This article covers:

Transferring money overseas or within geographic boundaries has become simple these days. Thanks to technological advancements and digitalization, the processing time has been reduced considerably, with limited scope for scams or frauds. One way of transferring money is through wire transfers.

Wire transfers allow customers to move money electronically from one bank account or credit union to another locally or overseas. The funds change hands electronically and can be carried out between financial institutions and banks within the country or internationally. Wire transfers are generally safe, and speed is their major highlight. Thus, a hefty wire transfer fee is typically associated with every transaction.

What is a wire transfer — In a nutshell

Wire transfer is one of the most common types of remittances or money transfers. They usually involve moving money from one bank account to another via a SWIFT network. They are considered a safe, quick, and easy way to transfer money for both individuals and businesses. Banks and other financial institutions or service providers facilitate wire transfers for which they typically charge a fee.

If you wish to send money via this method, it is essential to learn how to do a wire transfer and how long does a wire transfer take.

How much does a wire transfer cost?

Compared to other methods of fund transfer, wire transfers are relatively expensive. A wire transfer cost in the USA ranges from USD 15 to USD 50. Although, there may be some exceptions as some financial institutions may also offer free wire transfers, the instances of which are very few.

Typically, this money transfer method can attract different wire transfer charges for international and domestic wires, outgoing and incoming wires, and types of accounts. Many banks charge fees for sending outgoing and incoming wire transfers.

For example, have a look at the US Bank wire transfer fees.

For Consumer or Personal Accounts | For Business Accounts |

Domestic incoming charges: 20 USD Domestic outgoing charges: 30 USD International incoming charges: 25 USD International outgoing charges: 50 USD | Domestic incoming charges: 14 USD Domestic outgoing charges: 40 USD Domestic outgoing (voice-wire) charges: 35 USD International incoming charges: 15 USD International outgoing charges: 75 USD |

(Prices are taken from US Bank on 26th July 2023 at 6:03 PM IST)

Additionally, there are hidden fees in wire transfers that may be related to the correspondent bank (mainly in the case of international transfers), which you must account for.

Factors affecting wire transfer fees

Wire transfer charges vary due to different factors forcing you to either pay an exorbitant amount or enjoy the service for free. Let us look at key factors that affect wire transfer fees.

Service provider

The fees for wire transfers are predominantly determined by the service provider or the banks (both the sending and receiving banks). Every wire transfer service provider can have an independent fee structure which may include a standard fee, a percentage of the transaction amount, or both.

The capabilities of the service provider majorly influence this fee. Also, the wire transfer fee is typically higher if an intermediary bank is involved.

Countries involved

Since international transfer involves numerous regulations, the country where the transaction is initiated and the country where the funds are sent play a vital role in costing. For example, in a country where technological support is limited, the bank or the service provider may depend on the traditional methods, thus consuming longer time for transfer and added costs. A transfer between low-cost banks in countries like Nepal and Bhutan may be expensive.

Amount of transfer

There are mainly two ways in which a bank can charge fees. Some banks charge a flat amount for wire transfers irrespective of the transaction amount, whereas some charge a specific percentage of the transfer amount. Some banks may even combine these two methods and charge a flat fee up to a certain threshold, and then if that threshold is breached, a certain percentage of the amount is charged.

Urgency of transfer

You may have to charge extra to facilitate same-day transfers, especially for international transactions. Urgent transfer attracts higher fees than regular transfers.

Foreign exchange rates

Transferring money from one country to another involves the home currency (at the sender’s location) being converted into another currency (at the receiver’s location). The exchange rate is the rate at which one currency is converted into another.

Although the exchange rate is not a fee, it is a significant determinant affecting the wire transfer fee. Since the exchange rates between the countries keep fluctuating, it is essential to consider that. Thus, there is a considerable impact of currency conversion on wire transfer costs.

Mark-up exchange rate

When one bank charges the other for facilitating the transaction and trading large amounts of foreign currency, it is called midmarket. However, when banks convert the currency for individual consumers, they typically charge a higher markup above the mid-market rate. This may act as a hidden fee in wire transfer as it is an additional fee that the financial institution may charge.

Common types of wire transfer fee

Let us look at the components of wire transfer to better understand wire transfer processing fees.

- Outgoing wire transfer fee: This fee applies to the sender for every wire transfer instruction they give. Some banks or financial institutions may charge a flat fee, whereas some may charge a percentage of the transfer amount. Typically, an outgoing domestic wire transfer fee will be lower than an international wire transfer fee.

- Incoming wire transfer fee: This fee is charged to the recipient by their financial institution or bank for every incoming fund through a wire. Similar to the outgoing fee, incoming wire transfers can be a flat fee or a certain percentage of the transaction amount, and the domestic incoming wire fee is mostly lower than its international counterpart. Moreover, the incoming fee is generally lower than the outgoing fee.

- Correspondent or intermediary bank fee: The sender bank is different from the recipient bank and is located overseas for international transfers. Thus, an intermediary bank is typically involved in completing the transaction process. These banks charge fees for facilitating the transaction, currency conversion, etc.

How to minimize wire transfer fees?

Although the benefits of wiring a transfer outweigh its disadvantages, the expensive nature of this transfer mode is its biggest drawback. Here are a few ways on how to avoid wire transfer fee or minimize the same.

Choose the right service provider or bank: It is always advisable to compare the services and prices of various banks and service providers. Comparison can help you select the most cost-effective option for your money transfer needs.

Combine transaction amounts: Since the wire transfer fee is charged per transaction basis, making small multiple payments can prove more expensive than a large single transfer. So, consider making fewer transfers of more significant amounts. Alternatively, some banks or service providers also offer discounts on multiple transfers. Hence, if you require multiple transfers, consider opting for such providers.

Negotiate the fees: Some banks may consider negotiating fees for high-value transactions or loyal customers. If you have a long-standing relationship with a bank or service provider, you may ask for their services at a concessional rate.

Look for discounts: Since the competition in this segment is fierce, along with top-notch services, banks, and service providers may even lure customers with freebies, discounts, or other promotional offers. The discounts may be applicable for new as well as repeat customers.

Understanding wire transfer regulations and policies

Since wire transfers are mostly international remittances, they are highly regulated. The sender and receiver must abide by the rules, regulations, and guidelines of the countries they deal in. Financial institutions like banks or other service providers may decide on the pricing factor. Still, they function under the preview of the country’s and the monitoring body’s laws.

For a wire transfer, both parties must share details like the purpose of the remittance and personal details, including name, address, contact details, bank account details, etc. Additionally, the requirements and regulations for different countries may vary, including the transfer limits. The banks and service providers may impose transactional or duration-based transfer limits.

Examples:

- The Bank of Japan handles international remittance monitoring, and the Japan Government monitors all international funds transfers of more than JPY 2,000,000.

- The Consumer Financial Protection Bureau (CFPB) regulated all international transfers from the US, which amounted to more than USD 15.

- For the European Union (EU), the Funds Transfer Regulation (FTR) plays an essential regulatory role.

- In India, the Reserve Bank of India (RBI) has laid down different guidelines for inward and outward remittances.

You can check the International Money Transfer Limits for different countries.

Tips for businesses and individuals

The wire transfer process is pretty straightforward; you must follow the guidelines and procedures carefully. Here are a few tips for businesses and individuals to help save costs and trouble.

- Enter correct details: Entering incorrect details may lead to the rejection of the transaction or, worse – money getting transferred to the wrong person. Once wire transfers are processed, it isn’t easy to reverse the same. Hence, ensure to check the details entered before initiating the transaction.

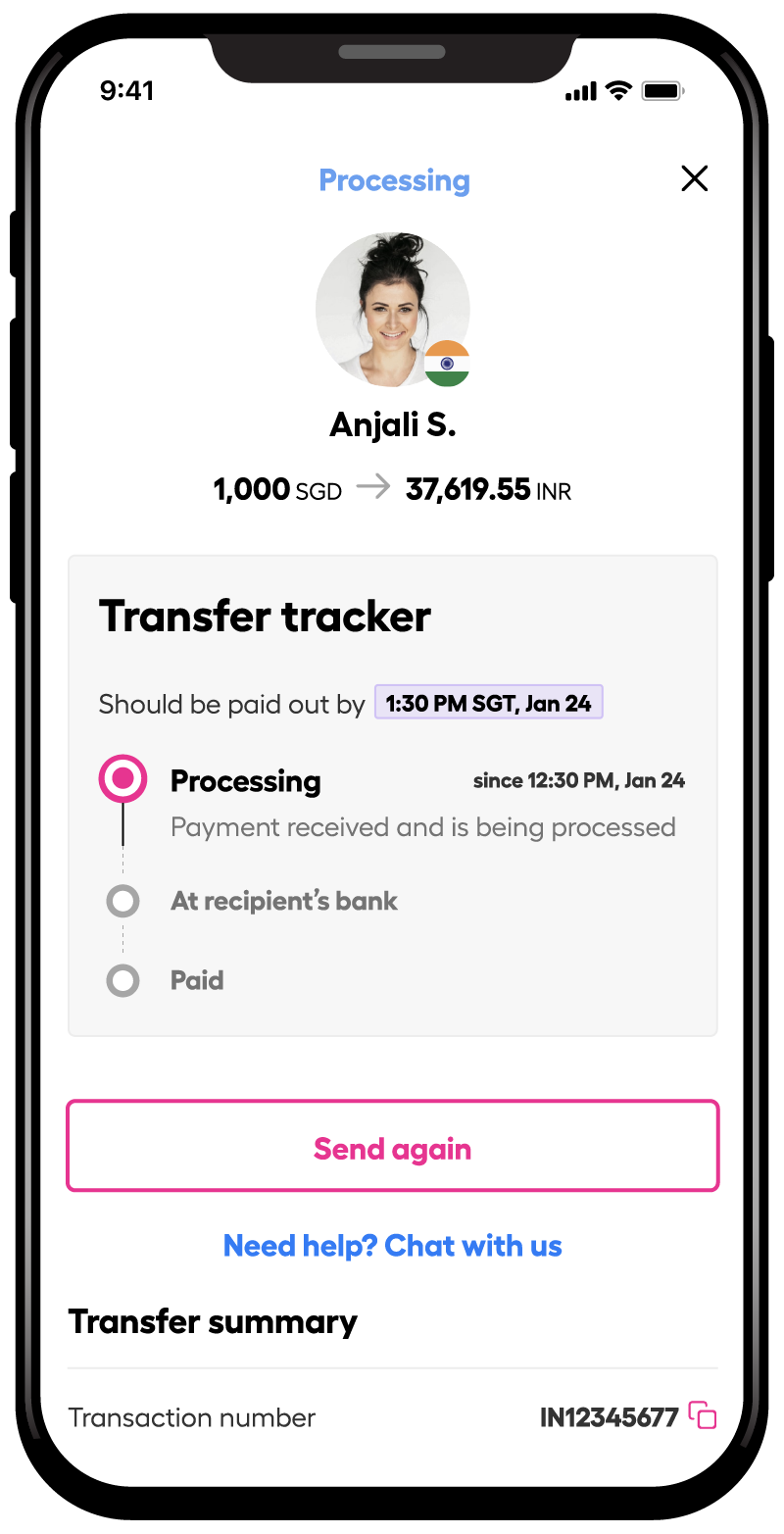

- Learn about exchange rates for international transfers: International wire transfers require one currency to be converted to another. The fluctuations in the exchange rate may impact the final amount to a great extent, especially for large transaction amounts. Hence, knowing the exchange rate is a must. You can use Instarem’s currency conversion facility to quickly determine how much you pay vis-à-vis how much the recipient will receive.

- Plan in advance: Planning always helps. Proper planning will ensure funds are received when required for transferring money. Planning is necessary to ensure your complete scheduling cycle is on track. If you want to send the money urgently, you will be charged higher for faster delivery.

Conclusion

Wire transfers are ideal remittance methods for quickly sending large amounts of money. However, financial institutions and banks typically charge a wire transfer fee for money transfers, which must be considered. Wire transfer costs are a significant determinant when choosing a bank or service provider.

Instarem offers quick**, hassle-free, reliable, and affordable*** money transfer service at your fingertips.

Try Instarem for your next transfer by downloading the app or sign up here.

Disclaimer: This article is intended for informational purposes only. All details are accurate at the time of publishing. Instarem has no affiliation or relationship with products or vendors mentioned.

* *Fast meaning 75% of our transactions are completed in 15 minutes. Depending on the funding method.

***When it comes to affordable exchange rates and fees, it’s worth noting that the cost will vary depending on how you choose to fund your transactions. Credit card funding and bank transfer fees can differ significantly.

Get the app

Get the app