtualisation’ – for the credit/debit card industry as a whole?

Besides, the availability of hundreds of virtual cards and other cashless, mobile or web-based payment systems also raises some interesting questions such as:

Will these newer cashless ‘push’ innovations completely phase out traditional physical (‘pull’) cards? Or will they complement each other and continue to co-exist in the global financial space?

The Global Remittance Industry

In April 2019, the World Bank’s Migration and Development Brief found that the global ‘remittances’ market is surging and is expected to maintain an upward swing in the coming years. According to this report, 2018 was a record year for remittances to low- and middle-income countries, touching 529 billion USD. This amount constitutes almost 77% of the total remittance flow, globally, and it registered an increase of 9.6% over the previous year’s record high of 483 billion USD. This total even topped the 344 billion USD Foreign Direct Investment (FDI) that flowed into these countries (excluding China) in 2018.

The same World Bank report estimates that in 2019, the remittance figures are expected to shoot up to 550 billion USD and become the largest source of external financing for low- and middle-income countries. All these facts indicate that the remittance industry is alive and well all over the world.

However, one problem with this trend, according to the World Bank’s Remittance Prices Worldwide database, is that the global average cost of remittances is still very high, especially, if migrants remit their money through credit cards, post offices or traditional banks at a fee of 11%, the highest in Q1 of 2019.

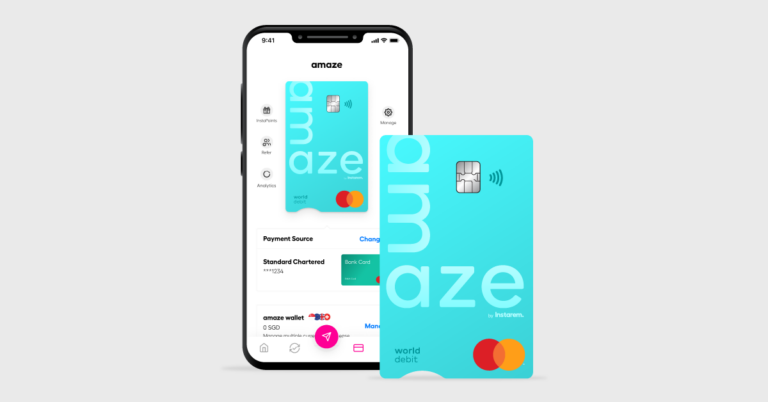

This is where cashless money transfer operators such as InstaReM are a boon for the remittance industry. InstaReM provides low-cost money transfers to over 55 countries across the globe. InstaReM offers a number of advantages including:

- Mid-market exchange rates without any added margins

- Complete transparency and no hidden charges

- Faster transfer time as compared to banks, money transfer operators and other services

Prajit Nanu, co-founder and CEO of InstaReM, believes that it is the customer’s expectations that are driving financial institutions to adopt new infrastructure models and enable real-time payments for individuals and businesses. In other words, he believes that the consumer is driving change towards a more cashless world.

The Global Move Towards Cashlessness

All over the world, but particularly in countries like India, Kenya and the Philippines, cashless services such as Immediate Payment Service (IMPS) and the Unified Payments Interface (UPI) are proving to be a game-changer in the payments and remittance industry. Through these services, senders can transfer funds securely and quickly at a lower fee than traditional remittance platforms like banks or credit cards.

India’s popular UPI system, launched in 2016, has simplified digital transactions by allowing app-based money transfers without the need for any bank account details. UPI is also becoming a role model for many other countries, especially those in Africa and West Asia. India’s home-grown card networks compete with global card giants such as Visa and Mastercard.

These cashless systems are not just changing remittances, but also eCommerce and brick-and-mortar transactions. They are also being utilised by banks (say for loan disbursal or processing utilities payments), small and medium businesses and corporations that are interested in tapping into the many advantages offered by cashless payment methods including:

- Real-time transfers and near-instant credits

- Security

- Convenience

- Seamless transfer process

Cross-border payment systems that integrate Finance with Technology (aka FinTech) are also becoming easier and hassle-free. They make it possible for international travellers to make payments in foreign countries in their own currencies through ‘mobile wallets’. In many cases, they can also use these systems to pay via cash or credit/debit cards.

In developed countries, alternative payment methods – driven by mobile phones and online portals – are becoming more common for everything from ticket purchases and charity donations to eCommerce and phone top-ups. Even countries that preferred bank cards until a few years ago, are now using digital wallets for daily transactions like groceries and utilities. For example, 26% of the people in the USA still rely on credit cards and 16% on debit cards for payments, but digital wallets are fast closing the gap, with 23% preferring this payment method for their purchases. Even in Australia, where credit cards remain the top payment method, digital wallets are rising in favour.

In many developing countries, the adoption of Smartphones, the constantly improving digital infrastructure as well as an evolving regulatory environment that supports the digital ecosystem are pushing their economies towards cashlessness.

The question is – how far along are they on this road?

The Case For Reducing Credit Card Payments & Increasing ‘Push’ Payments

Commerce will stall if financial transactions are not fast, secure or reliable. Even when there is trust between payers and payees (say customers and merchants), cash- or credit card-based transactions are not always problem-free. With such ‘pull’ payments, issues may arise on either end that may lead to delayed or declined payments (say due to insufficient funds), reconciliation, data breaches or surprising charges (such as those caused by Dynamic Currency Conversion (Read more on Dynamic Currency Conversion here).

Card payments often require strict compliance with the Payment Card Industry Data Security Standard which can be an expensive proposition all-round.

Push payments on the other hand – cashless and/or credit card-less – aim to either reduce these problems or eliminate them entirely. Whether it involves peer-to-peer (P2P) lending, salary disbursals, online bill payments or point-of-sale transactions at merchant locations, push payments reduce compliance costs, streamline reconciliation processes and provide more security options for consumers. Besides, they incur lower costs and are often a more efficient payment method due to speed and cost-efficiency.

But Are Credit Cards Really At Death’s Door?

In general, the digital payments pie in a lot of countries seems to be getting bigger, with players like Google and Apple (also InstaReM 🙂 ) acquiring more customers due to their distribution strength and well-known brand names. But smaller players are not far behind. The global cashless payments industry, now valued at a massive 110 trillion USD, consists of multiple companies fiercely competing for customers and market share. FinTech startups are developing Blockchain and smart contracts applications while established players like MasterCard and Visa are spending heavily to preserve their dominant market share in the credit card space.

However, banks often continue to lead in the ‘volume’ game when it comes to ‘cash processing’. This is because in many countries (India is a prime example), a large section of the population has come under the banking umbrella and also because many government subsidies are being routed via bank accounts. Both these factors have had an impact on the cash disbursed by banks, which means that in many countries, cash is still king, followed by cards.

According to Helcio Nobre, Chief Product Officer of UK-based FinTech Rapyd, “Only 6% of the world’s population has a credit card.” This may seem like a small proportion until we realise that this translates to a not-insubstantial figure of over 460 million people who still use cards for many of their financial transactions. Therefore, it’s unsurprising that Mastercard, the global financial services and credit card giant has engaged in acquisitions (e.g. Vocalink) and new launches (e.g. Mastercard Send) that complement its wide range of payment solutions; enhance its worldwide compliance capabilities and increase its cross-border connectivity and ‘indispensability’. Besides, although online payments solutions are growing rapidly across multiple geographies, they often integrate cards into their systems, indicating that plastic is far from becoming completely obsolete anytime soon.

Final Thoughts: Are Physical Cards On Their Way Out?

One of the world’s first ‘modern’ credit cards was the Diner’s Club card that was available way back in 1950. In the 1980s, magnetic stripe cards became more common all over the world, followed by EMV chip-and-PIN payment cards in the 1990s. It wasn’t until 2008 that mobile wallets first started appearing in the Apple app store. For a payments system that has been around for over half a century, it’s unlikely that it will be pushed into oblivion anytime soon.

Push payments are drawing increasing interest from governments, merchants, financial institutions (including banks), corporations, consumers, borrowers and employees alike. The rapid growth of Fintech-led innovation has delivered massive change throughout the financial services landscape.

But as with any innovation – disruptive or incremental – the adoption of cashless push systems will require huge adjustments, changes in perspective (‘cash is king – no more’) as well as a massive dose of trust all around. Even if more consumers are adopting cashless payment systems for convenience, they will probably not stop using credit and debit cards, at least for the next decade or so.

Fundamental change is already taking place and the hitherto dominance of credit card giants is looking somewhat shaky. However, it is unlikely that physical cards will entirely disappear, at least for the foreseeable future.

Get the app

Get the app