What are the benefits of using credit cards for business payments?

It facilitates use of your card credit limit for making payments to your designated domestic or overseas beneficiaries. The benefits of using Instarem and your credit card include:

- Extension of payment days for cashflow and working capital efficiencies as use of credit card can offer a payment period of up to 55* days. This is assuming that your bank credit card provider has a 30-day card billing cycle and offers 25 days post card statement cycle for you to settle billed amount.

- Potential to save on expensive interest charges and fees which would be otherwise payable on bank borrowing for the credit period extension of up to 55* days. This saving could be easily 1.1% assuming your cost of funds is 7.3% p.a and that you are able to utilise the maximum credit period of 55* days.

- Additional commercial benefits as available from the bank whose card you are using on our platform. These may include cashback or membership reward points on the total spend done on the card which can help reduce costs and deliver enhanced savings.

- Other benefits like cash rebate or reward points that may be offered by the bank whose card you are using on the platform.

*55-days interest free period is offered by the card-issuing bank (not Instarem) and may vary as per individual bank policies.

This service is available for clients in Australia, Singapore, Hong Kong and Malaysia.

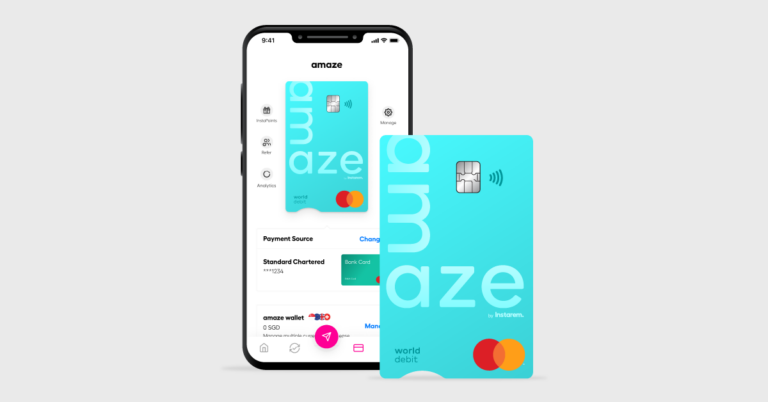

Get the app

Get the app